Stellar 5Y Auction Sees Surge In Foreign Demand, Record Low Dealer Takedown

Another day, and another stellar Treasury auction.

After yesterday's blockbuster 2Y auction, moments ago the Treasury sold $55 billion in 5Y paper in what can again only be described as a stellar sale.

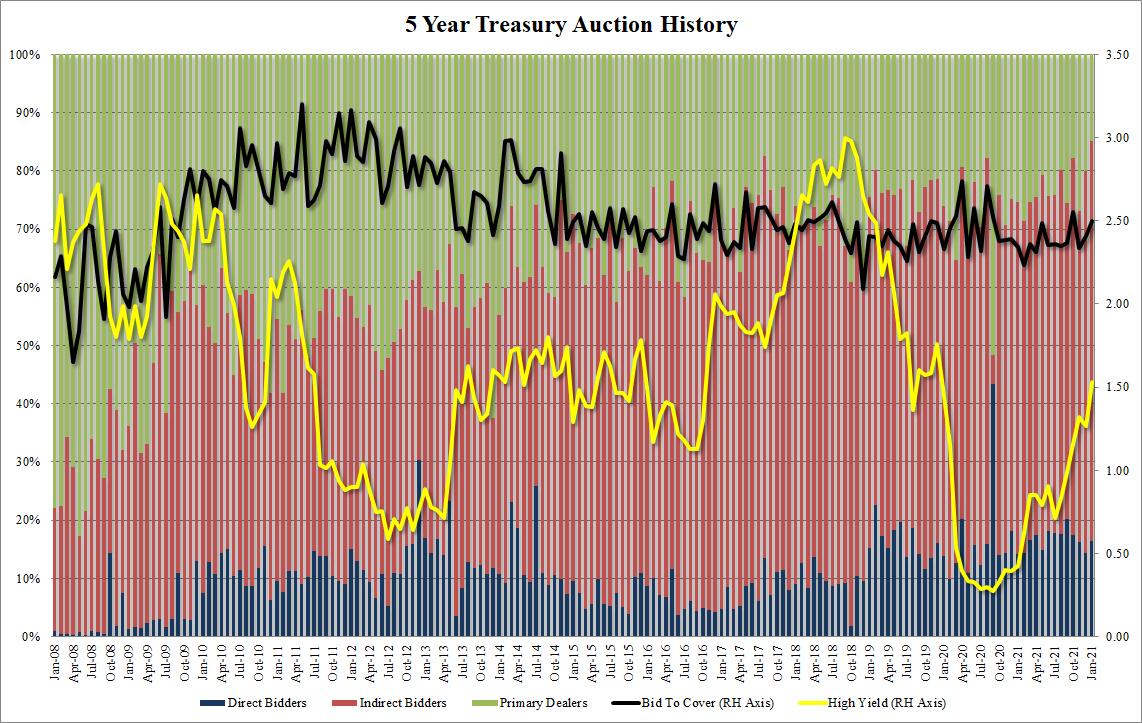

The high yield of 1.533% was well above last month's 1.263% and the highest since Dec 2019, but it was also 1.4bps below the When Issued 1.547%, which followed two disappointing tailing auctions.

The Bid to Cover confirmed the buyside demand for today's paper, coming at 2.50, well above last month's 2.41, and the six-auction average of 2.40.

But like yesterday, it was the internals that were most notable, with Indirect, i.e., foreign, demand surging from an already elevated 65.7% in December to 68.72%, the highest since Sept 2017.

(Click on image to enlarge)

And unlike yesterday, Directs were also solid at 16.5%, up from 14.3% in December if below the recent average of 17.2%. This meant that Dealers got 14.8% of the final allotment, the lowest on record, and perhaps a sign that dealers are getting ready for QT - where they can't flip any new issuance right back to the Fed - and are reducing their purchases at auction.

(Click on image to enlarge)

Overall, this was another stellar auction that saw near-record foreign demand. Coming at a time when everyone is petrified that the Fed's rate hikes will keep going up, up, up in the process hammering Treasury yields, it appears that at least someone is not freaking out and is buying up whatever the Treasury has to sell.

Furthermore, coming ahead of tomorrow's FOMC meeting when many expect Powell to emerge as extra hawkish, today's super strong auction was rather remarkable.

In response to the blockbuster auction, the 10Y yield barely budged perhaps due to the already sharp drop in yields due to today's flight to safety.

(Click on image to enlarge)

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more