What Is The Bond Market Saying About Inflation?

Chairman Powell surprised the market in his testimony before Congress when he decided to eliminate “transitory” from being used with “inflation”. It seems like transitory has been used as a companion for so long that many believed it, until now. However, how often is the leadership at the Fed actually right in their forecasts? History should cast some doubt and Powell may have capitulated near the top.

Types of Inflation

We hear about “cost push” and “demand pull” inflation, but what’s the root cause of our predicament?

Is the Biden administration correct that it’s because doing so well that we’re buying up all the available goods? Looking at recent savings data suggests that’s not the case. Also, consumer sentiment numbers, buying plans, and even recent Black Friday/Cyber Monday numbers suggest that consumers are pulling back.

Rather than looking at inflation in the two categories outlined above, I want to look at it from the perspective of COVID-related policies and Federal Reserve policies.

COVID Policies

The realities are that COVID policies globally have diminished productivity and output. For example, South Vietnam shut down all production for over three months. That is a lot of products that aren’t being made. Policies have diminished the output of a worker, the total product produced and has seen workers leave the workforce. Scarcity of labor, products and rising wages have contributed greatly to inflation. This type of inflation will be “sticky.”

Federal Reserve Policies

What happens when the Fed increases their balance sheet by over $5 trillion dollars? It’s like the Tootsie Roll pop, “the world may never know”. That’s because we’ve never engaged in this level of monetary insanity. The experiment that is being conducted by a body created in a place called “Jekyll Island” is ominous to say the least.

(Click on image to enlarge)

Federal Reserve Balance Sheet

The policies that originate from the Fed aren’t “virtuous” like the textbooks want you to believe. There are real displacements economically that centralized policy creates. The one thing we do know is that the Fed always makes policy errors, and the boom-and-bust cycle is perpetuated by their irrationality.

It’s the monetary inflation that we’re focusing on here and the misstep that the bond market may be looking at predominantly.

Bond Market and Inflation

Let’s take a closer look at the bond market dynamics that are playing out right now.

There are three ways of looking at the bond market that gives us a hint about inflation, which I wanted to point out. Here are the three approaches:

- Treasury yields

- Yield Curve

- TIPS spread

Treasury Yields

Looking at the yields, you should see long-term treasury yields rising as inflation expectations are expanding. Looking at the 10-year U.S. Treasury yield below, prices have been in a holding pattern for a couple months. Not exactly a representation of significant inflation fears. Even looking at 30-year Treasury yields paints a similar disinflationary picture.

(Click on image to enlarge)

Yield Curve

As inflation expectations increase, the yield curve should steepen as longer-term bonds are sold off more than shorter-term bonds. The result is the spread between a 3-month T-Bill and a 10-year Treasury note should be widening.

The chart below reflects the 3-month T-Bill, 5-year Treasury Note, 10-year Treasury Note, and the 30-year Treasury Bond yield. You may notice that the difference in yield is contracting with the 3-month holding steady since the Fed hasn’t raised rates yet. Also, it shows the current limitations on the Fed to raise rates more than 1% as it would cause the current yield curve to invert.

(Click on image to enlarge)

Ultimately, the flattening of the yield curve doesn’t reflect an inflationary outlook for the U.S. economy.

TIPS Spread

Treasury Inflation Protected Securities (TIPS) have been around since the late ’90s. The idea of this product is to have the face value of the bond change with the CPI. The result is a larger interest payment if inflation is high.

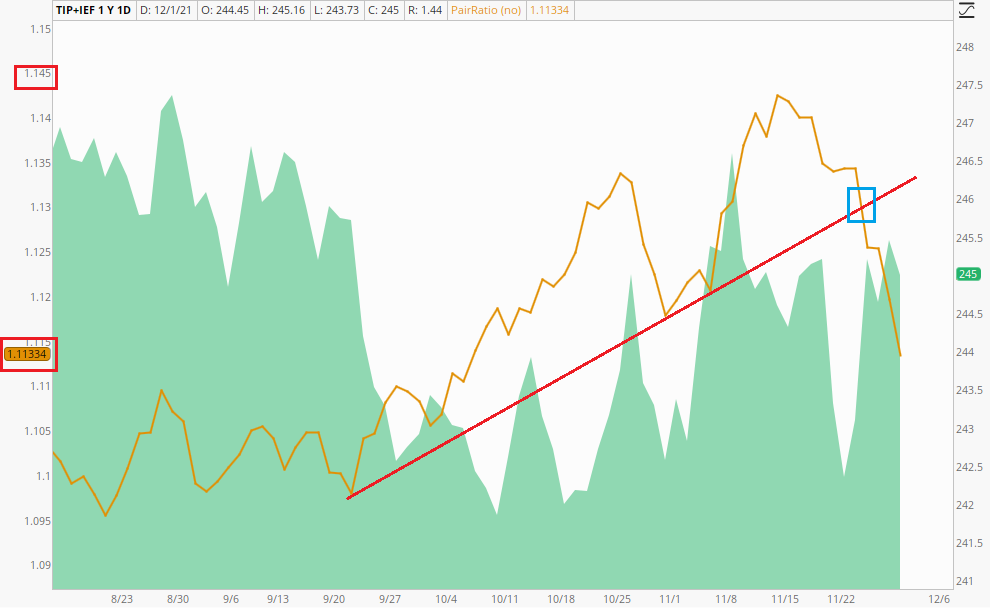

As a result, investors favor TIPS over standard Treasuries when inflation expectations are increasing. In the chart below, you’ll see a ratio of iShares TIPS Bond ETF (NYSEARCA: TIP) and the iShares 7-10 Year Treasury Bond ETF (Nasdaq: IEF). The yellow line represents the ratio of TIP/IEF. Notice how the line is falling as Powell is determining that inflation isn’t transitory. That represents a shift in inflation expectations that is more disinflationary.

(Click on image to enlarge)

Conclusion

There isn’t a crystal ball for telling the future of policy and perfectly predicting the future implications of policy. That’s what makes what the outrageous policies of the Federal Reserve so dangerous. The idea that they are doing yeomen’s work and the printing of money is virtuous isn’t reality. It reflects a faith in centralized authority that have failed millions of people in the last century and historically. The fact that Powell is capitulating on inflation with the indicators that the bond market is flashing, is just another reason to believe that their failure may soon be realized…AGAIN.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more