Testing Resistance Monday

7:30 am

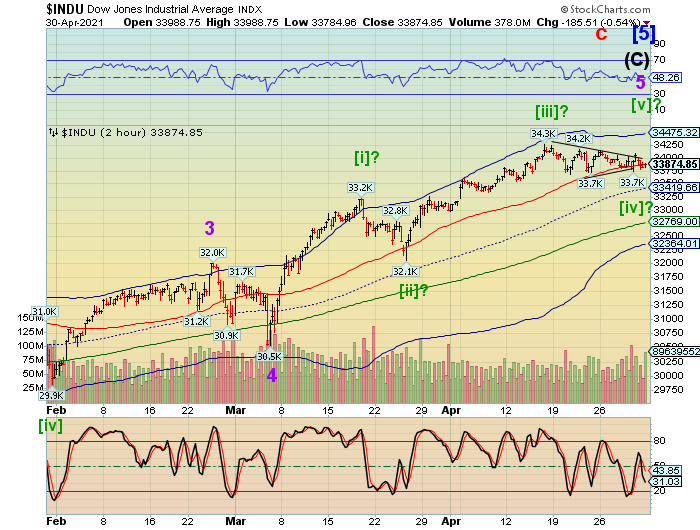

While the SPX and NDX appear weaker, SPX has not declined beneath Short-term support to establish a bearish pattern. The DJIA has been riding the up-sloping Short-term support while the upper probes have been declining to form a possible Triangle formation, which may be short-term bullish.

One of two possibilities exist. The first is a breakdown, not just Short-term support/resistance at 33880.00, but also mid-Cycle support at 33419.66, which may establish the bear market. The second is a probe higher to a new all-time high. The minimum target is 34300.00. The upper end of that range is near 35000.00.

US 30 futures have risen to a morning high of 33997.00, short of the Friday high of 34087.21. The bullish probe higher may be established above that level.

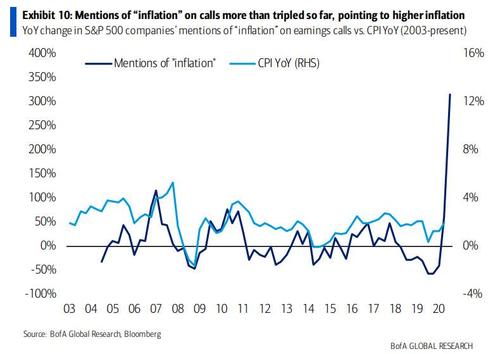

ZeroHedge observes, ““We believe we are at the early stage of the biggest Cobra Effect in the history of economics. As the massive monetary and massive fiscal stimuli (over $15T globally) conjoin to save the economy from a deflationary depression, instead they risk hyperinflation – overweight commodities.”

Vaccination parties have broken out on many street corners as explosive human energy has come roaring out of the cage. To us, this is a preview of what is about to transpire around the planet and the “Cobra Effect” has entered the 4th inning. When governments tinker in capital markets there are always unintended consequences. Above all, we must keep in mind – what transpired in Q1 to Q4 2020 was NOT a mere tinkering.

We have just lived through a colossal public-private experiment where fiscal and monetary policy globally have been unleashed at unprecedented proportions. It is easy to sit back and think the 2021-2022 recovery will be much like the 2009-2010 vintage. This is a mistake.’

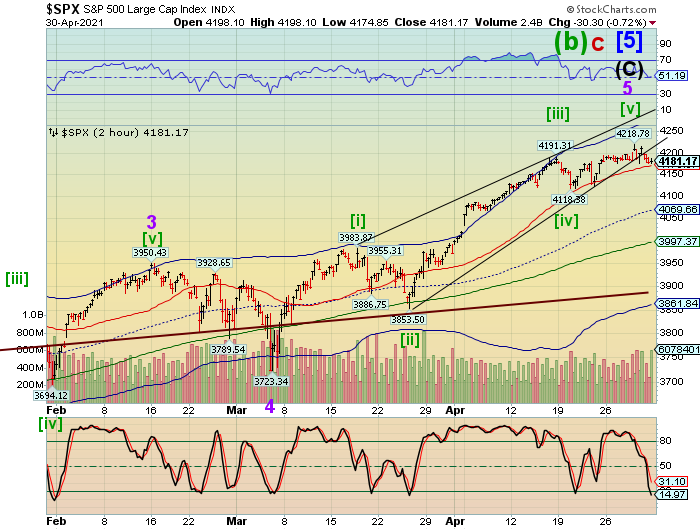

SPX futures have risen to 4198.62, still not climbing above round number resistance at 4200.00. The Elliott Wave structure appears complete, potentially leaving the DJIA alone to make new highs. The Cyclical period of strength ended last Thursday, leaving this week to sort out directionality without any help from the Cycles. Should a breakdown beneath 4150.00 occur, we may see 2-3 weeks of serious decline.

ZeroHedge reports, “S&P and Nasdaq futures, and European bourses were volatile but ultimately rose on Monday to kick off a new month in a quiet session which saw several major markets closed, following a week of record earnings beat which however resulted in big stock drops with investors also keeping an eye on India COVID cases and economic data to gauge the pace of recovery.

Trading was subdued with several including Japan, China and the U.K. closed for public holidays. S&P 500 futures added 0.6%, Dow e-minis were up 216 points, or 0.64%, and Nasdaq 100 e-minis were up 40.25 points, or 0.30%. Europe’s Stoxx 600 Index gained 0.4%. The yen weakened, while gold advanced (FXY, GLD, SPX, DIA, COMP).

With more than 60% of companies already having reported mostly stellar results so far, profits are now expected to have risen 46% in the first quarter, compared with forecasts of 24% growth at the start of April, which however has failed to propel stocks to new highs.”

VIX futures climbed to 19.12 before subsiding back to the trendline near 18.20. A breakout above the 50-day Moving Average at 20.36 gives a buy signal.

NDX futures have risen to 13913.75, but have receded back beneath Short-term resistance at 13898.07. NDX appears to be the weakest of the major stock indices. Should this persist, we will monitor the NDX Hi-Lo Index (must close below zero) and the VIX/VXN to obtain confirmation. The Shanghai Composite is closed for the holidays, so we may monitor it as the Chinese market re-opens later this week (NDX, VIX, VXN).

ZeroHedge comments, “Three weeks ago, just before th start of Q1 earnings season we said “Q1 Earnings Will Be Stellar, But Are Fully Priced-In” noting that “the past quarter is already fully priced in – and expected to be spectacular – which is why actual earnings may only disappoint.”

We were right.

As of this weekend, 303 S&P500 companies have reported first quarter results (75% of total market cap). 69% of companies reporting have beat street wide earnings estimates by >1SD (significantly higher than 46% historical avg) whereas only 6% have missed estimates by >1SD (significantly lower than historical avg of 14%). In short a spectacular earnings season not only in absolute terms, but also relative to expectations. Here is Goldman’s John Flood describing just how spectacular:

This earnings period we are seeing the highest percentage of companies beat street wide earnings ests (by >1SD) in the 20+ years that we have tracked this data. Very few companies are missing.”

TNX appears to be testing Intermediate-term support at 16.39 in a probable brief dip in the Trading Cycles. This indicates at retest of the 50-day Moving Average at 15.83 before moving higher, falling into place with the 10-year auction announced for Wednesday. The Cycles Model proposes a possible month-long rally to follow that breaks above the current high and targets the area near 19.71.