Tremendous Demand In 30Y Treasury Auction Following Morning Rout

There is just one word to describe demand for today's $16 billion 30Y auction: tremendous.

From the top to the bottom, this was one of the strongest auctions on record, largely aided by today's dramatic rout across the curve which built up a substantial concession ahead of the auction.

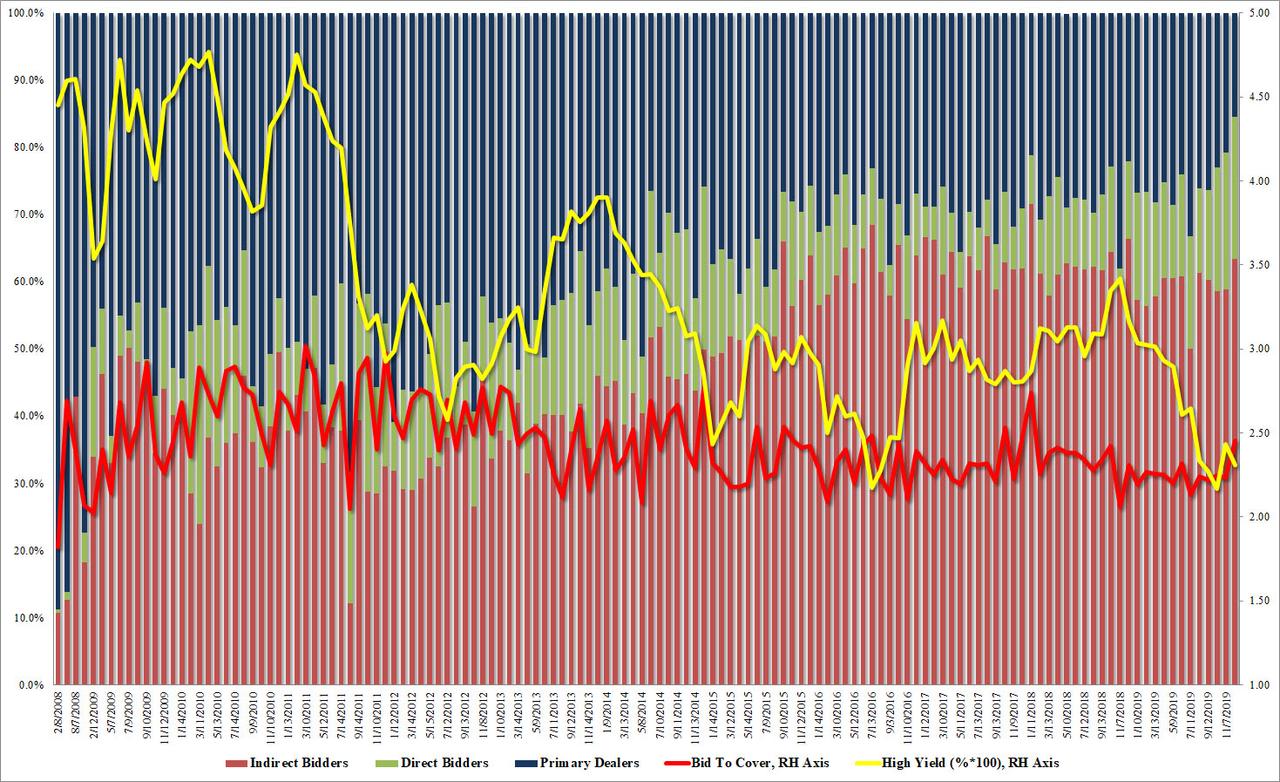

The auction stopped at a yield of 2.307%, well below last month's 2.43%, but more remarkably, this was a 2.1bps Stop Through the 2.328% When Issued, the biggest stop through since January 2018.

The bid to cover soared from last month's disappointing 2.233 to 2.455, the highest also since January 2018.

The internals were also a blowout, with Indirects taking down 63.4%, the highest since December 2018, and with the Direct takedown also rising from 20.5% to 21.1%, the most since Dec 2014, Dealers were left holding just 15.5% of the allotment, the lowest on record.

(Click on image to enlarge)

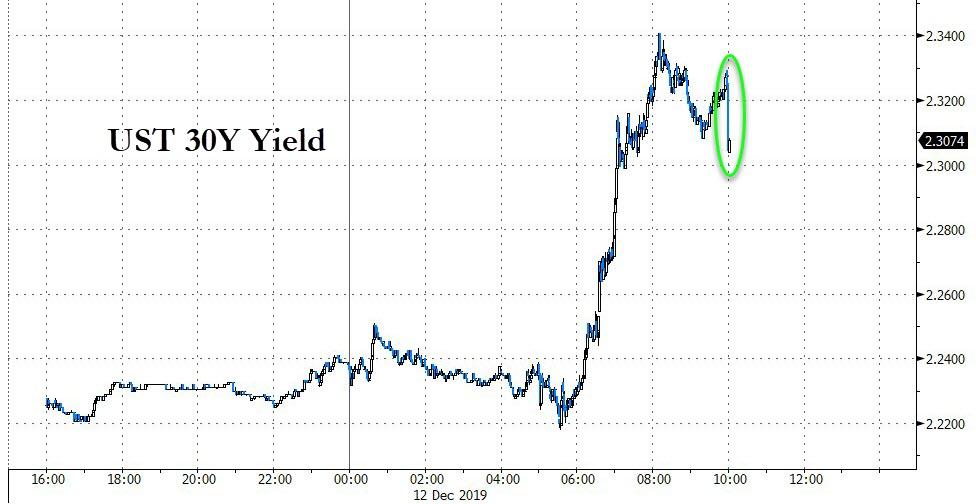

In short, in the context of today's bond rout driven by the latest rumorgasm which sent stocks surging and bonds tumbling, the bond market is saying the selloff won't last.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more