Treasury Market Becoming Increasingly Distorted By Record Bearish Sentiment (And Shorting)

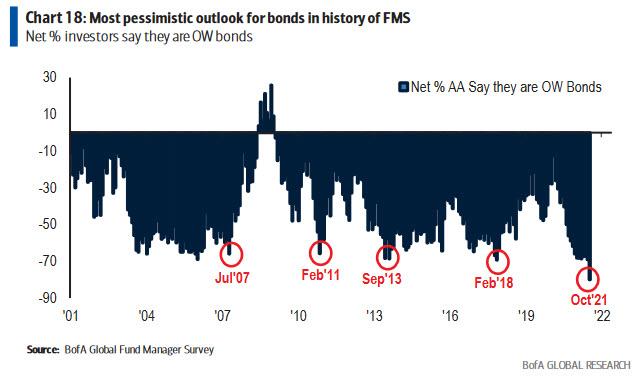

The latest BofA Fund Manager Survey showed something not entirely unexpected: the net (self-reported) investor allocation to bonds hit -80, which according to BofA CIO was "the most pessimistic outlook for bonds in the history" of the survey.

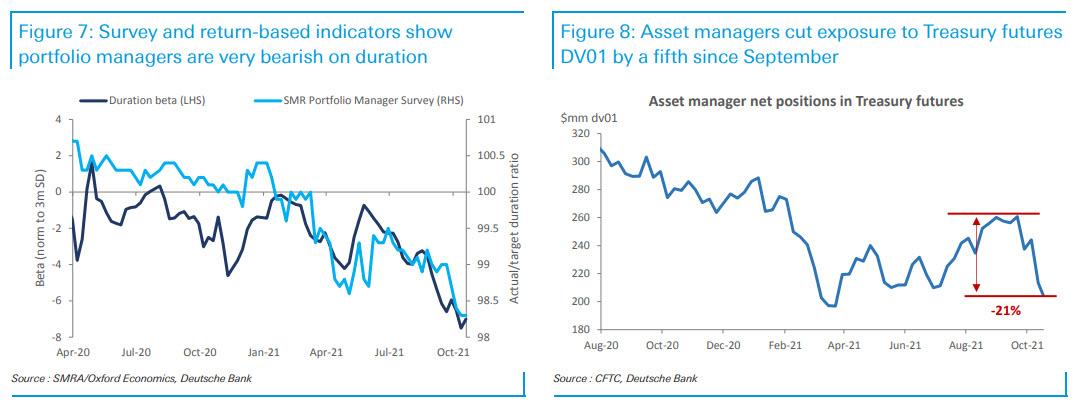

At the same time, real money positioning is leaning very bearish, with most other surveys also showing portfolio managers are considerably underweight duration and CFTC data corroborating their reduction to rate exposures.

While we traditionally take the Fund Manager Survey which a giant boulder of salt as respondents tend to say what they think they should say, not what they are actually doing, in this case, we would be willing to give them the benefit of the doubt for one simple reason: as Bloomberg shows, Treasuries are on pace to post their worst total return on record, and with inflation set to keep rising for the foreseeable future there is little hope of reprieve.

In light of this gloomy context, it is no surprise that Treasury yields are rising rapidly - on both the short and long-end - behind inflation worries and repositioning for a faster pace of Fed tightening. Furthermore, as Deutsche Bank notes, there is strong interest to be short front-end rates, which has led to distortion in the overnight and Treasury futures markets.

Below we do a deeper dive into the Treasury dynamics to see just what is really going on.

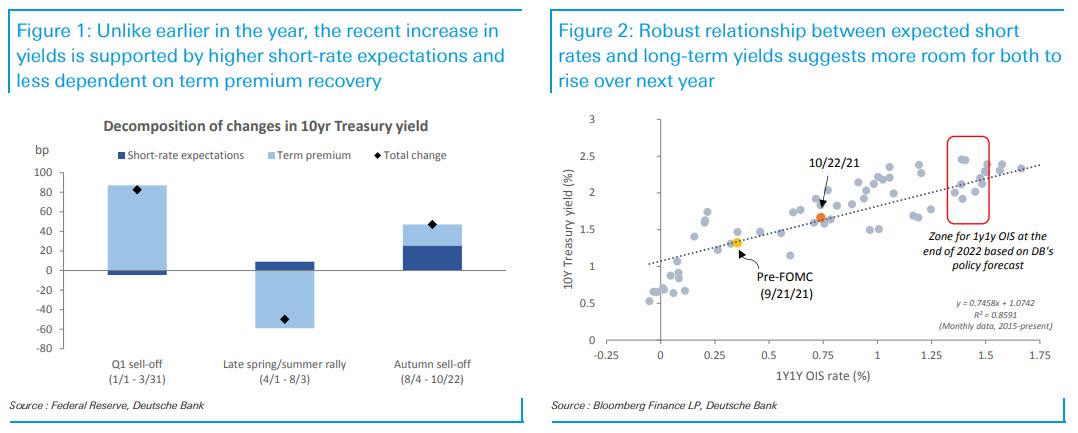

As DB's Steven Zeng writes, over the last month, markets have upped the probability of Fed liftoff from 70% of a single hike in 2022 to two full-rate increases. This is captured by the short-term rate expectations component of the Fed ACM model and it translates into a higher risk-neutral 10yr rate under that framework. This is important because it contrasts the recent yield increase with the experience of earlier this year, with the recent episode supported by higher short-rate expectations and less dependent on the unexplained term premium, which could quickly collapse behind myriad factors as witnessed during this summer.

On the other hand, the Fed provides a much stronger anchor for market expectations of its policy rate path, and hawkish Fed speaks act as a magnet to bring short-rate expectations toward its projections simply through the passage of time.

As the DB scatterplot below shows, there is a robust relationship between short-rate expectations and long-term Treasury yields. If markets fully price to the projected Fed path (DB economists recently revised their call for the policy rate to reach 1.90% by the end of 2024), it would imply the 1y1y OIS rate moving into a 1.3-1.5% range and 10yr yields to be dragged higher with it over the next 12-14 months.

(Click on image to enlarge)

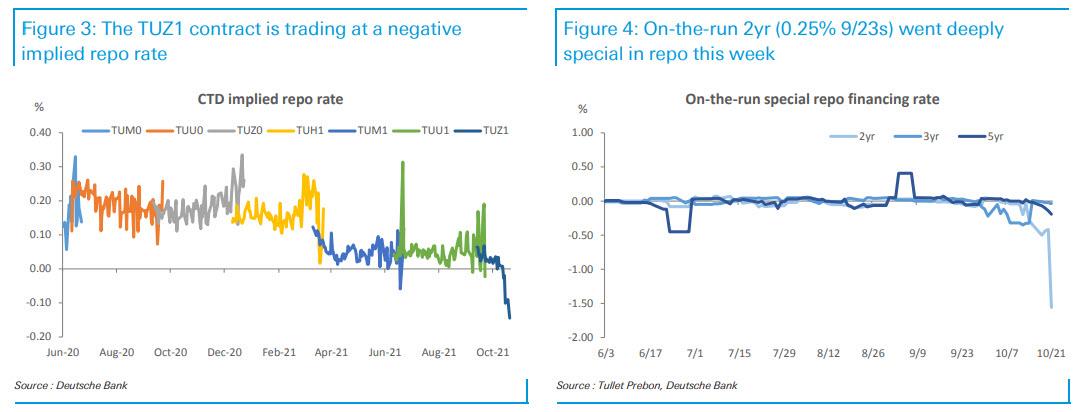

That said, as DB's Zeng warns, "the dash to be short the front-end has led to notable market distortions." Leveraged short positions taken in the TU contract have taken its implied repo rate to deeply negative levels. In cash markets, investors who want to be short are finding there aren’t enough securities to go around. The on-the-run 2yr notes (CT2) are trading deeply special in repo markets, and the specialness is expected to persist through the end of November.

(Click on image to enlarge)

At the Fed’s securities lending operations, demand to borrow 2022-2024 maturities spiked since last week, and propositions for CT2 outstripped availability midweek with dealers paying a hefty premium to get ahold of the specified issue, although conditions have eased by Friday.

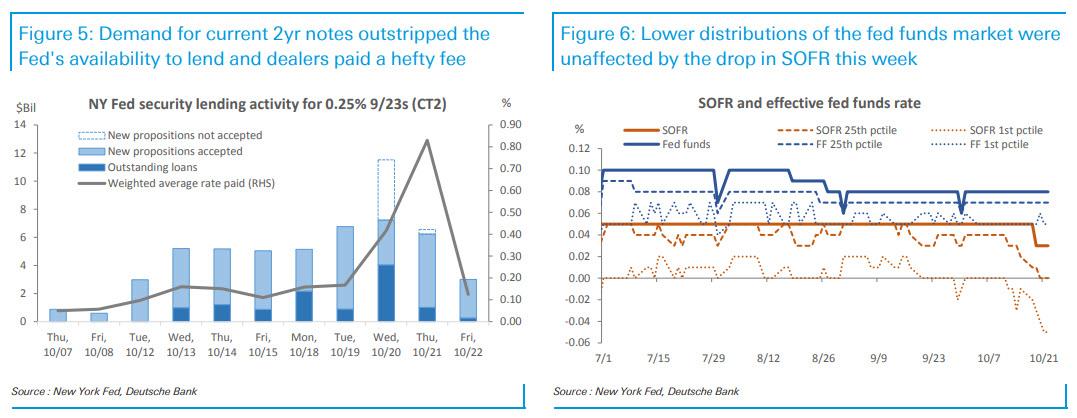

At the same time, investor demand to get hold of cash securities to be short either outright or against futures has made specified collaterals more expensive, and the decline in those financing rates has trickled into the general collateral market. The overnight SOFR rate dropped fell to 0.03% this week, breaching the overnight RRP "floor" rate for the first time, sparking concerns about the upcoming Libor to SOFR transition.

(Click on image to enlarge)

Still, despite these distortions, Zeng does not expect the Fed to need to hike IOER or the RRP rate to preempt a fall in the fed funds rate as the pressure appears to be contained in Treasury collateral markets for now and does not seem it would immediately trickle into the fed funds market, which has slightly weaker linkage to repo markets than say the linkage for repo and the bill market. The resilience of fed funds in the face of downward pressure on other money market rates in recent times may reflect the nature of relationship between participants in these markets.

An example of this is that the lower distributions of the fed funds rate were unaffected by the drop in SOFR last week, which suggests that the GSE lenders have not substantially rotated cash out of repos and into the fed funds market, and the FBO borrowers are not able to get concession in form of lower rates.

That said, there is a risk of repo specialness becoming more severe or persistent than expected. The SOMA add-on for 2yr notes in October and November are smaller than usual (5-6bn vs 7bn+), which contributes to pressure stemming from collateral scarcity. If fed funds begin falling in the coming weeks, the Fed could widen the IOER-RRP corridor (i.e. raise IOER but not the RRP rate) by 5bp before year-end, but that probability seems low for now.

Finally, looking at positioning, there are no surprises here: confirming the record bearish sentiment shown in the BofA chart above, portfolio manager surveys and return-based indicators continue to suggest that real money positioning is very underweight in duration. The latest CFTC data (as of 10/19) show that asset managers have reduced their DV01 exposure to Treasury futures by 21% since the September FOMC meeting. The cuts were made relatively evenly across sectors, but notably, asset managers are now net short in 2yr (TU) and 10yr (TY) contracts, which is a rare occurrence.

Still, crowded positions may be less of an issue than in early spring, when positioning was also very short which fed the subsequent rally when the bearish trades unraveled. As discussed earlier, investors’ bearish outlook this time are predicated on a faster pace of Fed tightening, which is a firmer ground for higher yields than simply expecting the term premium’s recovery.

(Click on image to enlarge)

That said, even a modest cascade of deflationary news could wreak havoc on what is easily the most crowded trade on Wall Street right now.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more