Wall Street Is Convinced A Recession Is Coming As Investors Are Most Bullish On Rates Since 2008

It's that time in the month when the results of the Bank of America Fund Manager Survey - which unfortunately has emerged as a contradictory exercise in intellectual masturbation, in which respondents answer what they'd like to respond, not what they are actually doing - are pored over by Wall Street, if only for a few brief minutes.

As a reminder, last August, when looking at the monthly Bank of America Fund Manager Survey, we pointed out a "paradox" in Wall Street sentiment that could only be attributed to schizophrenia (or merely another example of how central banks have broken markets): on one hand a record number of investors said that stocks are overvalued (they were correct), even as most investors admitted they - or their peers - are long tech stocks (they were also correct).

It is also the same survey which on one hand saw a record number of investors criticizing companies for buying back their stock, and on the other sees investors rushing to buy the stock of companies that buy back stock, almost as if the respondents can't carry more than one fact in their head at a time.

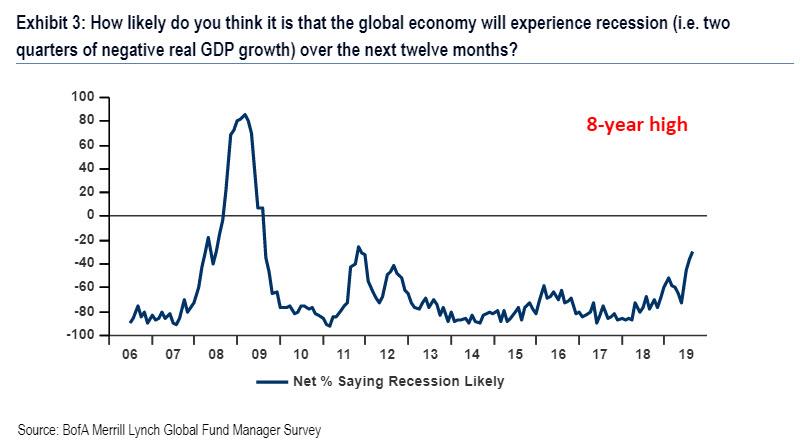

In any case, after polling 171 survey participants with $455BN in AUM, what BofA's CIO Michael Hartnett found in the August Fund Manager Survey (FMS) is that investors were most bullish on rates since 2008 as trade war concerns send recession risk to 8-year high.

Specifically, a net 43% FMS investors expect lower short-term rates & only 9% expect higher long-term rates over the next 12-months - taken together this is the most bullish FMS view on bonds since Nov'08.

(Click on image to enlarge)

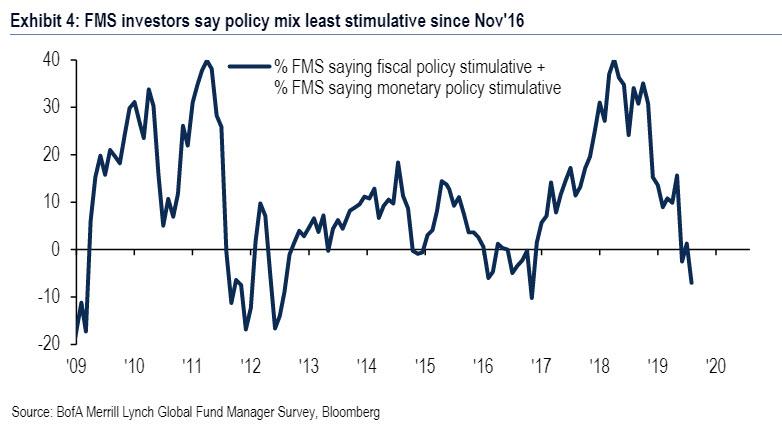

As part of this risk revulsion, investors slashed exposure to cyclicals to buy US Treasuries and US growth stocks; with global policy stimuli at a 2.5-year low, the onus is on Fed/ECB/PBoC to restore animal spirits.

(Click on image to enlarge)

And with investors fretting that fiscal policy is too restrictive, as just net 11% see monetary policy as too stimulative, Wall Street sees the current policy mix as the least stimulative since Nov'16, and only 9% see higher bond yields in the next 12 months, the most bullish stance on rates since 2008. Note:12 months ago, 90% of FMS investors expected higher short-term and 64% expected higher long-term rates.

(Click on image to enlarge)

As a result of this toxic miss of policies, one-third of FMS investors expect a global recession in the next 12 months, the highest since 2011.

(Click on image to enlarge)

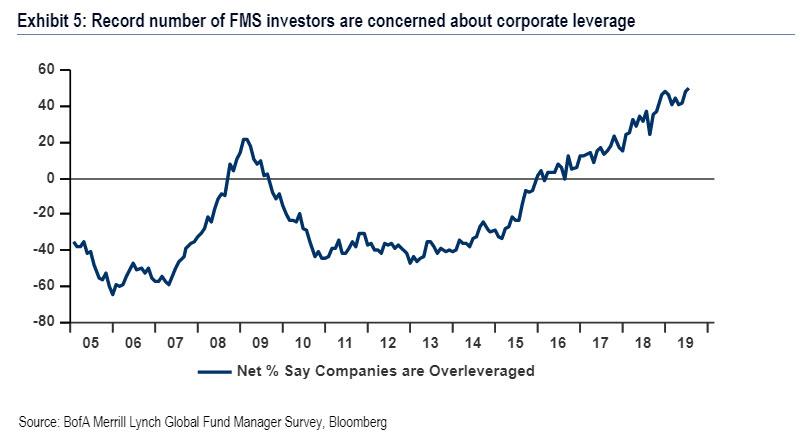

And as usual, Wall Street's hypocrisy - or perhaps stupidity - was on full display, when while investors rush to buy stocks that aggressively repurchase their stocks, in the survey, roughly half of FMS investors said corporates are excessively leveraged, a new record; investors want corporates to use cash to improve balance sheets > capex or buybacks.

(Click on image to enlarge)

Right, sure they do - and right after they filled out the BofA survey, they went on to over-allocate interest in the latest junk bond being issued with zero concerns about its fundamentals.

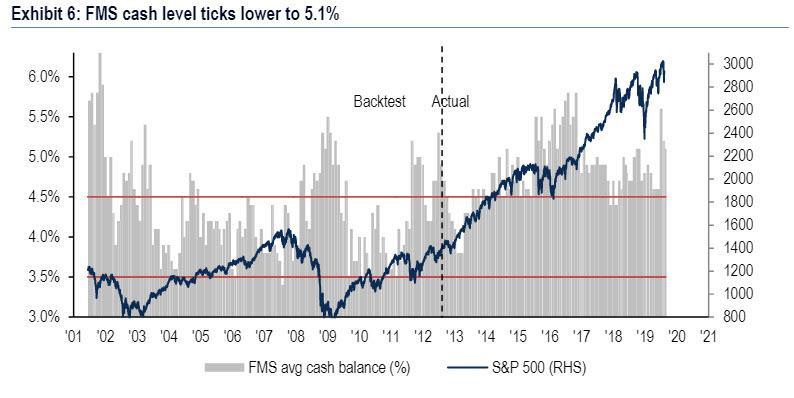

And speaking of just how fake this entire survey is - when it came to risk appetite, despite fears of imminent recession, FMS cash levels "oddly" did not surge as growth expectations plunged. In fact, a cynic would say there is absolutely no link between what investors think or say, and what they do... which is to be mostly long stocks. According to Hartnett, August cash levels fell from 5.2% to 5.1%; BofAML Bull & Bear Indicator holds at 3.7 (not extreme bearish though record net % say they have taken out protection).

(Click on image to enlarge)

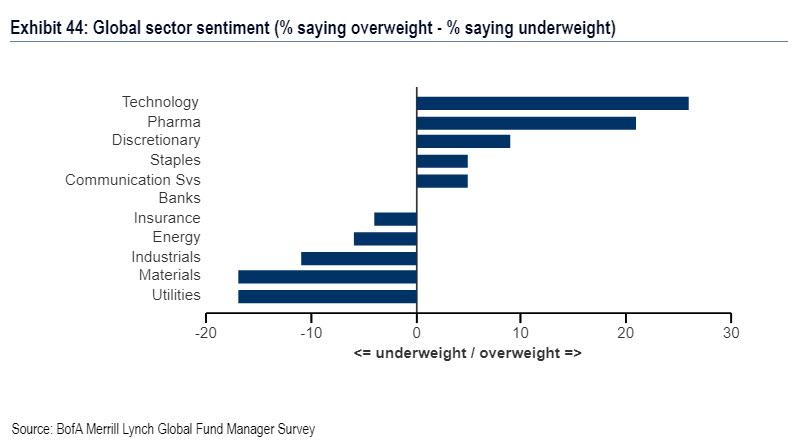

So where are these survey hypocrites parking their case now? In August, FMS investors sold cyclical value (Japan at 7-year low, industrials 2nd biggest MoM drop ever), bought defensives/growth (staples, tech) & bonds (#1 most crowded FMS trade is long US Treasuries); “growth overvalue” highest since GFC, the bank says.

(Click on image to enlarge)

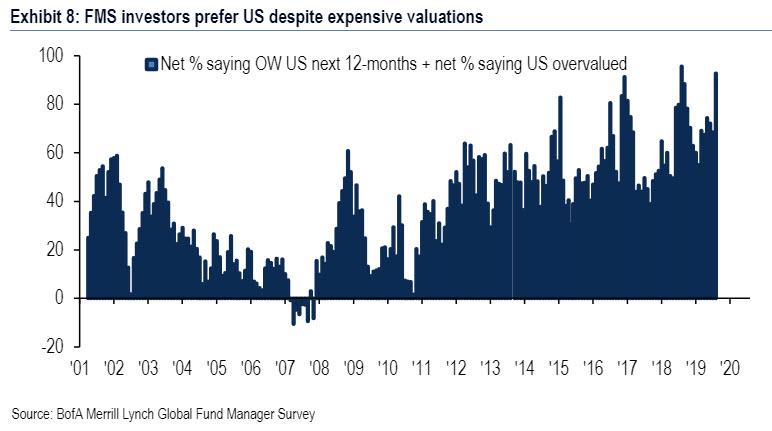

Additionally, FMS investors said US equities are the most preferred region over the next 12 months despite 78% saying the region is overvalued - yet another example of either the sheer schizophrenia, stupidity or pathological lies that permeate Wall Street. Note the combination of two 2nd most extreme on record (#1 Aug’18).

(Click on image to enlarge)

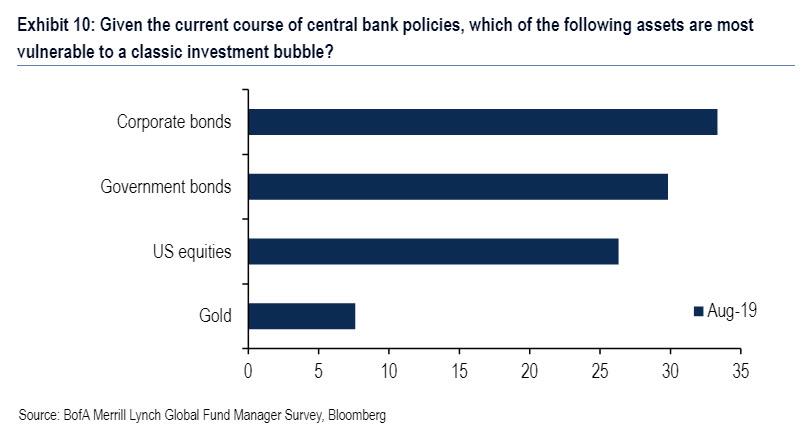

On bubbles, FMS investors said they see the biggest central bank-induced bubble risk in:

- corporate bonds (33%),

- Govt bonds (30%),

- US equities (26%),

- gold (8%).

(Click on image to enlarge)

BofA's trade recommendation for contrarians: be long inflation vs. deflation assets (equities>bonds, Japan>US, industrials>pharma).

"Investors are the most bullish on rates since 2008 as trade war concerns send recession risk to an 8-year high," said Michael Hartnett, chief investment strategist. “With global policy stimuli at a 2.5-year low, the onus is on the Fed, ECB, and PBoC to restore animal spirits.”

That said, we have no doubt that the central banks of the world will do whatever they need to "restore animal spirits", even if it means they will buy each and overstock in the open market.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more