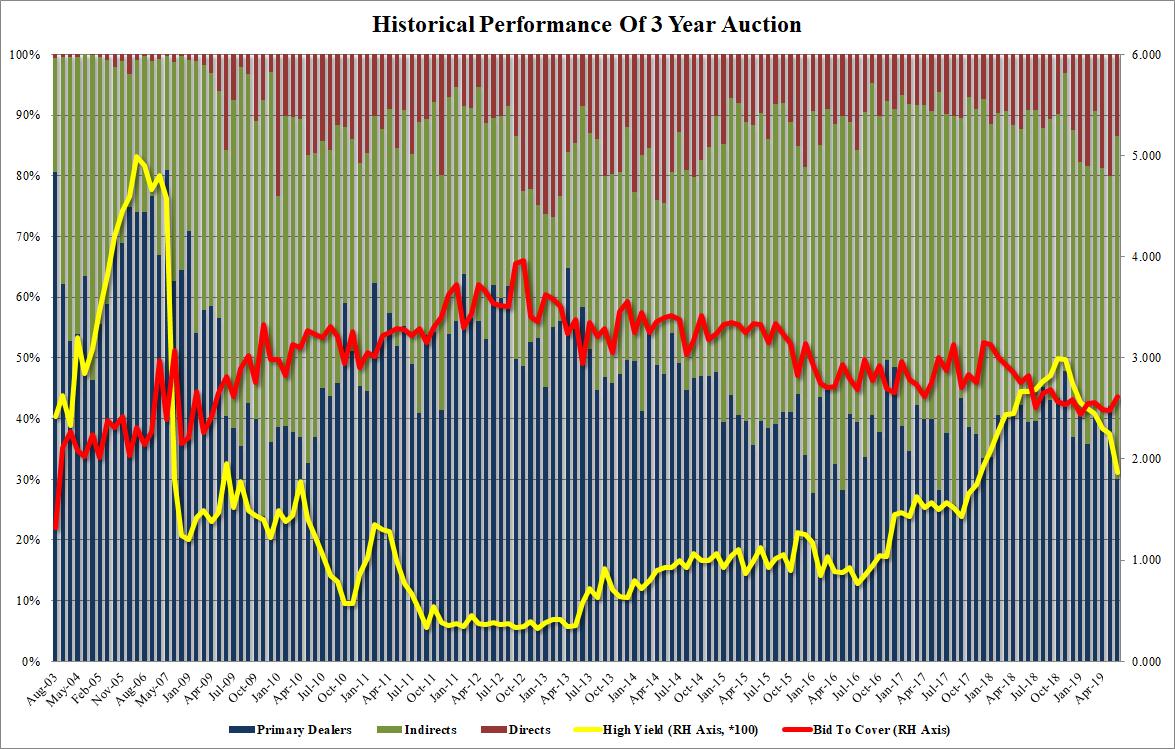

Stellar Demand For 3 Year Paper Despite Lowest Yield Since 2017

If there were any concerns about demand in the primary market for short-dated Treasury paper, those can be set aside with today's auction of 3Y bonds.

The sale of $38 billion in 3-year paper priced at a high yield of 1.861%, a big drop from the 2.248% in May, and the lowest yield since November 2017. But what was more remarkable is that despite the sharp drop in yield, buyers were more than willing to snap up the paper, with the auction stopping through the 1.867% When Issued, the biggest stop through since January 2018.

The demand was visible in the internals as well, as the Bid to Cover surged from 2.48 to 2.62, the highest since September. At the same time, Indirect bidders took down 56.6% of the offered amount, far above the 44.7% six auction average and the highest since December, with Directs taking down 13.4% and Dealers left holding 30.0%, the lowest going back to August 2017.

Overall, an impressive auction with stellar demand, which confirms that no matter how low rates drop, demand remains in an indication that buyers are convinced that rates are going far lower in the coming years.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more