Solid Demand For 30Y Treasury Auction Sends Bond Yields Lower

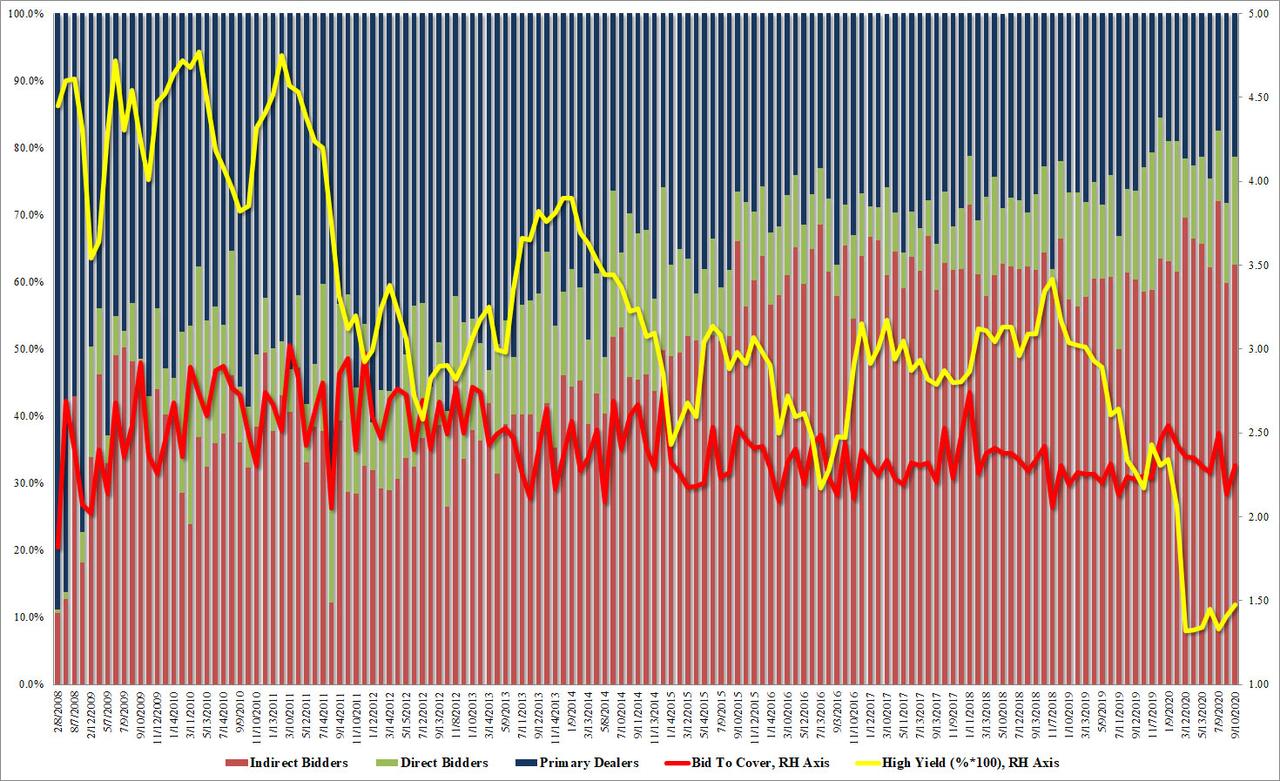

After an average 3Y auction and a subpar 10Y reopening yesterday, moments ago the Treasury completed its sale of coupon bonds for the week when it sold $23 billion (down from $26 billion last month) at a high yield of 1.473%, which was the highest yield on the 30Y since February, although stopping through the When Issued of 1.476% by 0.3bps, demand was stronger than in recent auctions at least superficially.

The Bid To Cover of 2.31 was above the August 2.14 which was the lowest since last August and was right on top of the 6 auction average of 2.31.

The internals were a tad weak, with Indirects taking down 62.6%m which while above the 59.8% last month was below the recent average of 66.0%. And with Directs taking down 16.1%, the highest since February, Dealers were left with 21.3% just below the 22.6% six auction average.

Overall, another average auction although the lack of a tail was taken as positive by the market and helped the 10Y yield dip from an unchanged, 0.70% by 1bp to 0.69%, a move which makes sense as stocks are taking on water.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more