The Yield Spread Albatross Around USD/JPY's Neck

In the past 24 hours, we’ve touched on potentially bullish setups in EUR/USD and AUD/USD, mirroring the potential topping pattern we’re seeing in the US dollar index itself. Continuing with that theme, USD/JPY looks increasingly susceptible to more downside even after Friday’s 130-pip dump.

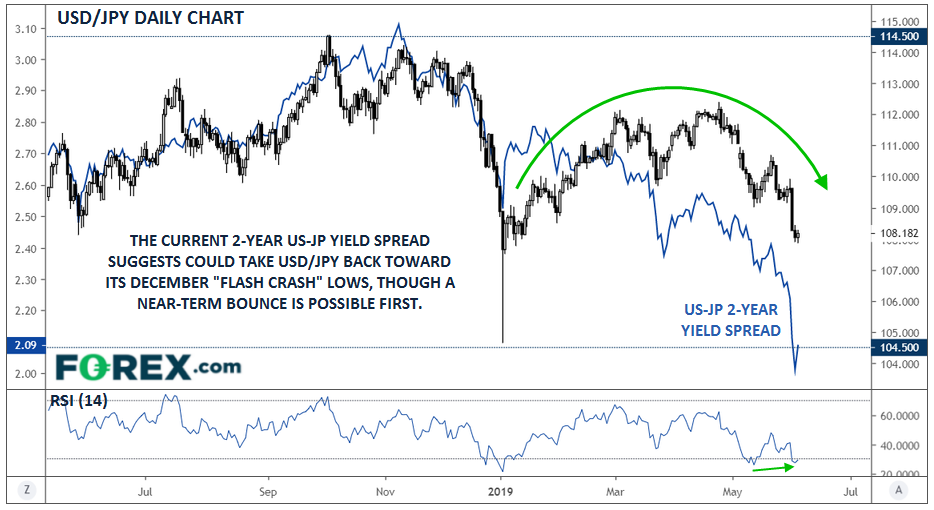

The culprit, once again, is collapsing US yields. Short-term yield spreads are one of the strongest drivers of currency values. So far this year, Japanese 2-year yields have held steady in the -0.15% to -0.20% range for the past six months, meaning that the recent collapse in 2-year US treasury yields has decreased the US’s premium over Japan from above 3% in November just above 2% now.

Source: TradingView, FOREX.com.

While there are other factors at play, the current yield spread is more indicative of a USD/JPY rate near the December “flash crash” lows in the 105.00 range than the current level around 108.00. In the immediate term, USD/JPY is showing a potential bullish divergence in its RSI indicator, suggesting we could see a short-term bounce this week if markets see even a modicum of positive (or even neutral) US news.

Given the rounded top pattern and strong anchor from a collapsing yield spread though, USD/JPY traders may look to sell any near-term bounces toward the 109.00 handle.