The “Straight” Bug: The BUG Investment Strategy With No Leverage

In a previous post we introduced our new investment strategy, the BUG. There has been a lot of interest but also some concerns when it comes to using leverage.

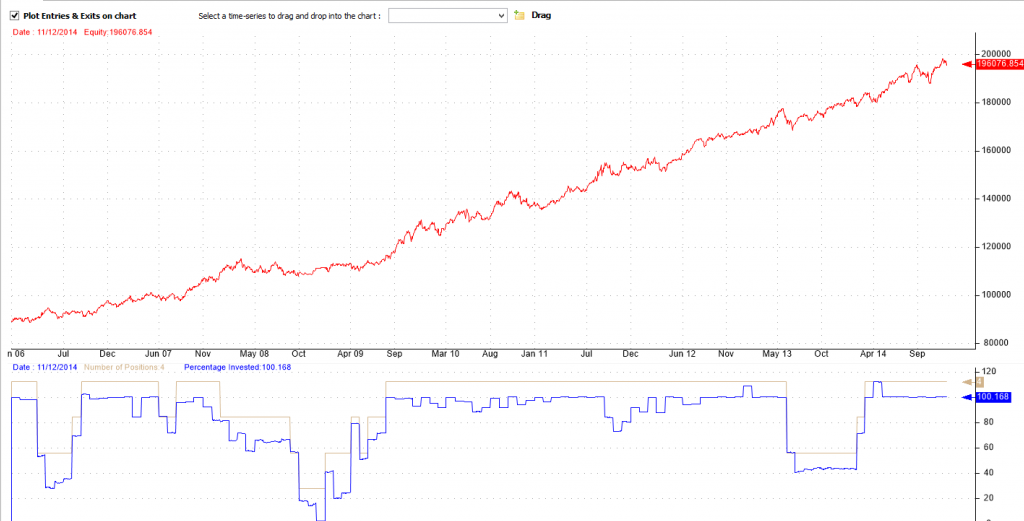

We are introducing a version of the BUG for non-leveraged accounts. Here are the statistics for the backtest for the last 5 years.

| Strategy | Return | MaxDD | Sharpe Ratio | CarMaxDD |

| BUG straight | 9.63% | 5.41% | 0.98 | 1.78 |

In this version we allocate amongst 6 ETFs: SPY, TLT, GLS, CWB, TIP and PCY. Again as in the original strategy we use these heuristics: Timing (using a simple average rule), Volatility Targeting (we reduce exposure to more volatile ETFs), Momentum (we reduce the size of the worst performer and add to the rest). We don’t employ short term mean reversion and we only trade up to 4 assets.

Trading the Strategy

The strategy trades near the beginning of the month. You will receive your signals the day before. You may place the trade for the opening or the closing of the session or you may place a limit order throughout the day. Exact timing makes little difference to the strategy in the long run.

Turnover

The strategy does not usually buy and sell whole positions but rather re-balances positions. We could start with a 25% allocation to SPY and the next month the allocation is reduced to 15%. Most of the time only a part of the position is bought and sold.

Which one should you trade?

Most people should trade the non leveraged BUG.

The leveraged BUG could be traded if you have an account with Interactive Brokers or similar type of discount broker that provides cheap leverage and rock bottom commissions.