Why Not Sell Savings Bonds To Support Infrastructure Spending?

Summary

- The incoming Trump Administration has big plans to spend about $1 trillion over a few years’ time on bridges, highways, railroads, seaports, airports, and other infrastructure projects.

- The American Society of Civil Engineers projects a shortfall of $700 billion in infrastructure spending between now and 2025, and a shortfall of about $2.6 trillion by 2040.

- A key issue will be the source of the funding that must be raised to support such a huge spending program; we could use savings bonds for raising a portion.

- War bonds were responsible for 73% of all funding used to finance our efforts in World War II; surely we could raise 10% or more for infrastructure spending.

- Factoring in the emotional appeal of letting almost anyone make a contribution, other programs could even be funded, like NASA; in any case, infrastructure funding would be greatly helped.

The incoming Trump Administration has big plans regarding rejuvenating growth in the US economy. There are tentative plans to spend about $1 trillion over a few years' time on bridges, highways, railroads, seaports, airports, and other infrastructure projects that are sorely needed. The American Society of Civil Engineers (ASCE) estimated in 2013 that the shortfall in infrastructure spending would reach about $1.1 trillion by 2020; this gap has grown substantially in the years since this quadrennial report came out.

Indeed, a recent update by the ASCE (David Harrison, 2016; WSJ) projects a shortfall of $700 billion between now and 2025, and a shortfall of about $2.6 trillion by 2040. The cost to the economy of all the poor quality infrastructure that would result from the funding gap is estimated at about $4 trillion in lost GDP growth, and around 2.5 million potential jobs by 2025. This rises to an astounding $14.2 trillion in lost GDP growth and 5.8 million potential jobs not created by 2040. Clearly, something needs to be done, and in light of the election results, there may be strong support in Congress for passing a major infrastructure bill in the first few months of President-elect Trump's term.

A key issue as the prospective bill works its way through Congress next year will be the source and nature of the funding that must be raised to support such a huge spending program. Mr. Trump has already indicated that he favors a public/private partnership approach to funding the major infrastructure projects, which if successful would cut the required funding substantially. However, it is not yet clear how private investors would make money on such projects, since recent experience with similarly funded projects has not been very encouraging.

Perhaps enough tax incentives can be provided to make these prospective new public/private partnerships profitable to the firms that take on that risk. But it also seems to me that there are other potential sources of funding that have not been effectively tapped in recent years.

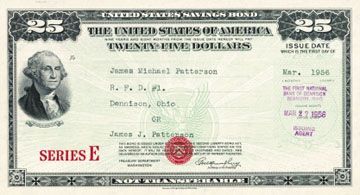

During World War I, a series of US Treasury issues called Liberty Bonds raised $21.5 billion from the public to fund the war effort, at a time when the federal budget in the year before the war was a grand total of $970 million (Source: Wikipedia). So that means the bonds raised 22 times the annual federal budget in just a few years. In 1935, Franklin D. Roosevelt signed a bill authorizing the sale by the US Treasury of the first modern savings bonds.

In World War II, the Series E War Bonds were sold to 85 million Americans and raised a total of $185 billion for the war effort. This is an amazing amount, because it represents a staggering 73% of the total debt ($251 billion) raised by the government to fund the war (Source: Wikipedia).

World War II War Bond Ad

With this kind of response in a time of great need, and given the huge support for infrastructure spending in both major parties and the electorate right now, isn't it likely that significant amounts could now be raised to support the notion of "making America great again?" What might happen, if Mr. Trump asks the average American to buy a 10-year or 20-year savings bond as a patriotic contribution to our collective goal?

It seems to me that such a program would eventually be perceived as non-partisan and would likely generate great interest from the public, because it will be a program that helps everyone. The bonds would almost certainly get hung with a boring name like "Infrastructure Series F" but might end up being more popularly called "Make America Great" or "MAG" bonds.

Recent experience with funding via conventional Series E Bonds has been disappointing, but there is a simple explanation for it. Paper bonds stopped being issued in 2012, and the hassle factor in having to register online each little bond given to grandkids or held in small amounts has cut sales by around 51% since then. In fact the impact of the paperless bond decision was felt almost immediately.

Sales fell from $1.48 billion in 2011 (before paper sales ended) to only $719 million in fiscal 2013, according to Ann Carrns of the New York Times. This trend could easily be reversed by simply reinstating paper bonds. Even then the normal volume would be very low compared to the needed funding However, there is no specific purpose in Series E savings bonds nowadays, which undoubtedly limits their popularity.

Once we add in a specific goal for this new bond series (i.e., rebuilding US infrastructure), and we factor in the emotional appeal of letting almost anyone make a contribution (with the smallest denomination at just $25, as in the past), it is quite possible that significant major long-term funding for the infrastructure program will be provided by the general public. Not only that, the average maturity of the new MAG bonds would be a big improvement over the average maturity of US debt now prevailing, which is only about 6 years.

Plus, we would avoid relying on large private investors in the capital markets for all infrastructure funding, which would have the effect of lowering the cost and decreasing the risk associated with funding such huge projects. It is not unreasonable to think that 10%-25% of total spending for infrastructure, or about $100-$250 billion, could eventually be raised via MAG bonds.

There is little downside to trying to unite people in pursuing a worthy cause like this. The idea could even be expanded to other areas of funding. What if a major funding push for NASA was made using Moon bonds or Mars bonds? Wouldn't this be just the kind of thing that could really jump-start our space exploration by providing new funding? Why not try it and see what happens?

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or ...

more