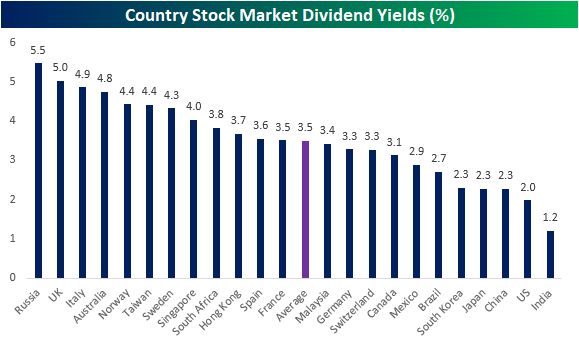

US Dividend Yields Significantly Lower Than Rest Of World

When it comes to dividends, the US may not be the best country for investors to look for a higher yield. US equities currently have a dividend yield of only 1.98%, well below the average of 3.51% for the 22 other major global economies that we track in our Global Macro Dashboard. The only country with a lower dividend yield is India with a 1.21% yield. A potential reason for this comparatively low yield in these two countries is simply higher equity prices. India runs away with the highest valuation of their equities with a P/E of 28.56; the highest among the 23 countries in our Global Macro Dashboard. The US similarly is not cheap relative to the rest of the world as it possesses the fourth highest valuation of 18.33x earnings. That compares to a world average of only 15.72.

(Click on image to enlarge)

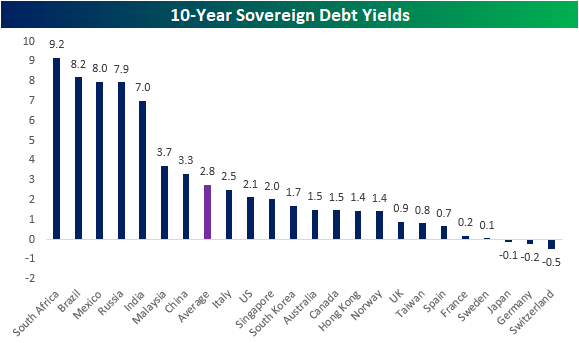

Over the past month, the yield on the 10 Year US Treasury Note fell considerably from over 2.5% at the beginning of May to 2.13% today. Unlike the dividend yield, the 10 year still holds up better than most of the world. The US has a higher yield than the comparable security for 14 other countries. Even with the yield coming down recently, it is still far more attractive than the negative yields on Japanese, German, and Swiss 10-years.

(Click on image to enlarge)

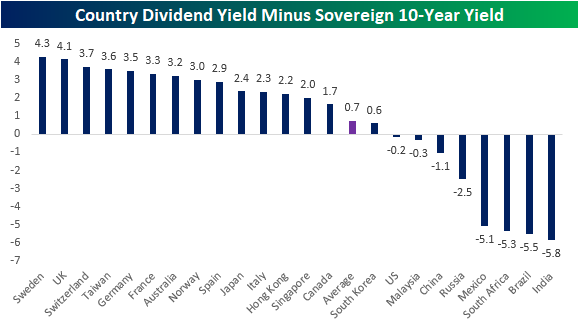

One more interesting dynamic of the US compared to the rest of the world is the very tight spread between the dividend yield and the 10-year. Currently, the dividend yield is only 15 bps lower than the 10-year yield for the US. Nine other countries similarly have a higher yield in their 10-year note. With such a low yield on dividends, India has the widest spread in favor of the country’s government debt, while on the other end of the spectrum, Sweden has the widest spread in favor of dividends.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our more