The Treasury Moment Of Truth

With bond yields gone wild, rates traders are again trying to justify how the world's (formerly) most liquidity security is trading like a penny stock, with today's sharp moves leaving many desks stunned and nursing substantial losses.

(Click on image to enlarge)

So what's going on? Well, as Jim Reid discusses in his latest Chart of the Day note titled "The Treasury Moment of Truth", over the last couple of months we have seen how the US government bond technicals have been overpowering everything over the last quarter, with the Tuesday news that a multi-billion hedge fund was stopped out of a massive TSY short at a cost of $1.5 billion. However, now that so many are covering and the technical picture is normalizing, there are signs these will ease over the coming weeks. So much so that if yields are still ultralow by the end of September, Reid believes that "there will be real evidence of something more structural keeping yields as low as they are."

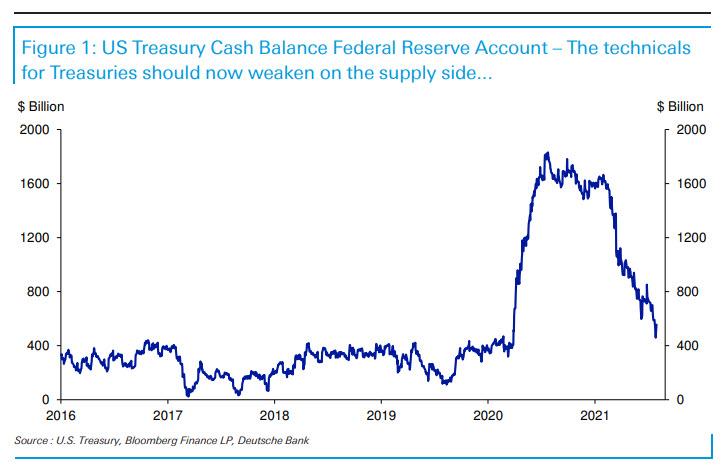

One such technical that we have discussed below and which has now largely normalized is the Treasury cash balance at the Fed (TGA balance), as we discussed earlier this week in "Stealth QE Is Over: Treasury Projects Adding $350BN In Cash By Dec 31, Reversing "Liquidity Tsunami"." This cash balance soared in Q2 2020 as the Treasury over-issued, and stayed high until the end of Q1 2021 but has subsequently fallen by over a trillion dollars, thereby dramatically reducing the amount of treasury supply needed.

(Click on image to enlarge)

And, as we noted on Monday, the sharp drop in TGA cash has been linked to the end of the debt-ceiling suspension period at the end of July. So now that the "stealth QE" is over and the Treasury is done injecting hundreds of billions in cash into the financial system, from here the Treasury will have to issue more in line with the deficit, which will be a function of growth and Biden’s tax plans.

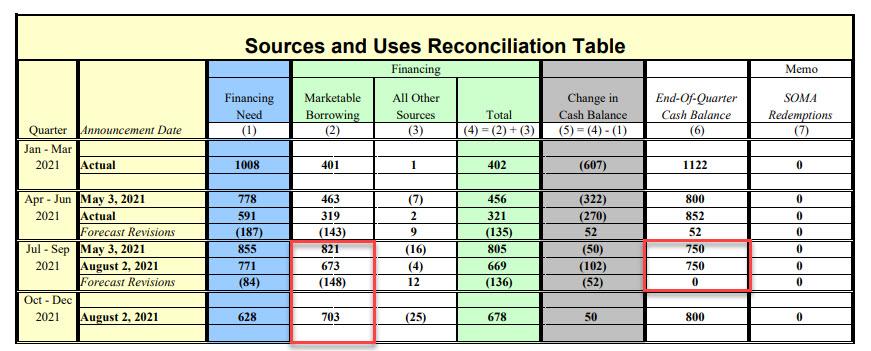

According to DB's Steven Zeng, this TGA balance is below the $750-800bn the Treasury feels comfortable holding if there were no debt ceiling issue, and which the Treasury forecasts will be its cash balance at EOY .

(Click on image to enlarge)

Source: Treasury Sources and Uses table

To Zeng, such a figure might be the new normal in a higher deficit world post-pandemic. As such, Reid believes that the Treasury is likely to over-issue again after the debt ceiling battle is resolved.

And since QE - which will be with us for a long, long time even once the taper begins - will still mean that the demand side is strong, which means the debate over the taper becomes the most important technical theme according to Reid

As a final aside, the seasonals are very strong in August, so the Deutsche Bank strategist doesn't expect these themes to come to the fore until September/October. At that point, Reid concludes, "those of us calling for higher yields will have less excuse if it doesn’t happen."

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more