The GOP's Fiscal Surrender: Why A "Yield Shock" Is Baked Into The Cake

The US Treasury is fixing to sell the staggering sum of $294 billion in bills, notes and bonds this week, and it's a holiday-shortened week at that. So you'd think the bond market would be choking at least a tad on this tsunami of paper, but in fact yields on the 10-year UST have slid 20 basis points recently and are now at five-week lows.

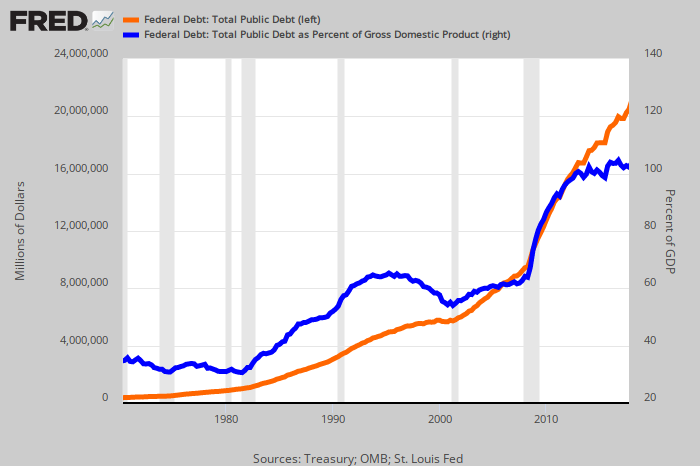

To be sure, at 2.75% the yield is still 140 basis points above it mid-2016 post-Brexit low; and its is only a matter of time before the treasury benchmark resumes its upward march through the 3.00%mark on the chart below and from there toward 4.00% and beyond.

In fact, that impending "yield shock" is so baked into the cake that you can smell it burning on the bottom of the pan. By contrast, the minor head fake in the opposite direction this week is just the boys in the bond pits buying a silly rumor and squeezing some folks who perhaps got too short too fast.

Here we use the word "silly" purposefully. The chatter at the moment is that the so-called inflation scare from the 2.9% reading on January wages has faded markedly, and that the Fed consequently may find a reason to ease the pace of its rate hiking campaign or even end it early.

As former Lehman trader and now Bloomberg macro commentator, Mark Cudmore, recently noted:

Tomorrow brings February’s PCE data, supposedly one of the Fed’s preferred inflation measures. The consensus forecast is for the core number to climb to 1.6% year-on-year. That paltry rate of inflation would still be the highest since since March last year.

A miss of just 0.1 of a percentage point and investors will start considering the possibility that inflation may already have peaked, and hence perhaps so has the Fed’s rate-hiking cycle. That would put the cat amongst the short Treasury pigeons (positions).

It’s not going to take too much for serious discussion to begin over the possibility the Fed’s hiking cycle may be at an end, or near an end, already.

With all due respect (i.e. not much) neither the second decimal place on the PCE deflator nor the precise number and pace of "hikes" in the Fed phony" target rate" has anything to do with the impending "yield shock".

Recall that in the aftermath of the Fed's QE madness there are still $2.1 trillion of excess bank reserves on deposit at the Fed, meaning that the Federal funds market is still deader than a doornail. What the Fed's "target rate" consists of, therefore, is the pro forma rate (now 1.75%) at which the FOMC---purportedly in its wisdom---confers windfall IOER (interest on excess reserves) payments on member banks.

At the moment that amounts to $37 billion per year of profit goodness for the banks, and if the Fed should dither again and raise rates only one more time this year rather than twice as promised at the March meeting, the IOER payment by December would annualize to $42 billion rather than $47 billion.

But a $5 billion difference among thieves banks will make no matter at all in the bond pits. That's because what is happening in the latter is a monumental monetary/fiscal collision. The Fed is dumping its swollen balance sheet at the very time that the Trumpite/GOP has kicked on the deficit after-burners with positively reckless abandon.

Beginning in October, the Fed's bond-dumping campaign will be in full stride at a $600 billion annual rate. Moreover, unlike in the case of the phony rate hiking campaign, where the proverbial "incoming data" on inflation, jobs and growth could impact timing, the QT (quantitative tightening) operation is strictly on auto-pilot.

That distinction, in fact, is crucial. The Fed heads, including Chairman Powell who has been drinking the Cool-Aid for upwards of six years now (he was appointed by Obama in early 2012), fully understand that the unparalleled power of their unelected franchise depends upon the capacity to flood the economy with "stimulus" in the event of recession, which even they concede has not been outlawed.

So they are determinedly in the business of replenishing their dry powder as a matter of institutional self-interest and Keynesian ideology, not from reading the monthly macro-economic tea-leaves. Accordingly, short of an officially defined recession, which always comes well after the fact, the Eccles Building will persist in its bond dumping campaign well into FY 2019, and that's where the rubber will meet the road.

In fact, $1.8 trillion of Federal debt will be seeking a home in the bond pits when you add next year's $1.2 billion of new borrowing to the existing securities the Fed will be dumping.

Moreover, the manner in which Washington is stumbling into borrowing an unheard of 6.0% of GDP in what will be the 10th year of economic expansion is even more telling.

It is happening because the so-called fiscally conservative party has been insistent on twin budget busters.That is, a huge tax cut for business, which couldn't have passed had it been paid for with loophole closers or spending cuts; and a massive $80 billion military spending increase, which could not pass unless it was coupled with a nearly identical add-on to domestic appropriations.

So the whole fiscal equation grew like topsy from an inherited baseline that CBO predicted last summer would result in a hefty $690 billion deficit for the upcoming fiscal year (FY 2019).

Needless to say, that itself was a pretty nasty number for this late in the business expansion: Once upon a time, even dyed-in-the-wool Keynesians thought you should balance the budget at least at the cycle's tippy-top.

But then came the front-loaded GOP tax bill at an FY 2019 cost of $300 billion (including interest) and shortly thereafter the Horribus appropriations bill (as we called it yesterday).

Now that one is a special piece of work, and not just because it added annual cost of $143 billion to appropriations levels for the current fiscal year. The real stinker was that this was done with full knowledge that there's no chance whatsoever that 12 appropriations bills can be passed before October 1 for FY 2019.

Instead, there will be a pre-election CR (continuing resolution) that will lock in all of this year's pork ($80 billion for DOD and $63 billion for domestic agencies) for the second year running. And even the so-called fiscal hawks of the Freedom Caucus will feel compelled to vote for this next-in-line CR for fear of getting blamed for a government shutdown or in order to pay the troops and buy the fuel for America's imperial forces scattered all over the planet.

But it actually gets worse from there. Congress also literally went nuts appropriating "disaster relief" money for any county from sea-to-shining-sea that perchance suffered a hurricane, flood, forest fire, earthquake, tornado or any other slightly unruly act of mother nature last year.

Indeed, over the years we have seen a lot of pork slopping into the amble troughs on Capitol Hill. But nothing like this current round of disaster thieving. To wit, after appropriating $15 billion in September, they added $37 billion in October and then another $81 billion in the omnibus bill just passed.

So when you add-in the Horribus appropriations bill, $133 billion of disaster relief spending over the next few years and the $50 billion or so of annual borrowing that is excluded from the deficit (e.g. student loan disbursements), you have a $1.2 trillion borrowing requirement in the upcoming fiscal year, and it only gets worse from there.

Thus, the $80 billion increase in defense spending for FY 2019 is only the down-payment: What the Donald, his new War Cabinet and a war-fevered Washington has actually embraced is a defense bow-wave that far exceeds even the Reagan build-up. In our judgment, the already bloated 10-year defense baseline of $7 trillion will soon inflate to budgets of $1 trillion per year and more than $10 trillion for the period as a whole.

At the same time, the entire budget for social security, medicare/Medicaid and the lesser entitlements has been put off limits by the Donald himself, as well as by a goodly share of the GOP ranks on Capitol Hill. But those ring-fenced entitlements amount to upward of $2.5 trillion of annual spending currently and are rising rapidly owing to the tsunami of baby boom retirements.

But the heart of the matter is that the Trumpite/GOP has now effectively punted in even the tiny corner of the budget (about $550 billion per year) accounted for by domestic discretionary spending. That's where the "guns and butter" log-rolling process that we recently described came into play last week.

Here is how the liberals at Politico gloatingly described what happened in the Horribus bill, and it tells you all you need to know about why the "yield shock" is indeed baked into the cake:

Now the Republicans who control Congress have passed a $1.3 trillion omnibus spending bill, and it not only protects Obama’s priorities, it expands them. It does far less for Trump’s stated priorities...

The omnibus—Capitol Hill jargon for a single spending bill that funds most government functions—does not kill any of the programs or agencies Trump’s budget proposed to kill; it triples funding for TIGER, nearly doubles CDBG, and boosts ARPA-E’s budget by 16 percent. Trump wanted to slash the Energy Department’s renewables budget 65 percent; instead, Congress boosted it 14 percent. Trump proposed to keep nonmilitary spending $54 billion below the congressional budget cap; the omnibus spends right up to the cap, a $63 billionincrease from last year.

Still, given the power of Republicans in Congress and their usual deference to the president, it’s fairly remarkable how many of Trump’s budget priorities failed to hitch a ride on the omnibus. Not only won’t it build his wall.....(it) won’t eliminate the National Endowment for the Arts, the National Endowment for the Humanities or the Legal Services Corporation, and actually provided modest funding increases for all three agencies. It won’t fund Trump administration proposals to expand school choice or replace food stamps with home-delivered boxes of food.

Mulvaney’s budget blueprint called for a dramatic shift in Washington’s fiscal trajectory, shrinking just about every domestic program that didn’t involve the military, veterans or the border. But it has been clear throughout the Trump era that the Republican leaders who clamored for austerity in the Obama era no longer care so passionately about shrinkage.

The omnibus did not adopt Trump’s proposed cuts to Pell Grants for low-income students, Head Start for low-income children, the Centers for Disease Control and Prevention or the National Institutes of Health, which all got more money than they got last year. The Environmental Protection Agency, which would have lost nearly a third of its budget if Trump had his way, was level-funded.

Those are presumably the kind of priorities Trump was grumbling about when he tweeted that he “had to waste money on Dem giveaways in order to take care of military pay increase and new equipment.”

Indeed, he did. And that's why it's now all over except the shouting.

As we said at the beginning, they are going to borrow nearly $300 billion this week, and from your editor's vantage point that is a pretty symbolic number. Riding into the nation's capital in a taxi cab to report for work on Capitol Hill in June 1970, we heard a man on the radio lamenting the national debt had just crossed the $350 billion mark.

At least that had taken 182 years and 37 president to accomplish, and at the time it amounted to a modest 32% of GDP. In the interim, we got to $22 trillion of public debt and 104% of GDP.

But like we said. That was just the warm-up. Now it's going to soar---even as our money printing central bankers finally head for the sidelines.