There Is A New "Biggest Risk On Wall Street", And This Is How Some Are Trading It

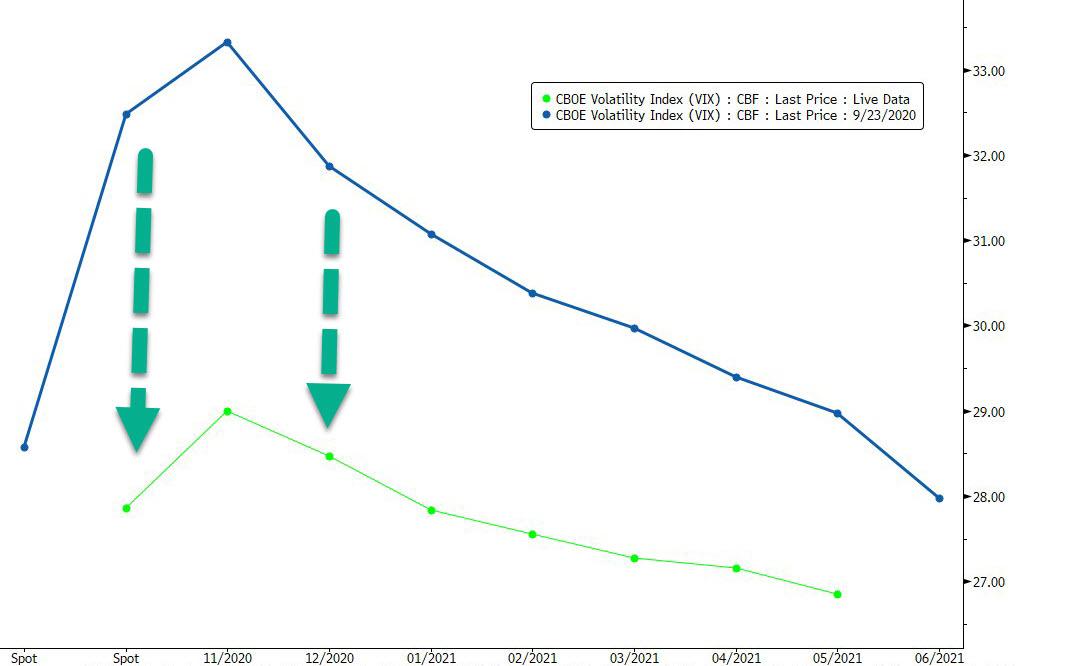

Exactly one month ago, Nomura's Charlie McElligott suggested that the market was too skittish heading into the election, and that contrary to expectations of a contested outcome, the "risk" for consensus positions was that the kink in the VIX term structure that had emerged around the Nov. 3 event would collapse, should there be a decisive outcome on or around Nov 3.

As a result, the Nomura quant concluded that "that some brave vol traders will try to take advantage as a perceived “generational” opportunity to sell this POST-NOV election “richness” (Dec / Jan) - could be a career “maker or breaker,” with the potential to see monster returns if the event were to pass and all that crash is puked back into the ether", although he also hedged by warning that the opposite could just as easy happen and said returns could "conversely be turned to dust into a God-forbid realization of chaos, with civil disorder, dual claims to the throne etc."

One look at the shift in the VIX term structure over the past month shows that McElligott has been spot on as implied vol has shrunk considerably across the curve.

Fast forward to today when McElligott follows up on these observations writing that as he had anticipated for the past month, "the consensual buy-in to the 'election worst case scenario' meme and thinking calamity could be pushed out post the calendar event and into Dec / Jan (in addition to the likely Dealer dynamic, where in light of the recent March vol shock, Risk Management wouldn’t really allow for anybody to be meaningfully “short crash”) meant creation of an 'overhedged' vol dynamic that frankly would require tremendous and SUSTAINED daily market moves in order to realize what was being priced-into markets."

In other words, the market has continued to anticipate sharp moves in vol even as implied vol has contracted, resulting in big pain for all those who were long the VIX across the curve.

So now that we have seen much of the post election kink/premium begin to soften (see chart above), with more traders now aligning with McElligott in thinking there is potential for a much cleaner election outcome, and as some of that "crash" hedge is then unwound back into the market, the Nomura x-asset strategist writes that "there is a mechanical catalyst for a melt-up into YE (even though there is absolutely still "gamma event" risk between now and then)—thus a lot of folks pushing these VIX 1x2 Put Spreads trading in the market, looking to put this on as their "short vol" trade expression to capture a melt-up."

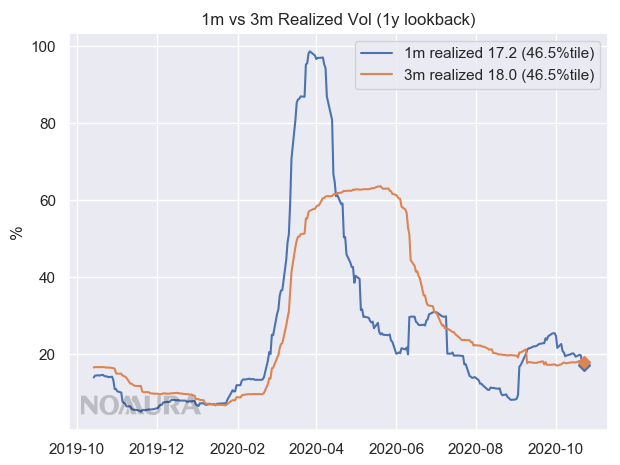

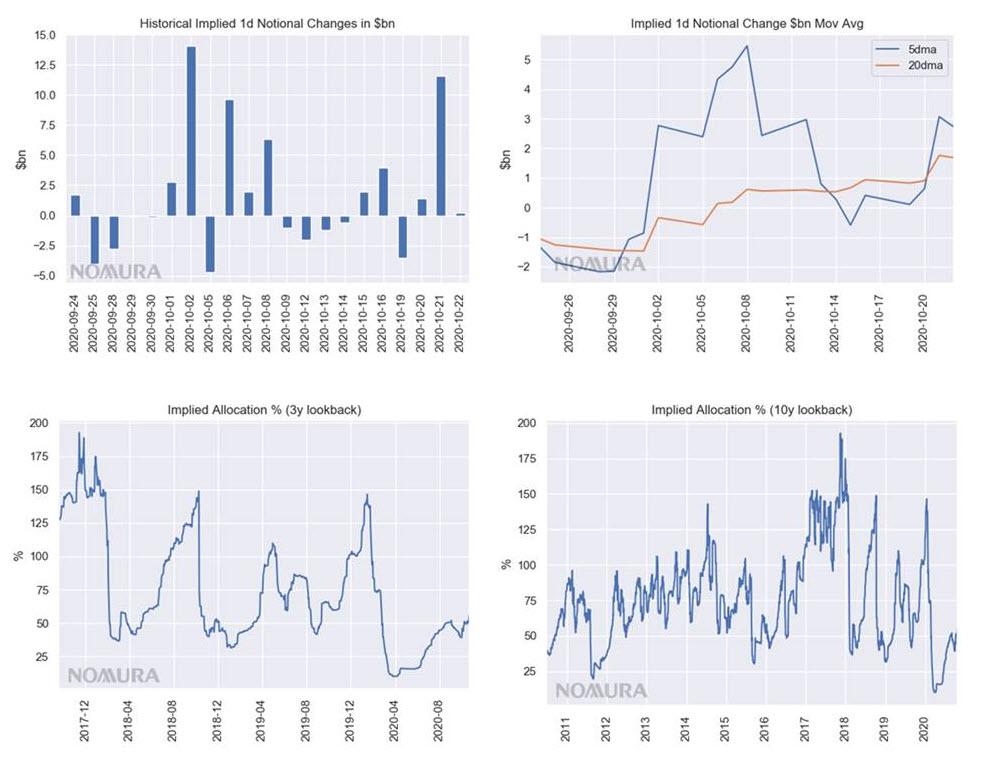

As McElligott then adds, this melt-up scenario gets even more interesting when looking at the recent directional shifts of Nomura's Vol Control model, which after being a massive and latent buyer to the tune of $90-$100 billion after central banks and governments globally unleashed unprecedented monetary and fiscal policy easing, "then saw the summer vol event in the Equities space dictate a spike in realized, which then meant reversal of part of those prior flows, selling ~ $30B at one point during the past two or so months."

But now that the previously elevated VIX is sinking again, thanks to the recent "calm", it has allowed 1-month realized vol (the recent vol input trigger) to average down under the weight of the Aug/Sep blast, which makes 3-month realized vol the new trigger input according to Charlie, as it is the max of the two lookback windows. It is this easing in the VIX term structure that has meant "a recent blast of BUYING per the VC model over 5 of the past 6 sessions (+$13.7B in 5d) which is helping stabilize market against headline shock potentials."

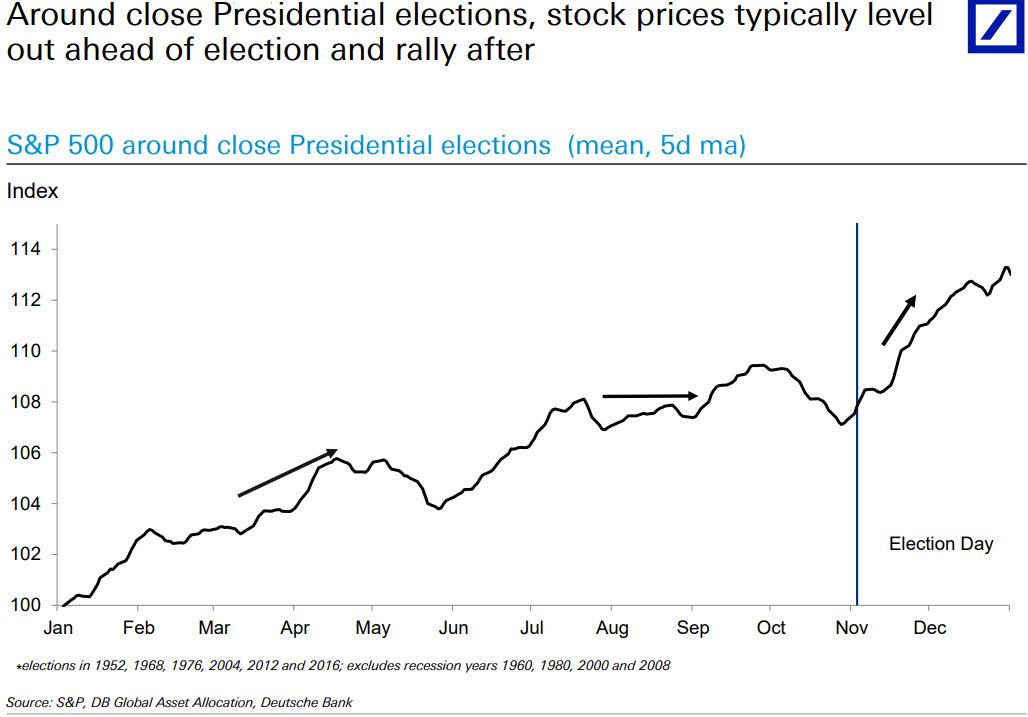

This in addition to all the previously discussed option-linked reasons why the market could blast off higher into year end, in addition of course to the seasonals which heavily skew toward market upside post-election day as the following chart from Deutsche Bank shows:

According to McElligott, the caveat means that the largest risk for the market, which is rapidly reversing its "contested election" bearishness, is this: "NO stimulus between now and the new administration taking-over, which then gets really complicated if the Senate stays Republican as well, who are then emboldened to act as the last line of defense into the Dem House and WH and act as a thorn in their "fiscal largesse" policy plans."

This, the Nomura quant concludes, is why treasury flattening expressions need to be looked at as hedges for the above "tail" which markets are not priced-for, "because everybody is “set-up” for the bear-steepening/pro-cyclical fiscal stim + deficit spend + infrastructure + vaccine RECOVERY trade."

This incidentally is also the topic of a Bloomberg article from yesterday, which looks at the market "certainty" that Trump is going to lose the U.S. election next month and his Republican Party may even fail to keep the Senate, and points out "that traders have been burned betting the house on one side before, such as in the last U.S. presidential election in 2016 and the Brexit referendum the same year. The risk that the consensus for a Democratic sweep of power this time doesn’t play out, or the result being contested, is leading some to take no chances with less than two weeks until the Nov. 3 vote."

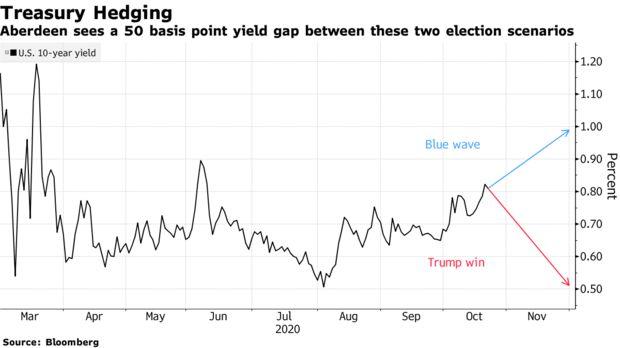

As Bloomberg notes, the market’s view has shifted in recent months from worries about a contested election that would spur volatility, to bets on a solid win for Democrat Joe Biden as the polls consolidate in his favor. That has pushed up Treasury yields along with U.S. stocks on the prospect that a Biden administration would usher in bigger fiscal stimulus, especially if the Democrats take the Senate.

As a result, at least one trader is following the McElligott playbook and loading up on TSYs (and a curve flattener) if the market is once again terribly wrong:

James Athey, a money manager for Aberdeen Standard Investments, has loaded up on Treasuries and has a long position in the dollar and the yen versus riskier currencies such as South Africa’s rand. That’s because he expects these to benefit in the event of a surprise.

“I see a very real chance that the incumbent wins,” he said, looking at social-media sentiment indicators as well as changes in party registrations, both observations we showed first (here and here). "Both suggest more Republican support than the polls."

Manulife portfolio manager Chris Chapman is another who believes the risk of a delayed outcome is underpriced in the market. He has now reduced his underweight position on 30-year Treasuries to reflect that view.

"For us, duration would be the primary hedge for a contested election, and probably some dollar strength,” said Chapman. "The risk of a contested election does seem to be diminished but the market is probably a little ahead of itself with the blue wave consensus."

One final point: with a absolutely staggering, and record, number of shorts piling on the long-end, a Nov 3 surprise either in the presidency or the Senate which takes a massive fiscal stimulus off the table and which sparks bond buying and curve flattening, could quite literally result in the biggest bond short squeeze ever.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more