Retirees: New No-Load Fund + Experienced Fund Manager = High Yield Opportunity

Buying utilities at 25 times earnings or consumer staples at 30 times earnings, or more, is a fool's game. These are not growth stocks. Whenever prices are bid up and yields therefore reduced, the seeds of that sector's decline are planted. It takes only one untoward event and the weakness is exposed, and the stocks return to their historic channels.

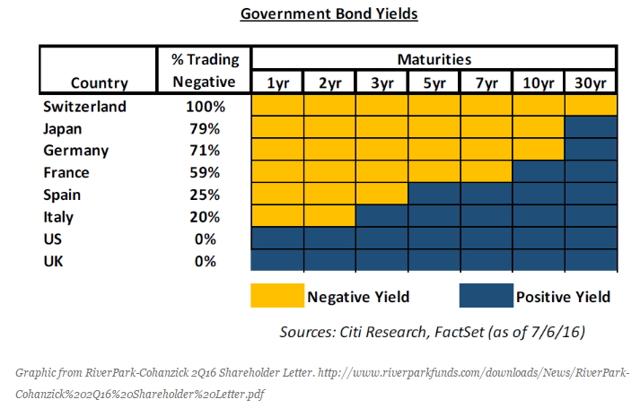

There is a case to be made for bonds, but it certainly isn't the sovereign bonds of developed nations. Earlier this week, Jim Grant of Grant's Interest Rate Observer wrote, "Sovereign debt is my nomination for the number one overvalued market around the world. You are earning nothing or less than nothing for the privilege of lending your money to a government that has pledged to depreciate the currency that you're investing in."

He’s right, of course.It is lunacy to entrust your future well-being to invest at a negative interest rate in an instrument underwritten by a country that has sworn to increase your cost of living (via an “acceptable and desirable” 2% inflation rate.) You get zero or less than zero from the same issuer that is dedicated to making you lose an additional 2% of purchasing power in order for the value of their debt to be decreased by 2% every year.

(click to enlarge)

It is lunacy to entrust your future well-being to investing at a negative interest rate in an instrument underwritten by a country that has sworn to increase your cost of living (via an "acceptable and desirable" 2% inflation rate.) You get zero or less than zero from the same issuer that is dedicated to making you lose an additional 2% of purchasing power in order for the value of their debt to be decreased by 2% every year.

Still, I understand that many readers want at least some fixed income in their portfolios. If the issuer pays a fair return and remains solvent you know you will beat inflation and receive your capital back at maturity. It's that "fair return" part of the equation that has become so difficult to find. At maturity for the above negative rate sovereign bonds above, the issuing government may well have succeeded in their desire to pay back 50 cents on the dollar in real buying power. You should at least have been paid $1 and more in order to stay ahead in purchasing power.

This led me to look at some issuers that don't have the luxury of hoodwinking investors into exchanging illusory safety for certain reduction in purchasing power. One such find is the Matthews Asia Credit Opportunities Fund (MCRDX).

MCRDX is not without risk. While Morningstar calls it a world bond fund, it is invested in a number of Asian companies' bonds. While 82% of its holdings are rated BBB ("investment grade") or higher, it still is comprised of names less familiar to American investors. So our choice is to pay 47 times earnings for Kellogg because it is a name we know - and receive a 2.5% yield - or to range a little further afield and buy a diversified fund with mostly A and BBB rated bonds and receive 4-5%, all with less beta, and the likelihood of possible capital gain as well.

Nobody does Asia better than Matthews and I believe the yields will increase on its holdings over the next few months. I would rather trust the decades of experience Matthews managers have as old Asia hands. They are going where the growth still exists, seeking the bonds of companies that are growing and filling the needs of expanding populations and significantly expanding middle classes.

Their theater of operations consists of all countries and markets in Asia, including developed, emerging, and frontier countries and markets from Pakistan to Japan and Indonesia to China.

When discussing the risks inherent in their investments in this area, Matthews says "Investments in Asian securities may involve risks such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. …Investing in emerging markets involves different and greater risks, as these countries are substantially smaller, less liquid and more volatile than securities markets in more developed markets."

To which I would respond,"Investments in developed market (Europe, North America, etc) securities may involve risks such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and over-regulation," and " …Investing in developed markets involves different and potentially greater risks, as these countries are substantially larger, with the possibility that their failed central bank strategies may implode while freer open markets in the rest of the developing and emerging world allow the markets to contract and expand without the heavy hand of know-it-all bankers attempting to guide them."

"Ya pays your money and ya takes your chances." I would rather depend upon market forces to determine the success or failure of a company or nation. After all, we've given the developed market central bankers nearly a decade and the best they can do is negative interest rates?

I applaud Matthews' decision to limit this fund's participation in even these more free-markets' government bonds. Only 12.9% of MCRDX's holdings are in sovereign government bonds; the rest are invested in the bonds and convertible bonds (for a possible capital gain) of firms that, while they may be highly rated, are simply not well enough known outside the region or, sometimes, their home country to attract attention from US investors.

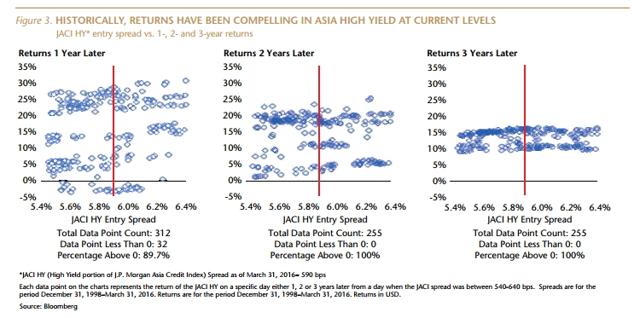

Investors the world over are seeking good returns and, with experienced fund managers, the risk that an individual issue will default - as they occasionally will! - is subsumed by the increased yield paid by all the other holdings. And history tells us that, at least over the past 15 years, such investments (in Asian high yield bonds, mind you) have returned 3 times what US stocks have returned - with about one-half the volatility. Indeed, in starting from the levels we see today, over this previous 15-year period, such investments earned 8% or more in the following 3-year period.

I began researching this investment approach back in April 2016, when I read a paper by Teresa Kong, current portfolio manager of Matthews Asia Strategic Income Fund (MAINX) and selected to lead MCRDX as well.

She wrote then, "…it may seem counterintuitive, but in some respects, investing in high yield at this point in the cycle may potentially have less downside than buying U.S. Treasuries because current spreads capture much of the credit risk. …To be sure, it takes a lot of intestinal fortitude to buy when the majority is selling. But at today's downtrodden prices, there is margin for error even if we are wrong about the bottom." She then provided the chart below.

(click to enlarge)

I see MCRDX as a way to get higher yield from a dozen countries and scores of companies, big and small, across the Asian region, that I could never hope to uncover and research myself in this kind of depth. We are buying MCRDX.

Disclosure: I am/we are long MCRDX

more