The Fed Will “Follow” TBill Rates Lower And Cut .25%

“Davidson” submits:

There are presently 3 perceptions by investors watching Fed actions on the Fed Funds rate.

- Some may see another Fed FedFunds rate cut as positive.

- Some may see the Fed as panicking with another cut, a negative, sending an ominous signal about perceived economic weakening.

- Some see economic strength and believe the Fed is grossly out of touch with reality.

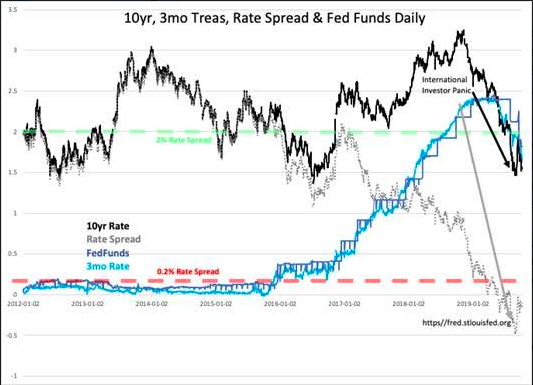

The one belief in common is that they all believe that the Fed controls interest rates. The historical data tells the opposite. The Fed’s history always follows T-Bill rates after a short interval. The one exception was Fed Chair Volker’s early 1980’s Fed Funds rate actions to counter the market’s inflationary expectations. Other than this, the Fed follows, it does not lead. The same is true for Central Bankers globally. One can see this in the details of daily rates. With T-Bill rates declining to 1.63% today, the gap vs. the Fed Funds at 1.88% is now 0.25%. Chair Powell’s last Fed Funds rate cut came shortly after the T-Bill rate fell 0.25% below the Fed Funds rate of 2.12%. As T-Bill rates again reflect a 0.25% gap below Fed Funds, investors should expect the Fed to follow once again.

(Click on image to enlarge)

(Click on image to enlarge)

What is driving rates is capital streaming out of China. China’s shift towards authoritarian governance and its attempt to impose this on Hong Kong has panicked investors to shift out of Yuan-priced assets. The Yuan/US$ exchange rate has plummeted as capital seeks safety. This net/net has driven US 10yr Treasury rates to 1.55%, T-Bills to 1.63% and ~$17Tril of Sovereign Debt in Europe to negative rates. The correlation of the Yuan/US$ exchange rate to the 10yr Treasury rate is very pronounced.

The historical implications that falling T-Bill rates and an inverted US yield curve no longer hold as signaling economic weakness. With capital streaming out of China and other locales to safer Western markets, the signal an acceleration in the better economies due to lower borrowing rates. China is in economic trouble with its push into autocratic governance. The rest of the world is benefiting. Capital is shifting to better venues which hurts China while benefiting growth elsewhere. Global growth, especially growth in the US, continues as supply chains shift with this massive shift helped by very low-interest rates.

In short, capital is fungible and as China has declared war on Democracy, capital shifting out of China and other autocratic-leaning countries is stripping these leaderships of the economic activity they need to survive. In my opinion, the fluidity of capital in today’s world permits capital to better balance risk/return. Starving autocratic leadership of the capital it needs to succeed is what is driving rates, not Central Bankers.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more