The Market And Fed: Diverging Expectations

It’s extremely difficult to guess what monetary policy will be in 2022 and 2023 because the Fed has a new policy prescription and we don’t know how quickly the economy will ramp up. The Fed has historically looked for 2% core inflation, but now it wants core inflation to average 2% for the cycle which implies it wouldn’t have raised rates at all last expansion. We wonder if the Fed would have gone through with that over the 10+ year expansion (had that been its policy). If the Fed had never raised rates, it wouldn’t have been able to cut them early last year. We learned last year that the Fed almost never can run out of ammo in a crisis. That makes it less necessary to worry about how the Fed will respond to a future recession if rates are low. (The Fed doesn’t need to raise rates so it can cut them in a crisis).

Bond market pricing in faster and larger increases in the Fed’s policy rate – over 80% odds for a 25 basis points rate hike in 2022, followed by two rate hikes in 2023. By the end of 2024, investors expect a cumulative 125 basis point tightening. Fed should push back. @SoberLook pic.twitter.com/zrMrdjDENf

— Kathleen Bostjancic (@BostjancicKathy) March 2, 2021

This is a very perplexing scenario because in a previous article we laid out that if the Fed doesn’t hike rates until the 3-year average core PCE inflation rate gets to 2%, it probably won’t hike them in 2022 or 2023 because 2020’s low numbers will drag the average down. With that understood, it’s odd to see the market pricing in rate hikes so soon. In the past couple of weeks, the market has moved towards expecting more rate hikes and having them start sooner. There are now 80% odds for a quarter-point hike in 2022 and two hikes in 2023. By the end of 2024, the market sees five hikes in total.

The market doesn’t think the Fed will follow through with its new average inflation target. The next Fed meeting is from March 16th to the 17th. It will be very interesting to see how much it tries to talk down the odds of hikes while still recognizing the improved economic outlook. It would be much easier for the Fed if the February labor report ends up being terrible. We don’t think it will be terrible. The median forecast is for 210,000 jobs created. It would be weird for the Fed to go out of its way to be extremely dovish as the economy is showing signs of bouncing back. However, that’s what is necessary to alter the Fed funds futures market.

Shale’s Decline & The Near-term Future Of Oil

Shale has a much larger decline rate than conventional drilling. This was a major criticism during the heyday of the shale bubble in the 2010s. These companies didn’t generate positive free cash flows when oil prices were high and production was the highest. Lower production due to high decline rates and lower oil prices are why these stocks have taken such a hit. EOG Resources, which is widely regarded as the premier fracking company, has seen its stock fall over 50% since 2018.

'Without significant new drilling, US shale output will decline sharply.' https://t.co/irNfSgxVCp via @SoberLook pic.twitter.com/yugKrmbz76

— Jesse Felder (@jessefelder) March 2, 2021

The collapse of shale production is bullish for the price of oil. As you can see from the chart above, the large decline rates in the past few years led to a big decline in overall production. The 36% decline rate in 2020 led to a 3 million barrel per day loss of production. Shale is the only reason oil prices have been so low in the past few years. The oil market needs shale to avoid $80 or higher prices.

The chart below uses the managed money short position to calculate where prices are headed in the short term. Managed money short positioning has fallen below 12%. Once it rises back above that point, it’s a negative signal for oil prices. This strategy has a good long-term track record.

Oil Managed Money short positions closing in on 10%.

— Warren Pies (@WarrenPies) March 3, 2021

History argues - quite strongly - that there is not much room to rally from here without a positioning rebalance (i.e. shake out some longs/bring in some shorts).

OPEC prod increase could be the catalyst. pic.twitter.com/9VmIUxe8cD

Consumer Staples Win Big

The consumer staples sector is widely thought of as a bond replacement. That’s important now because investors are scared the 10-year yield will rise further. You shouldn’t sell these stocks on the thinking that they are bond proxies because they actually have much higher earnings growth than the real bond proxies. As you can see from the chart below, staple’s earnings growth averaged 7% over the 22 year period studied. The real bond proxies, which are telecom and utilities, only averaged slightly above 2% earnings growth per year.

It's a couple years old (should be updated soon), but I like this illustration from @JonFell73 showing the bulk of global staples' returns the last ~40 yeras have come from earnings and dividends pic.twitter.com/fkWG4AvwHH

— Lawrence Hamtil (@lhamtil) March 2, 2021

That being said, this sector will be hurt by higher commodities prices. Many of the stocks in the food industry have been weak because of the rise in inflation expectations. The Dow Jones Food and Beverage index is down 1.9% in the past 3 months which is way below the S&P 500’s 5.5% gain in that period.

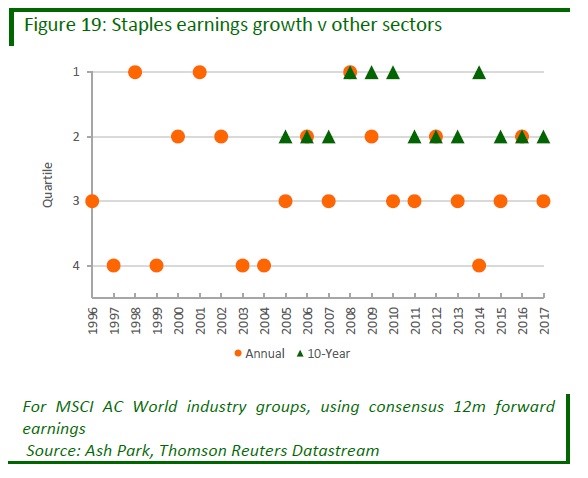

The exciting aspect of staples is their long-term consistency. As you can see from the graphic below, the 10-year average staples earnings growth rate never was in the bottom half of performance by sector from 1996 to 2017. It was in the lowest quartile in 5 individual years and the highest in just 3 years. It will rarely be great in 1 year periods, but it has always been better than average in 10 year periods.

Money Buys Happiness

Conventional wisdom says money doesn’t buy happiness. Most people believe after a certain point where all necessities are taken care of, more money doesn’t lead to more happiness. A new survey shows happiness doesn’t actually plateau after earnings reach $75,000 per year (basic necessities met). There are many benefits to earning $150,000 per year over earning $75,000 per year. It’s not shocking to see satisfaction increase. What level of income do you think you need to be happy? Clearly, there are other aspects to life satisfaction besides money.

Chart: Money Does Buy Happiness After All 💰https://t.co/FSoUXSNMEE pic.twitter.com/NJISfPshtO

— Visual Capitalist (@VisualCap) March 2, 2021

Conclusions

Using its new plan, the Fed won’t hike rates for a while (years). However, the market now sees hikes next year. Shale is facing deep declines if it doesn’t increase drilling intensely. Oil prices might be on the verge of a pullback if an indicator is reached. Consumer staples grow earnings quickly and steadily because they tend to have wide moats. A new study shows that happiness keeps increasing after you make over $75,000 per year. It was weird to think satisfaction stopped going up at that level.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be ...

more