Ugly 20Y Auction Prices With First Tail Since November

Moments ago, the Treasury sold $14 billion Treasuries in a 19-year 11-month reopening of the infamous "kink" tenor in the pancaked US yield curve. "Kink", because as shown below, the yield on the 20Y remains the highest one across the entire curve...

(Click on image to enlarge)

... and today's auction only added fuel to the fire.

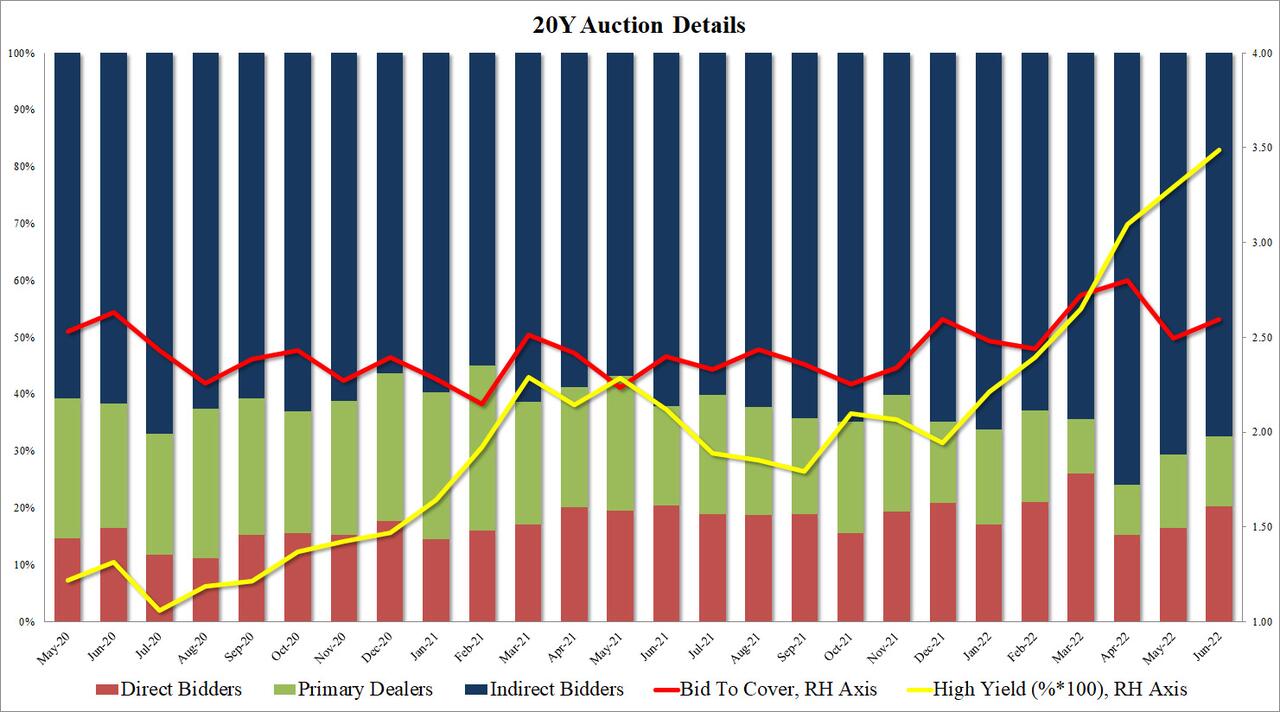

Pricing at a high yield of 3.488%, the auction was some 19.8bps above the 3.290% yield in May, and the highest on record for the tenor. It also tailed the When Issued 2.486 by 0.2bps, the first tailing 20Y auction since November.

The bid to cover of 2.60 coming above last month's 2.50 and just above the six auction average of 2.59.

The internals were also nothing to write home about with Indirects taking down 67.4%, right on top of the recent average of 67.5%, and slightly below last month's 70.6%. And with Directs taking down 20.2%, the most since March, meant that Dealers were left with just 12.4%, one of the lowest on record.

Overall, a disappointing auction - which however was not too dramatic and the weakness can be explained by the sharp drop in yields across the curve and lack of concession -especially once the Fed pivots and turns dovish in the coming months which will send yields on the 20Y crashing lower.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more