Toyota, Volkswagen, And Daimler: Here Are The Corporate Bonds The Fed Is Buying The Most

Two weeks ago, the Fed sparked a mini market rally after it announced again that it would buy corporate bonds (not just ETFs); something it had said it would do three months prior, yet which neither the algos or the Robinhooders ever quite grasped. This sent stocks soaring, even though it wasn't actual news.

That said, there was some actual news in the Fed's announcement.

Recall that initially, the Fed's Secondary Market Corporate Credit Facility, or SMCCF, was structured to hold two types of investments: "Eligible Individual Corporate Bonds" and "Eligible ETFs." On Monday, June 15, the Fed introduced a third category: "Eligible Broad Market Index Bonds." This new category allows the Fed to immediately begin buying individual corporate bonds in much larger volume than previously anticipated (for more read "The Fed's $250 Billion Debt-Buying "Index" Loophole").

And while it remains unclear just how static the index is or will be, on Sunday, the Fed finally unveiled the constituents of said Index of "Eligible Broad Market" bonds: it consists of 794 names ranging from auto giants Toyota (TM), Volkswagen, and Daimler (DDAIF) at the top, all the way through Valspar (VAL), Washington Gas Light (WGL), and Westside Intermodal. This is what the Fed said:

The Broad Market Index is intended generally to track the composition of the broad, diversified universe of secondary market bonds that meet the criteria specified in the Term Sheet for Eligible Broad Market Index Bonds, subject to generally applicable issuer-level caps specified by the Term Sheet.

It will be recalculated at least every four to five weeks, and the list of bonds that are eligible for purchase will be refreshed more frequently to add or remove those bonds that newly meet or no longer meet the eligibility requirements. The Broad Market Index will be published roughly once a month.

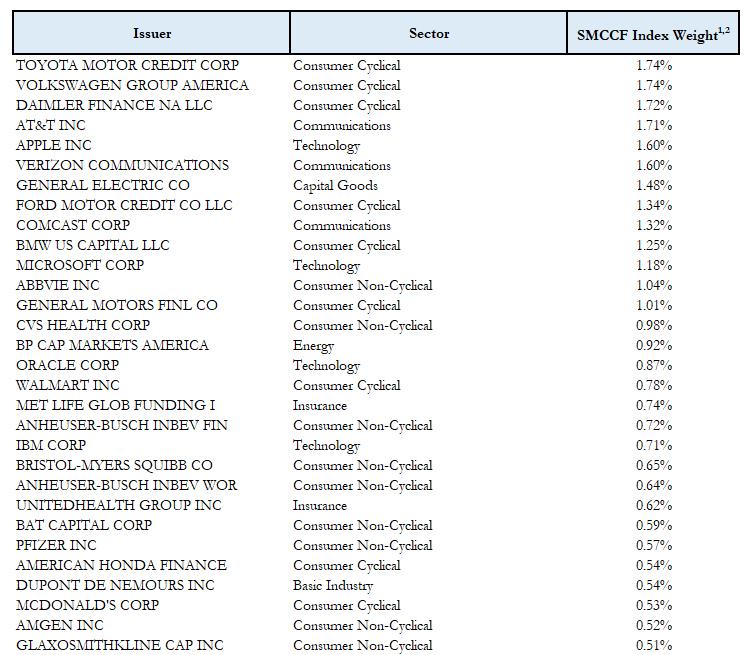

The top 30 constituents by index weight are shown below:

Of note: just 6 names comprise 10% of the entire index, and, as noted above, these are led by Toyota, Volkswagen, Daimler - all of which are foreign companies, and thus will beg the question how do purchases of foreign corporate bonds help the American middle class.

Additionally, the Fed is buying a lot of AT&T (T), Apple (AAPL), and Verizon (VZ). While these are at least US companies, the next question is how does the Fed purchasing Apple bonds, and enabling the company to fund even more buybacks, help Main Street America?

As Bloomberg further observes, "of the $207 million of purchases made on the first day of buying, about 21% were of debt issued by firms in the consumer non-cyclical sector, while 15% were of consumer cyclical debt and 10% were of technology debt."

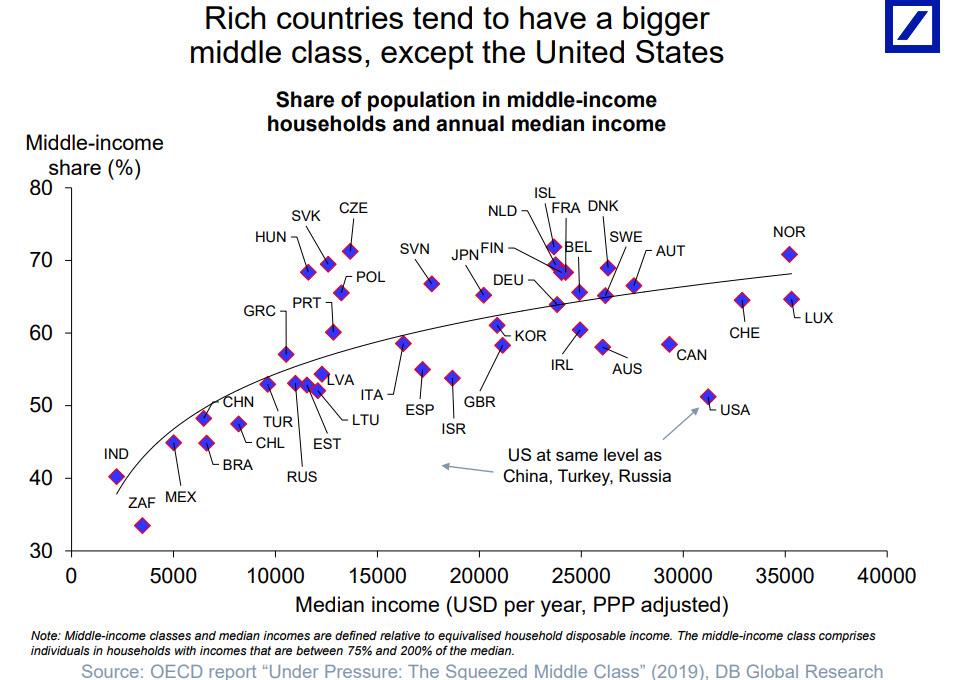

And something else rather interesting: junk-rated issues comprised 3.6% of the securities acquired. Surely, purchases of junk bonds will help the US no longer be a banana republic, whose disappearing middle class is now on par with that of China, Turkey, and Russia.

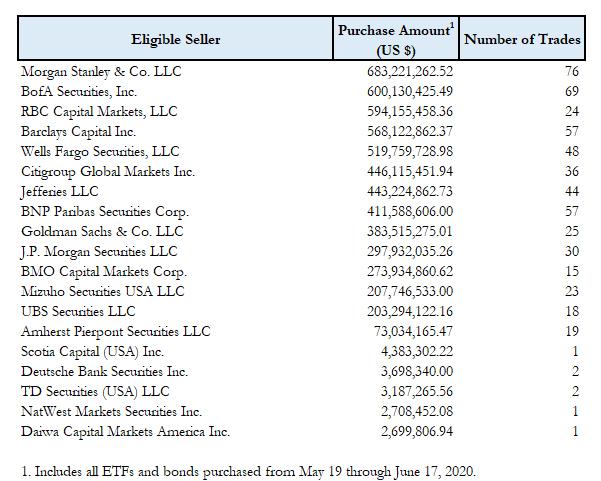

Separately, the Fed also listed which banks were most active in selling bonds to the Fed: the list is below, and is headed by Morgan Stanley (MS), BofA (BAC), RBC (RY), and Barclays (BCS) - four banks, and two of which are foreign.

Still, it's good to know that besides the companies directly benefiting from the Fed artificially propping up their bond prices which thereby become even further disconnected from fundamentals, at least a handful of other - both US and foreign - companies benefit from the US taxpayer's generosity.

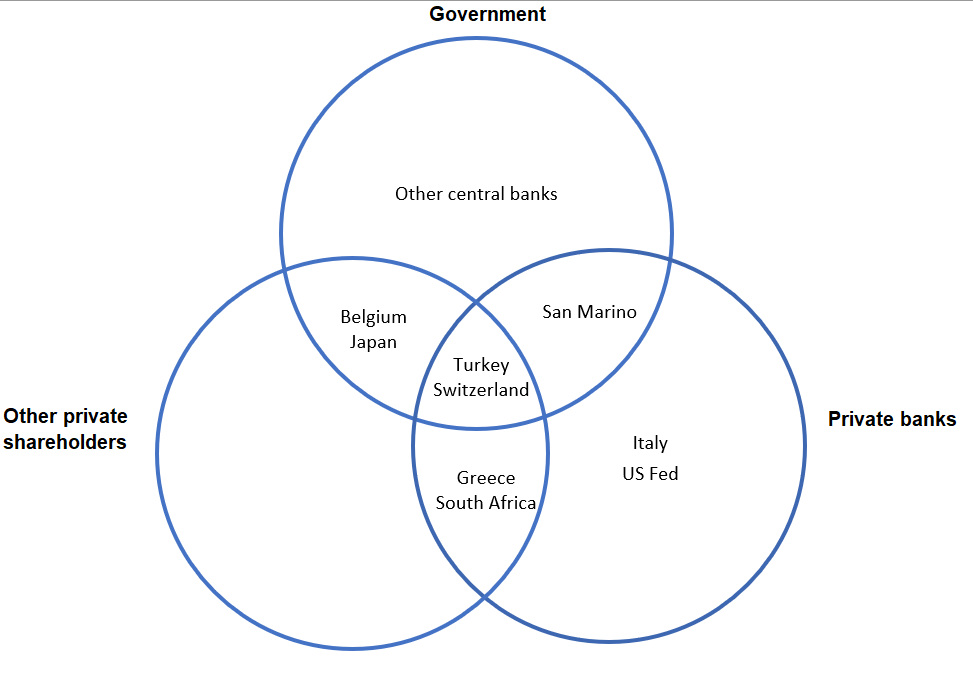

Of course, here we arbitrarily assume that the Fed is an institution that operates on behalf of US taxpayers, even though by now everyone knows that the Fed is a private institution, owned by a handful of commercial banks, as the Bank of England was so kind enough to remind us of last year.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more