The Markets Are Now Addicted To Fed Interventions

The financial system is now completely addicted to Fed interventions. As I’ve noted over the last month, the Fed has implemented monetary programs to buy just about every asset class.

As a brief refresher, the Fed is now intervening directly in:

- The Treasury markets (U.S. sovereign debt).

- The municipal bond markets (debt issued by states and cities).

- The corporate bond markets (debt issued by corporations).

- The commercial paper markets (short-term corporate debt market).

- The asset backed security market (everything from student loans to Certificates of Deposit and more).

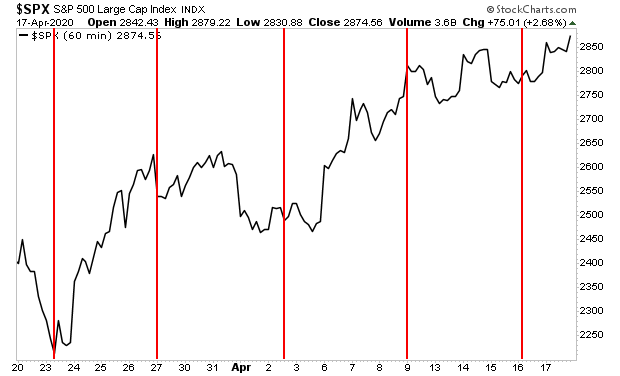

Of the various programs the Fed announced, its daily QE program is the most important, as far as stocks are concerned. The Fed first announced a daily QE program of $75 billion on March 23rd, 2020. That was the day the stock market bottomed.

It then reduced this operation from $75 billion per day to $60 billion per day on April 2nd, and again to $50 billion; then $30 billion the following two weeks. And last week, the Fed announced it would be cutting its daily QE even further to $15 billion.

You’ll note in the chart below that with each reduction in the Fed’s QE programs, the market’s momentum has slowed. The one exception to this was the week of April 2nd to April 9th, during which the Fed announced another $2.3 trillion in monetary interventions, which negated the drop in its daily QE programs that week and sent stocks soaring.

What does this tell us?

That the markets are addicted to Fed interventions. Every time the Fed reduces its daily QE programs, stocks lose momentum. It is no coincidence that stocks are red right now, on news that the Fed will be lowering its daily QE program to $15 billion.

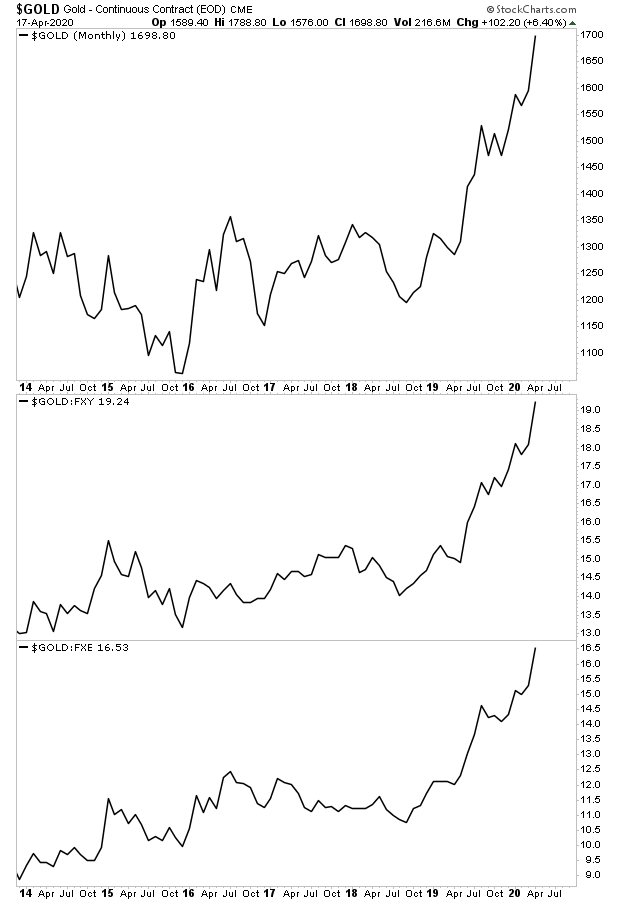

If the impact of Fed interventions on stocks is high, it’s even greater on gold. The precious metal has exploded higher in the last month. Mind you, the Fed isn’t the only central bank ramping up the printing presses; gold is exploding higher priced in dollars, yen, and euros, as central banks around the world are printing trillions of their currencies.

Gold is realizing that all of this money printing is going to ignite an inflationary storm.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.