US: The Self-Fulfilling Threat Of An Inverted Yield Curve

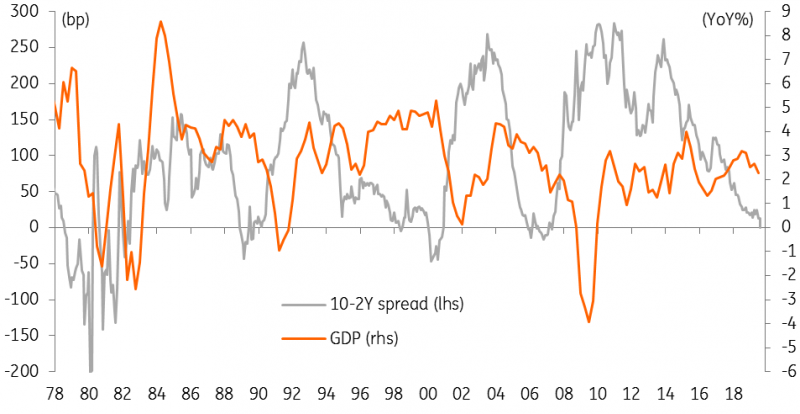

Yield curve underlines recession fears

On the economics dashboard of doom, we have another flashing warning light. Overnight we have seen the inversion of the 2-10 year part of the Treasury yield curve, the first time this has happened since 2007 when the global financial crisis started to bite. Moreover, an inverted yield curve preceded all nine of the US recessions since the mid-1950s so it is understandable why economists are getting a little nervous.

In normal times investors want to be compensated for the risk of lending for longer periods of time – you do not know what may happen over the next ten years (will inflation spike, will a country get into debt problems, etc) – and they feel more comfortable lending over a shorter period of time. Hence why interest rates on 2-year debt are normally lower than 10-year borrowing costs. However, the fact that this has flipped suggests that investors are seriously worried about a downturn, which will keep inflation low. The market is also hinting that it thinks the Federal Reserve is “behind the curve” and that it may not cut short-term interest rates quickly enough to head off a recession.

The 2-10 year yield curve and GDP growth

(Click on image to enlarge)

Source: Macrobond, ING

Is it different this time? Probably...

Now it is important to point out that an inverted yield curve has given false signals in the past on possible US recessions (around the Russia/LTCM crisis in 1998 for example), while other countries have experienced prolonged yield curve inversion in the past without recession – the UK for example through much of the 1990s. As such it is important to emphasize the obvious point there is no inevitability of recession.

Then there is always the argument that “things are different this time” and there is certainly a strong case that can offer some comfort. The lagged effects of the Fed’s quantitative easing program has made the curve flatter than it otherwise would be (relative to previous cycles). After all, the trillions they invested in the Treasury market were to stimulate the economy by driving down borrowing costs through the economy, boost liquidity and make higher-risk assets look more attractive.

There have also been arguments about the perceived time value of money given aging populations around the world, making people more willing to hold such assets, but at the current juncture, the negative yields in Europe are a bigger factor in play. This is making the positive yielding US Treasuries look incredibly attractive and those European managers that have some discretion or flexibility on where they can invest are taking advantage. Throw in the US’ safe-haven status and the seeming solidity of the dollar for now and it is unsurprising managers are moving more of their allocations here.

The economic outlook is certainly "mixed"

For now, the US economy remains in decent shape and recession is certainly not our base case. The consumer sector is strong and the plunge in longer-dated borrowing costs is a clear boost here. Today we have seen Mortgage Banker Association data showing the typical 30-year mortgage rate has dropped to 3.93% from 5.20% in November last year. This prompted a 36.9% surge in mortgage refinancing to a three year high, which will help to put more cash in the pockets of homeowners. Mortgage demand for home purchases has also been trending higher through 2019.

What is causing the market's fear of recession is, of course, a combination of the weaker global environment – another set of woeful German numbers haven't helped sentiment – and concerns that the protracted nature of the “trade war” with China is sapping business confidence, putting up costs and hurting profits. The result may be weaker hiring and investment in the US that could lead to a broader economic downturn.

We continue to make the case for an eventual more stable truce on trade with China as President Trump looks to focus on re-election next year. He will recognize that a strong economy with rising asset prices is critical for his campaign so securing some form of a deal will help lift a huge dark cloud hanging over the global economy while a few more rate cuts from the Federal Reserve and more stimulus from around the world will also help.

But prolonged inversion could make a recession more likely

Even if we are right, we have to be wary that an inverted yield curve driven by recession fears can potentially be self-fulfilling. Banks typically borrow short term and lend longer term so when the yield curve is inverted the interest rate received on assets could be lower than what they pay on their liabilities.

This will hit profitability and could decrease risk tolerance, which implies tighter lending standards. Indeed, when asking banks about this for the Federal Reserve's Senior Loan Officers report, the write up concluded an inverted yield curve would be interpreted as 'signaling a less favorable or more uncertain economic outlook and likely to be followed by a deterioration in the quality of existing loan portfolio.'

So far there is little evidence that the flattening and subsequent inversion of the yield curve is feeding through into reduced credit availability (certainly not if you look at today’s mortgage lending numbers), but that could change if the inversion persists. A scenario of much tighter credit conditions would clearly add to the headwinds facing the US economy and heighten the chances of a downturn. It's difficult to see the Fed not bowing to the markets' will and cutting rates more aggressively in such an environment.

In this regard, the Federal Reserve’s Jackson Hole symposium 22 -24 August will be the next thing to focus on.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more