The Bond Market Is Not Expecting Inflation To Take Off

There is a virtual tidal wave of opinion that we are slated for a surge in inflation globally. This is fuelled by the fiscal stimulus package from Washington and the continuation of an expansionary monetary policy from the major central banks. Nominal bond yields in the US, Europe, and even in Japan have jumped significantly and many are anticipating this upward adjustment is not yet completed. The narrative is all too familiar: the pandemic is a short-term negative; the vaccine will allow nations to open up fairly rapidly; using stimulus funds, consumers will flock to spend on restaurants, travel, and entertainment services in record numbers; the Fed has indicated that it will continue its QE purchases and hold short-term rates at current levels; all of which will unleash well-above-average economic growth accompanied by an acceleration in prices increases.

Readers are most familiar with the two inflation indices--- the CPI and PCE – as a measure of price changes from year to year. However, these track recent prices change and may not always provide a good indication of what is expected. Hence, investors commonly look to the bond market to provide signals that inflation expectations have changed. There are two metrics that have received a lot of attention when it comes to determining what investors expect interest rates to be over time.

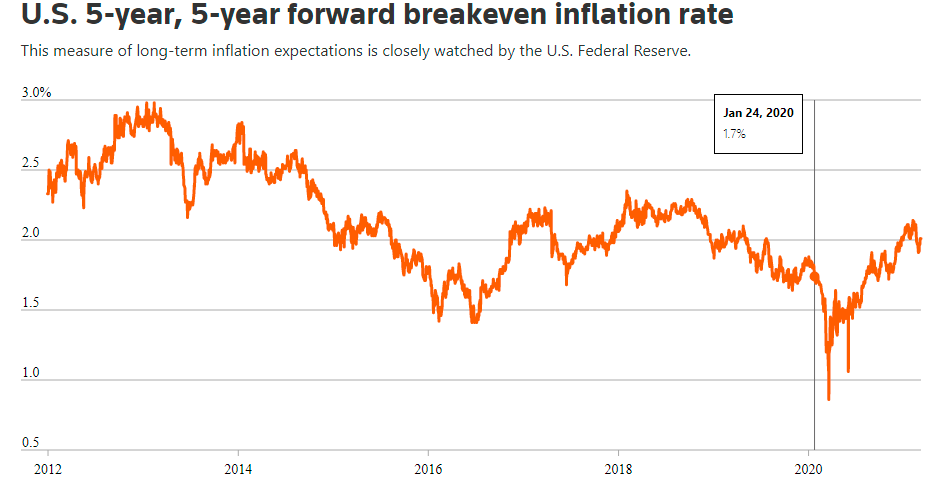

The first is typically known as “5y5y swap rate”. This measures the expected inflation rate (on average) over the five-year period that begins five years from today. Currently, that 5yr5yr rate stands at 2.10% and hardly warrants the recent anxiety over an expected surge in inflation over the longer-term. The Fed has indicated that it will tolerate inflation slightly above the target rate, if necessary, to reach full employment. Finally, the bond market is signaling that the Fed is capable of keeping the inflation rate within its set target of 2%.

(Click on image to enlarge)

The second measure of inflation expectations is found in the Treasury Inflation-Protected Securities (TIPS), in particular, the “breakeven rate”. So, in the case of the 10-year TIPS, the breakeven rate is calculated as the difference between a 10-year nominal Treasury rate and the 10-year TIPS Treasury rate. Today, the difference is 2.2% which is what investors expect the inflation rate to be over the next 10 years. To be clear, the inflation breakeven rate should not be viewed as a forecast. Rather it is a snapshot of today's inflation expectations going out 10 years. For most of the past decade, actual inflation turned out to below the breakeven rate, and, as such, those who bought TIPS paid a premium for this form of protection.

(Click on image to enlarge)

In sum, the bond market is expecting an uptick in inflation, however, the rate is slightly over the Fed’s inflation target. This should not be interpreted that bond yields are on a steady, upward path. From today’s perspective, inflation will remain relatively tame.