Use Market Volatility To Save Your Portfolio

Many investors are liquidating their portfolios with huge losses. They sell all asset classes from equity to Treasuries and gold. I will explain a better strategy to cut losses.

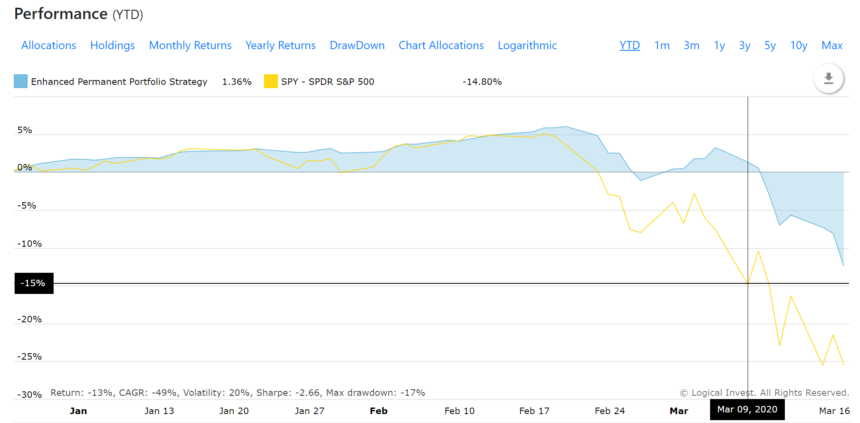

Below is a chart of our Logical Invest Permanent Portfolio Strategy, which invests in the 3 main assets: equity (S&P 500), Treasuries, and gold. The strategy uses a variable allocation of Treasuries and gold to hedge against equity losses. As you can see in the chart, this worked well during previous market corrections below 20%.

The next chart is a year-to-date view of the coronavirus market correction. Here you can also see that until the correction reached -15%, the hedge worked well and the strategy still had a positive performance. This alone should tell every investor how important a hedge is. It gives you enough time to exit from your investments without big losses.

However, the correction went on and markets began to panic. Investors began to sell everything including safe-haven gold and Treasuries to cover losses, and respond to margin calls. At this moment, the strategy is down 12% and many investors are thinking of liquidating their positions and going to cash.

In fact, there is a better way to deal with losses due to the record-high market volatility of all these asset classes.

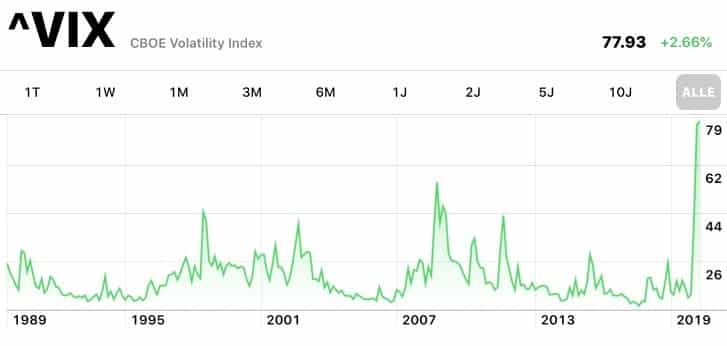

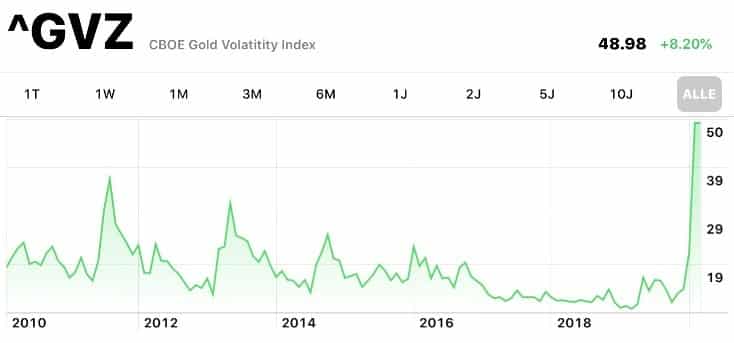

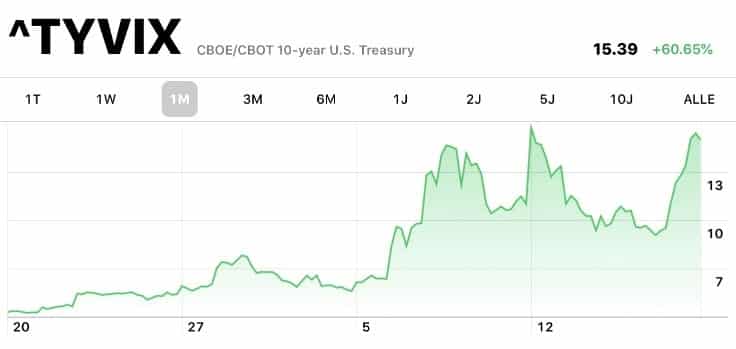

Here is an overview of the volatility of different asset classes:

S&P 500 - the volatility reached 86

Gold volatility reached 54

10-year Treasury volatility reached 18

This record-high volatility also means that option premiums reached record levels. One way to protect your portfolio is to sell holdings in SPY, GLD, and TLT, and also sell far-out ATM (at the money) put options of these same assets. You can also keep SPY, GLD, and TLT, and sell ATM calls. 1 call per 100 shares. This would be a covered call and is the same as selling naked puts. Here is an example:

- You have $100,000 in SPY, which is about 400 shares at a price of $240.

- Now you sell these SPY shares and also sell 4 SPY put options with a strike of $240. Remember that one option is for 100 shares.

- I would sell January 15, 2021 options, which trade at a premium of about $40, which is nearly 17%!

That’s all. Now you just wait until everything normalizes. The outcome scenarios are the following:

- If SPY goes up you will realize a maximum profit of 17%

- If SPY stays the same but volatility goes back to normal values, you will realize a profit of about 10% because of the volatility drop. Upon expiry you will get the whole 17%.

- If SPY is between $200 and $240, you will still make a profit. If the price on Jan 15, 2021 is at $220, which is 10% lower than now, you still make 9% profit.

- If SPY is below $200 on Jan 15, 2021, then you get back your 400 SPY shares for a price of $200, which means that your losses are 17% smaller than they would have been by just keeping your portfolio.

You can do the same for GLD and TLT ETFs. GLD premium is about $16, which equals about 12%, and TLT premium is about 11%.

If you own the Permanent Portfolio strategy, which is down about 12%, you may be able to cover all your current losses before January 15, 2021 if prices only go up a little from here. If prices go down further you can reinvest at about 11% to 17% lower prices than the current levels, which should be a good place to start the next bull market.

Logical-Invest.com is not a registered investment advisor and does not provide professional financial investment advice specific to your life situation. Logical Invest is solely an ...

more