They Fought The Fed And Lost: How Powell Triggered A "Spectacular" Short Squeeze In LQD

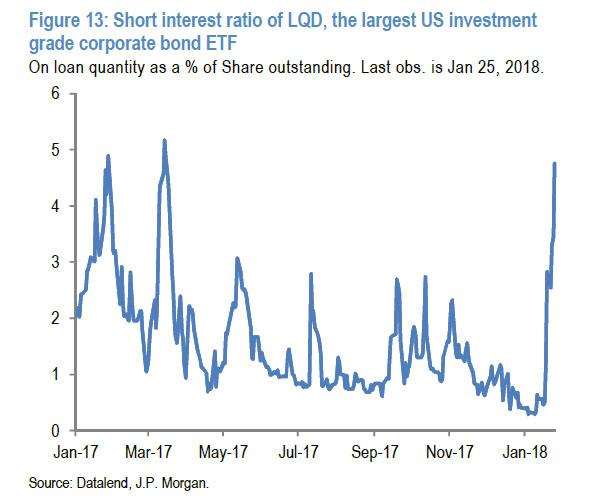

Over two years ago, in Jan 2018, we first showed that when it comes to betting on trouble in the investment grade bond market, investors had a preferred instrument for pessimism: shorting the LQD, the largest US investment grace corporate ETF.

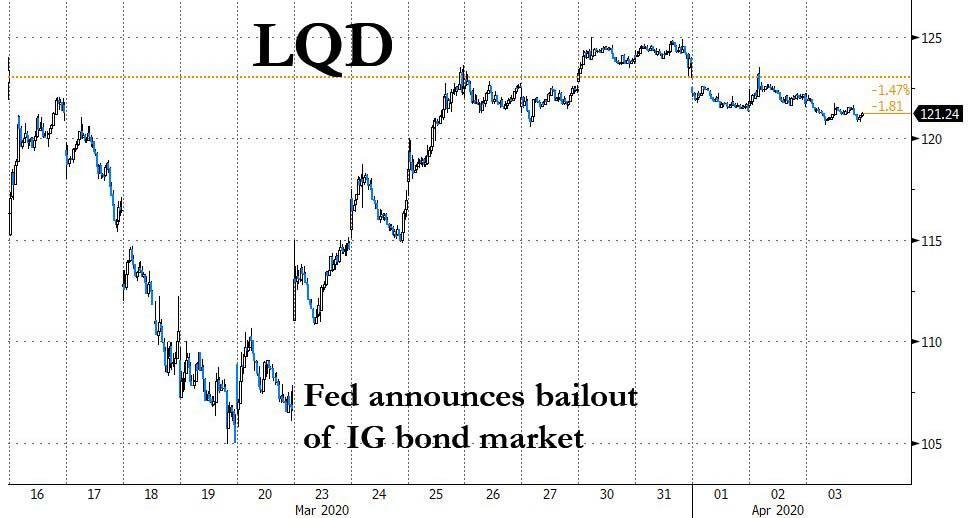

In retrospect, and loosely paraphrasing Crocodile Dundee, what happened to the LQD in Jan 2018 wasn't trouble. This - as shown in the chart below - was "trouble": between its all time high on March 6, and the ten year low hit just two weeks later on March 19, the LQD went bidless as the corporate bond bubble burst, and both investment grade and high yield debt ETFs and single names cratered.

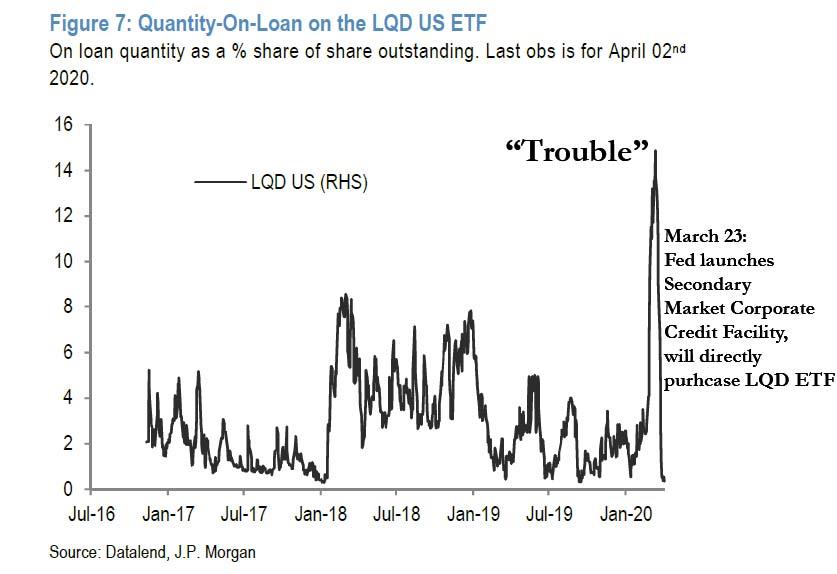

As LQD plunged, the shorts soared, rising to never before seen levels, send the index even lower and sparking even more shorting. By this point, only one thing could save capital markets - both bonds and stocks (why stocks? Because as a reminder the only buyer of stocks in the past decade have been buybacks; kill the bond market and suddenly companies can't issue debt to fund buybacks and it's bye bye, not buy buy, stocks): the Fed had to step in and buy bonds, something we explained on Thursday, March 19 in ""The Bond Market Is Broken" And Only Fed Buying Bonds Can Fix It".

However, on quad-witching Friday, March 20, the Fed did not do what so many traders were now expecting, and the liquidation continued with stocks in freefall, sending the Dow below 19,000, and to levels not seen since the Trump election.

By the following Monday, the Fed was trapped - either it unleashes not a bazooka but a "nuclear bomb" (as Paul Tudor Jones called it) and stabilizes the unprecedented panic gripping traders, or the market was about to close. It picked the former, and before the open on Monday, March 23, the Fed announced not only unlimited QE, but in an unprecedented move, Powell said he would also start buying loans and bonds in the secondary market, as well as the LQD.

What happened next was also unprecedented: as JPM puts it, "looking at credit ETFs, the short base collapsed in spectacular fashion from LQD, the biggest HG ETF after the Fed’s credit backstop programs." As shown in the chart below, all those traders who naively expected that the Fed would not nationalize virtually every market and - at least implicitly fought the Fed - were carted out following the biggest, most "spectacular" short squeeze in history: that of LQD on March 23.The chart below shows that between March 23 and April 2, the % of LQD shares loaned out - a proxy for shorting - had dropped from an all time high to a record low...

... as the Fed triggered a historic short squeeze, crushing all those who did not even know they were fighting the Fed when they shorted the LQD, which had become a systemically important instrument, explaining why everything in the cap structure above IG debt is no longer subject to any market forces but merely to the whims of the NY Fed's trading desk - will it buy LQD, and how much. That's all that maters now.

What happens next?

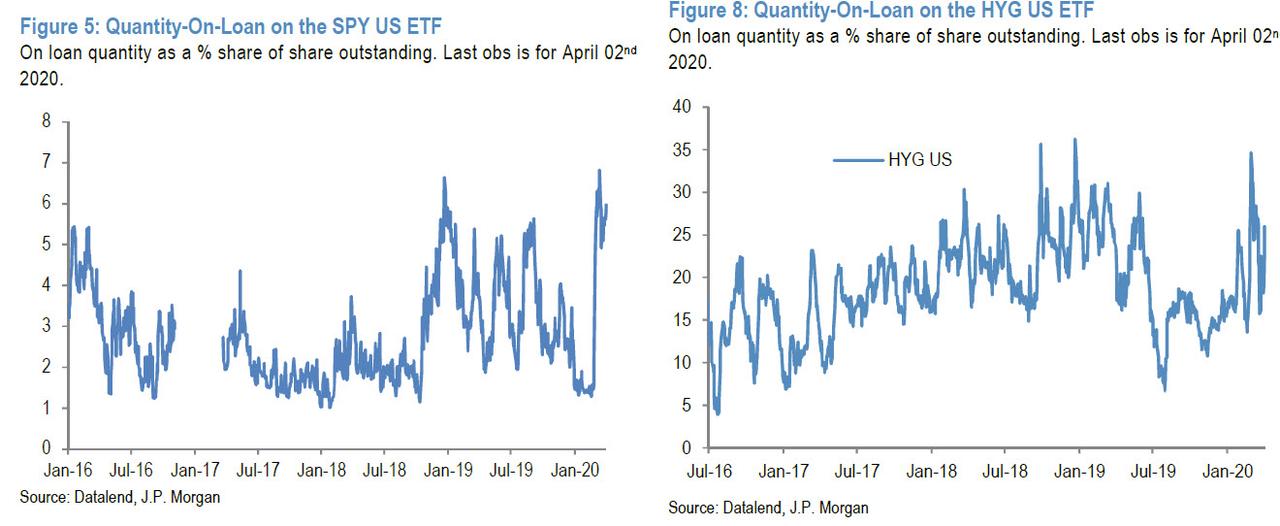

Well, with shorts no longer allowed to speculate in IG debt or anything less risky as it is all backstopped by the Fed now, only a few things remain subject to the whims of markets: junk bonds and stocks.

Which is why, as JPM observes, after the epic squeeze in LQD, the short base on both HY ETFs and the most popular ETF of all, the SPY, remains elevated...

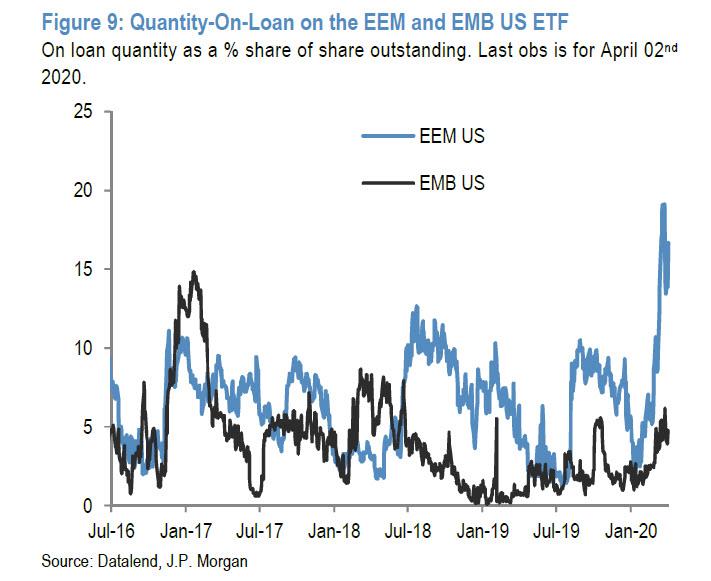

... as does the short base on the EEM ETF.

We point this out because the pain for markets is hardly over, and with shorts now having an even more limited arsenal of instruments, they will inevitably focus on HYG and SPY during the next crash. Which also means that now that the Fed has effectively gone all in, the only question is how low will it allow first junk bonds and then stocks to drop, before Powell goes full Haruhiko "Peter Pan" Kuroda and announces that the Fed will buy both junk bonds and stocks going forward, in the process nationalizing the entire market.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more