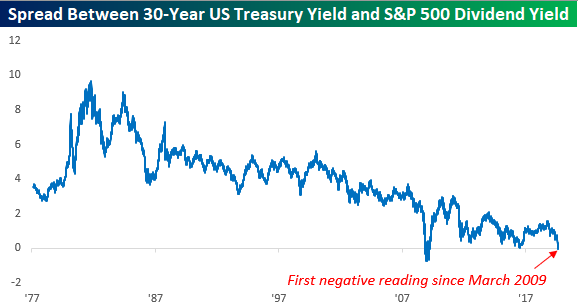

S&P 500 Yield Tops The Thirty Year

The yield on the 10-year US Treasury dropping below the dividend yield on the S&P 500? That’s so last month. Today, it’s the 30-year yield that’s falling below the S&P 500’s dividend yield. At 1.966%, the 30-year Treasury yield just dropped below the dividend yield of the S&P 500 for the first time since March 2009. Who knows if we’ll finish the day with a 30-year/S&P 500 inversion, but the way things have been moving, it’s probably just a matter of time if it doesn’t happen today.

(Click on image to enlarge)

The chart below shows the spread between the 30-year and the dividend yield of the S&P 500 going back to 1977. The only other time in the last 40+ years where we have seen a similar inversion was for a few months in late 2008 through March 2009 (the low point of the Financial Crisis).In July 2016 right after the Brexit vote, the S&P 500 dividend yield came within 0.01% of the 30-year’s yield, but it couldn’t quite make it higher.

(Click on image to enlarge)

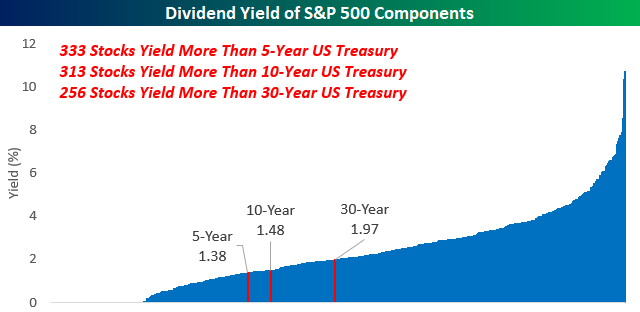

Looking at individual stocks, it’s pretty amazing how many stocks now yield more than the 5,10 and 30-year US treasuries. As of this morning, two-thirds of the stocks in the S&P 500 yield more than the 5-year, more than 62% yield more than the 10-year, and slightly more than half yield more than the 30-year.

(Click on image to enlarge)

Disclaimer: Read our full disclaimer here.