Solid, 20Y Auction Stops Through As Yields Tumble

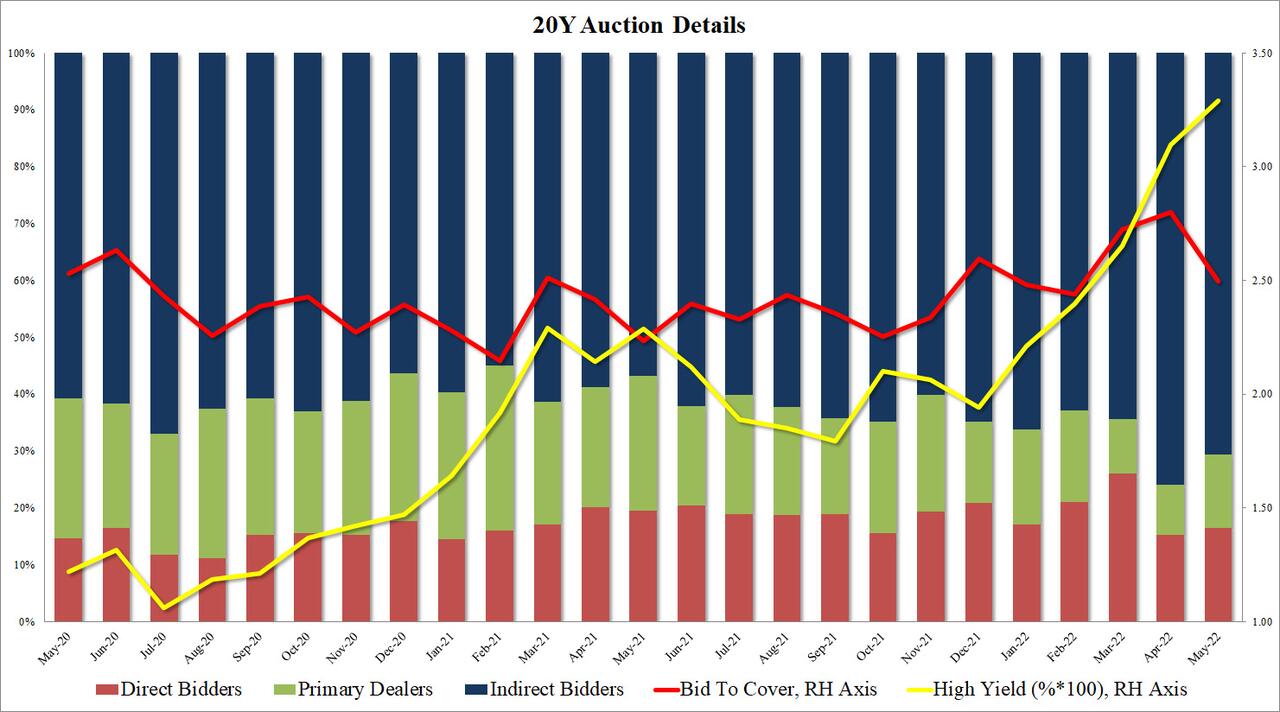

With the 20Y-30Y curve still solidly inverted, moments ago the US Treasury sold $17 billion in paper at a yield of 3.290%, which is well below the yield on the 30Y at 3.09%, and was above last month's yield of 3.095% if stopping through by 0.2bps the When Issued 3.292%, the 6th consecutive stopping through 20Y auction.

The bid to cover of 2.50 was a sharp drop from last month's 2.80 and was also below the six-auction average of 2.56 (it was the lowest since February's 2.44%).

The internals were much better with Indirects taking down 70.6%, which while below last month's record 75.9% was the 2nd highest since the 20Y auction was introduced back in May 2020 (and naturally it was above the recent average of 65.7%). And with Directs taking down 16.4%, just below the six-auction average of 19.9%, Dealers were left holding 13.0%, also below the recent average of 14.3%, but above both the March (9.6%) and April (8.7%) auctions.

Overall, a solid, stopping though auction, with the one surprise being that the auction didn't tail in light of today's sharp drop in yields across the curve. Not surprisingly, 10Y yields dropped to session lows just below 2.90% after the auction hit.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more