The Dividend Strip Strategy

Today, we’re looking at the dividend strip strategy. We’ll look at the problem of low yielding defensive assets, and an alternative solution.

The Problem

Many investors, especially men, are always on the lookout for the BBD: the Bigger Better Deal. This can lead to these investors ignoring standard guidelines of proper asset allocation, and/or taking on more risk than they would otherwise be comfortable with. But let’s face it: with interest rates at nearly 0%, who wants to invest in things like CDs or bonds?

The latter varies up to about 2%, while the former comes in at a paltry 0.35%. And money market accounts that offered 12% some 30 years ago aren’t much better than CDs today, with top yields of only 0.6%. And yet, these are all things that the investor is offered as the “fixed income” portion of their portfolio.

So, are conservative investors left with no other choice than to take the soul-crushing rates of 2% or less for upwards of half of their portfolio? Even “aggressive” investors are recommended to have a quarter of their portfolio in bonds.

And to get the top rates, you often have to pick the longest-term investments you can find, locking in those rates for up to 30 years(!).

An Alternative

Although less popular among investment firms, another form of fixed income can be found with dividend stocks. To be fair, investment firms do not consider dividend stocks part of the “fixed income” portion of your portfolio because, well, you’re investing in stocks. That means that your investment is part of the overall stock market, hence it belongs in the “stock” portion of your portfolio.

But dividends offer a way to generate returns (or income) without having to sell the underlying asset (in this case, the stock paying out the dividend).

There is another problem with dividend stocks being “fixed” income, however: just because the stock has offered a dividend before, does not mean anything about future years. It could stay the same the next year, go down, or even disappear altogether.

It’s possible to try to get around this by investing in mutual funds or ETFs that carry a basket of dividend stocks.

That way, even if some of the companies lower or even stop offering dividends, there are enough other companies who are keeping and maybe even increasing their dividends that you can still derive some income from that investment. Yet even this is hard to classify as “fixed” income.

Wouldn’t it be nice to be able to capture the dividend regardless of whether the stock decided to offer a dividend?

And what if you were able to lock in a rate that you were comfortable with, rather than hope the rate will stay the same?

Another “Option”

Many traders and some investors are familiar with options.

Options are contracts that you can buy that give you a right to purchase or sell a particular stock (the underlying) for a particular price (the strike price) by a particular date (the expiration).

In addition to buying options, it is possible to sell options – however, selling options means you are taking on the obligation of purchasing or selling the underlying for the strike price by the expiration.

There are call options and put options.

When you buy a call option, you MAY purchase the underlying for the strike price by the expiration if the price of the underlying is above the strike price.

If you sell a call option, you MUST sell the underlying for the strike price by the expiration if the price of the underlying is above the strike price.

When you buy a put option, you MAY sell the underlying for the strike price by the expiration if the price of the underlying is below the strike price.

If you sell a put option, you MUST buy the underlying for the strike price by the expiration if the price of the underlying is below the strike price.

Don’t worry if all that sounds confusing. We are going to be looking at a strategy that solely focuses on selling put options.

Selling put options gives you immediate income – but means that you must be willing (and able) to buy the underlying at the strike price, should the price of the underlying go below the strike price.

For example, the current price of XYZ stock is $100. You can sell a put option with an $80 strike price to bring in immediate income. But that means if the price of XYZ stock falls below $80 by the expiration, you must be willing and able to buy XYZ for $80. That means that the price of XYZ would have to fall 20% by expiration before you’d have to buy it.

Therein is the rub: how likely is it that XYZ will fall 20% by the expiration, and if it did, would you be ok with owning it (at $80)?

A Creative Solution – The Dividend Strip Strategy

Let’s take a real-world example: AT&T.

The current price (as of 2/13/21) is $28.80. It’s expected to pay a dividend (over the year) of $2.08, or 7.22%, for every share you own. That’s over 3 times better than the best bond rate.

If you owned 100 shares, it would mean that you invested $2,880 for the stock, and the dividend you would expect is $208. You could invest the same $2,880 into a bond, and let’s say that you got the best rate, 2%. That same investment would only bring $57.60 for the same year.

There are a few differences, however.

First, bonds pay you their interest rate, PLUS, at the end of the term, you get the principal investment back, or in this case, the $2,880. Of course, the term is 30 years, which is a long time.

But for the sake of argument, let’s say it’s only one year. In the case of buying $2,880 in AT&T stock, at the end of the year, you would have earned $208, but it’s uncertain what your principle would be in a year. The price of the stock could have gone up, which would be good for you, or it could have gone down, which would be bad for you.

You would only get the initial $2,880 investment back if the price of the stock was exactly the same: $28.80 per share.

However, there is a strategy called the Dividend Strip Strategy that would allow you to earn a comparable percentage to the dividend on the stock, but with much less risk.

It involves selling a put option on AT&T stock. I’ll explain the details in a little bit, but for this example, we could sell a $25 put that expires January 21, 2022, for $171. This would involve putting up $2,500 in cash in case the price of AT&T stock was below $25 per share by expiration. This means you would earn a 6.84% return on your investment.

Additionally, the price of AT&T could fall by as much as 13%, and you would still be able to keep your full initial $2,500 investment.

Whereas if you bought 100 shares of the stock at $28.80 and the price fell 13%, your initial $2,880 investment would only be worth $2,505.60. Adding back the $208 in dividends, you would only have $2,713.60 left.

That’s a loss of more than 5% on your investment.

In contrast, by selling the put, the stock price could fall to $23.29 per share – which is more than 19% – before you would start to lose any of the initial $2,500 investment. (If the stock falls more than 13%, you would start losing the $171 you earned by selling the put. With a stock price of $23.29, you would be at break-even from the income generated by selling the put.)

Dividend Stripping

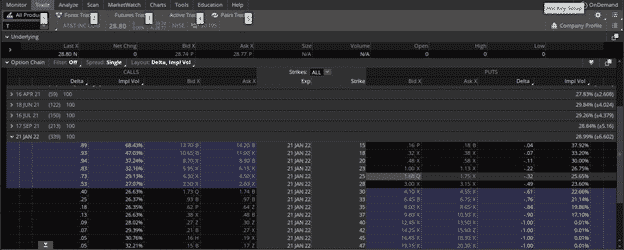

Stocks that have options display the list of options in what’s referred to as an option chain.

Different platforms display them in different ways, but at the core, they all share the same information: there is the underlying, the strike prices that are offered, and the expiration for which those strike prices are available.

Next to this you’ll find the prices offered (for both buying and selling) that option.

The Bid is the lowest price that anyone is willing to sell, while the Ask is the highest that anyone is willing to buy. The real price that you’ll get is likely between the two.

Occasionally, you won’t see specific Bid or Ask prices and you’ll only see the Last Price.

Each option contract is for 100 shares, but the prices you’ll see are per share. So, in the case of the January 21, 2022, $25 Put, we see $1.68 for the Bid. The Ask is $1.75. The real price is probably somewhere in between, so $1.71 is a fair representation.

The above is from the ThinkOrSwim platform on TD Ameritrade.

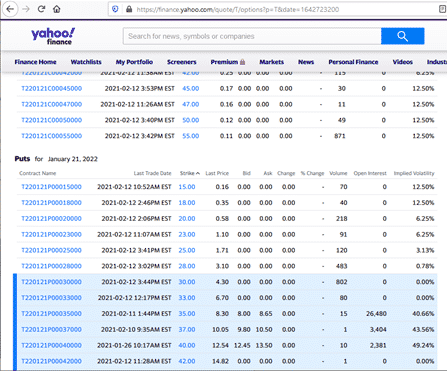

If we look at Yahoo! Finance, we’ll only see the Last Price, which confirms the $1.71 price.

This means that you would get $1.71 per share for selling the $25 Put that expires January 21, 2022.

Since each option contract is for 100 shares, that means you would get $171 for selling that particular Put.

By selling the January 21, 2022 $25 Put, you would have to be willing and able to purchase 100 shares (per contract) of AT&T at $25 – if the price of AT&T was lower than $25 by January 21, 2022. Given that AT&T’s lowest price for the last year was $26.08 (when the pandemic affected the market), it seems reasonable to expect that AT&T will be above $25 in a little over 11 months from now.

However, it’s NOT guaranteed, so there is a risk.(Also note: this is NOT a recommendation. It is provided solely as an example.)

The Downside

So, what’s the catch?

Well, as was just pointed out, there is a risk that you’ll have to buy those shares. If that happens, that means you will be paying MORE than what the actual shares are worth. The difference will cut into any income you got from selling the put and may potentially start cutting into your initial investment.

There is also the fact that you are giving up any chance of growth from the underlying. If you bought 100 shares of AT&T at $28.80 and within a year, it was trading at $35, your initial investment would have grown from $2,880 to $3,500, not counting any dividends you may have received.

By selling the $25 Put, you get to keep the income from selling the Put and the only requirement is that the price of the stock stay above $25.

It could go to $100, yet your only gain would be from the initial sale of the Put. Therein is partly where it gets its name: you are “stripping” just the dividend from the stock.

You also need to be mindful of the underlying’s price. Remember, you’re not just dealing with 1 share of stock: each contract is for 100 shares.

So, while it may be tempting to pick a stock like Tesla, Google, Amazon, or even Apple, you would need to have enough in your account to buy 100 shares of them.

In that group, Apple would be the “cheap” one, only costing $13,537. Amazon, on the other hand, would require over $300,000.

But with anything, there is risk.

Yes, even bonds. Bonds are a debt instrument, meaning that if the company or entity goes bankrupt, then it’s possible to lose the principle, too. And you’re locked into whatever rate you got for the entire term.

If interest rates go back up, the rate you get will be the same, meaning you’ll lose out on that gain.

In Summary

The Dividend Strip Strategy offers a fairly conservative alternative for the fixed income portion of your portfolio. The example we looked at was for AT&T, but it can be for any stock with options, which can even include mutual funds and ETFs.

This means you can pick a stock, mutual fund, or ETF that is much less volatile than the overall market. You don’t need to pick something that has a dividend, but it’s a good starting place.

You get to determine how much risk you want to take. Ask yourself, “If I had to buy this stock, what would I be willing to pay for it?” If you’re not interested in ever owning that stock (or mutual fund/ETF), then move on.

But if you are willing to own it, at what price would you like to buy it? (Another way to ask is what kind of a discount would you want?) Look in the option chain for the Put with the strike price closest to the price you would be willing to buy. Then look at the Bid. Take the Bid and divide it by the strike price.

That’s the ROI.

Are you comfortable with that number? If so, then the Dividend Strip Strategy would work in that case.

Going back to our example of AT&T, we ask ourselves if we would ever want to own AT&T. If so, at what price? Maybe a 10% discount. The current price is $28.80, so 10% off would be $25.92. There isn’t a $26 strike for the options expiring in about a year from now, so either $28 or $25. $25 is closer.

The Bid is $1.68, meaning the ROI would be 6.72%. If we were comfortable with an ROI of 6-7% (given the dividend is 7.22%), then that would work.

There isn’t a right or wrong ROI, but be mindful that the higher the ROI, the more likely you will have to buy those shares.

If you are more interested in owning the stock, and you truly wouldn’t mind owning them at the strike price you chose (even though it means the price would be lower at the time you had to buy them), then a higher ROI might make sense.

But if you don’t really want the stock and are only interested in the “dividend” (income), then a lower ROI would be more appropriate.

Remember, the Dividend Strip Strategy is intended to be a substitute for the fixed income portion of your portfolio. That being the case, the income is the goal and not the stock.

There are other strategies, such as The Wheel, that use selling puts specifically with the intent to own the stock.

Therefore, for the portion of your portfolio that should be fixed income, an ROI of 5-8% would likely make the most sense.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more