Solid Foreign Demand For Record-Sized 7Y Auction

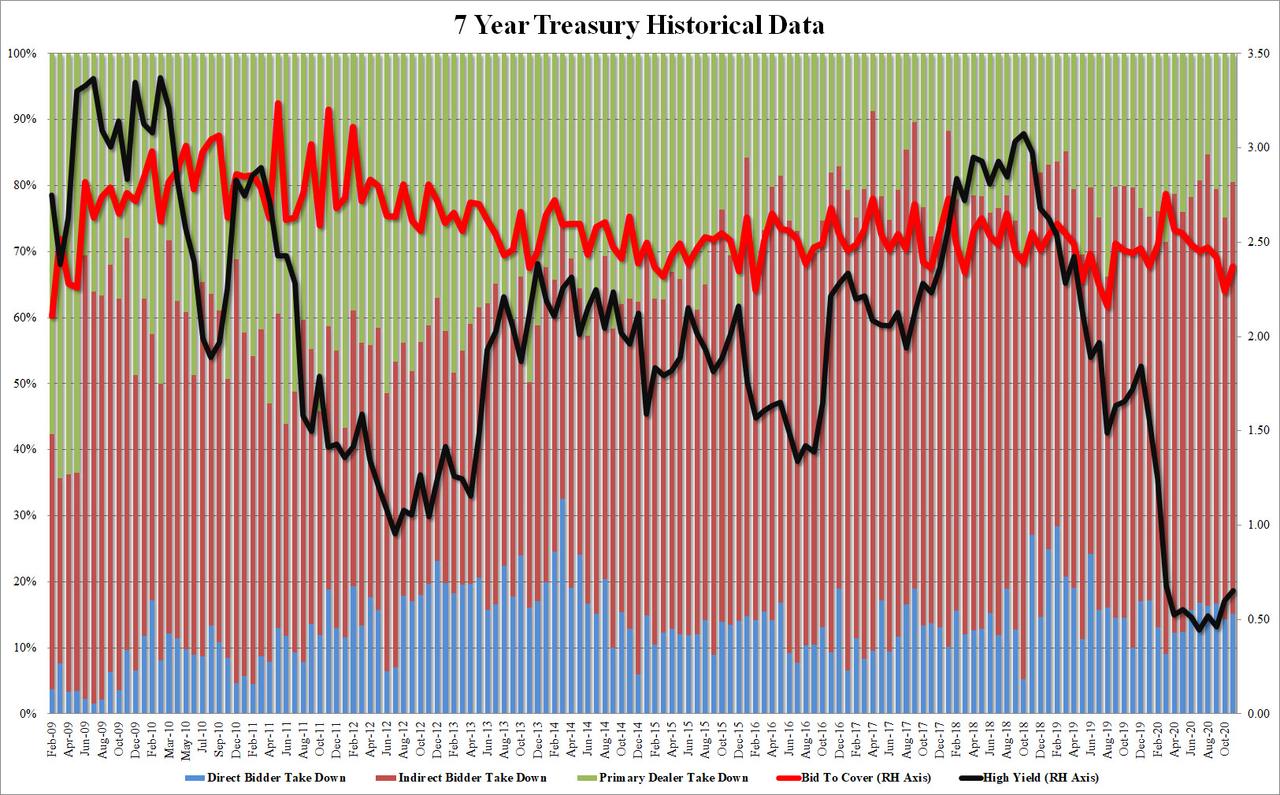

After two mediocre, record big coupon auctions in the Treasury shortened week on Monday, moments ago the Treasury concluded the week's abbreviated issuance schedule with the sale of another record large auction when it had no difficulty finding buyers for $56BN in 7Y paper, the most on record and double the average 7Y auction size since 2010.

(Click on image to enlarge)

The auction stopped at a high yield of 0.653%, which was the highest since March (and decidedly above October's 0.600% auction), but due to the selloff in the rates complex, the auction had built up enough of a concession and it stopped through the When Issued 0.657% by 0.4bps.

Other metrics were less attractive, with the Bid to Cover at 2.374, which while up from 2.236 last month, was below the six auction average of 2.44.

There was some quite welcome news when looking at the Internals, where Indirects - i.e., foreign buyers - jumped from 60.1% to 65.4%, the highest since August, and well above the 63.7% recent average.

(Click on image to enlarge)

Overall, this was a solid (if hardly spectacular) auction, with more than enough demand at the belly of the curve, which confirmed that there remains ample buyside demand at the sensitive belly of the curve, and indicating that fears that the 10Y will soon blow out above 1.0% are overstated. To wit, the 10Y yield promptly dipped almost 1bp after news of the auction broke, although much of the move has now been faded.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more