Tailing 5-Year Auction Prices At Lowest Yield In Almost Two Years

After yesterday's super-strong, stopping-through 2Y auction which printed just as the bond market was sliding following Powell's latest less dovish than expected comment, moments ago the US sold $41 billion in 5 Year notes, in a less impressive, if nowhere near weak auction.

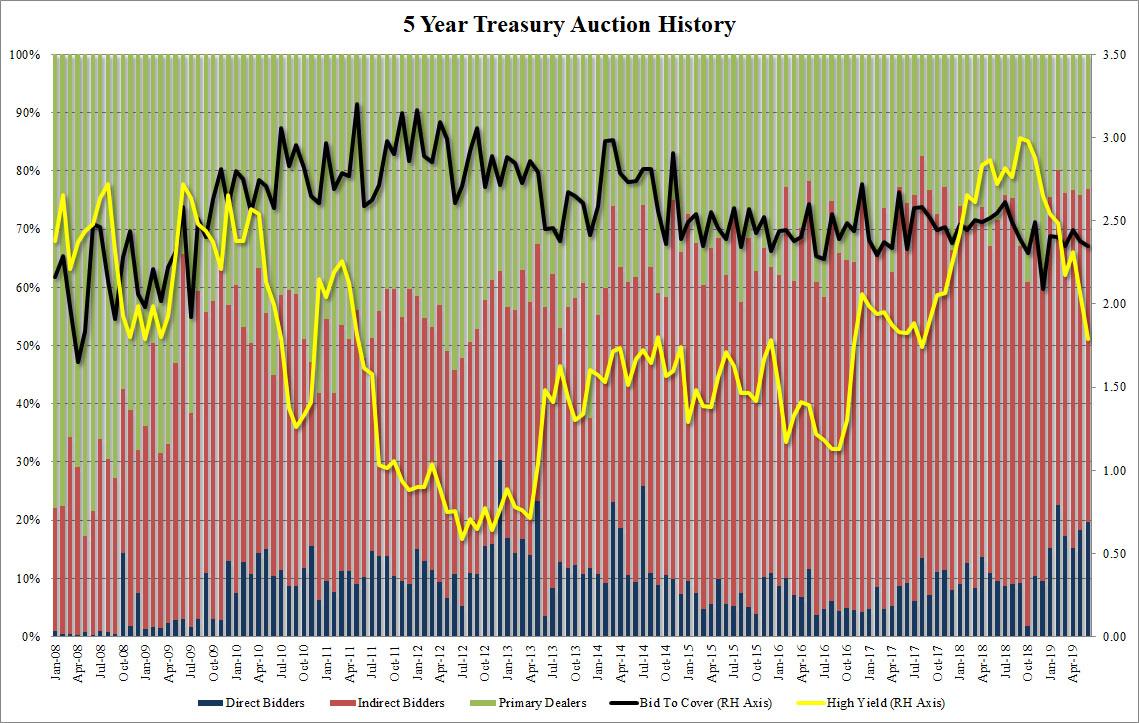

The high yield of 1.791%, which tumbled from last month's 2.065% and was the lowest yield since August 2017, tailed the When Issued 1.786% by 0.6bps, although considering the sharp moves in recent days, that may have simply been a precautionary concession.

The bid to cover of 2.35 was virtually unchanged from 2.38 last month, and right on top of the 6-auction average.

The internals were also largely as expected, with Directs rebounding to a 4 month high, rising from 18.4% to 19.4%, the highest since 22.5% in February, as Indirects took down 57.1%, down fractionally from 57.5% last month, and below the recent average of 58.2, leaving Dealers with 23.2%, which in turn was just below the recent average.

All in all, a mediocre auction which is in itself an achievement considering yields are now down to levels not seen in nearly two years.

That said, following the tailing auction, 10-year futures dropped to 127-21 session lows as yields rise to 2.038%, cheapest levels of the session, as traders got a little worried how much further yields can keep on dropping.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more