Record Large 3Y Auction Prices On The Screws

With refunding week upon us (which now will be monthly instead of the usual quarterly affair as the exploding US deficit needs constant net debt issuance), moments ago the Treasury sold its first coupon auction for the week when it found buyers for $58BN in 3Y notes - a size which matched last month's record...

(Click on image to enlarge)

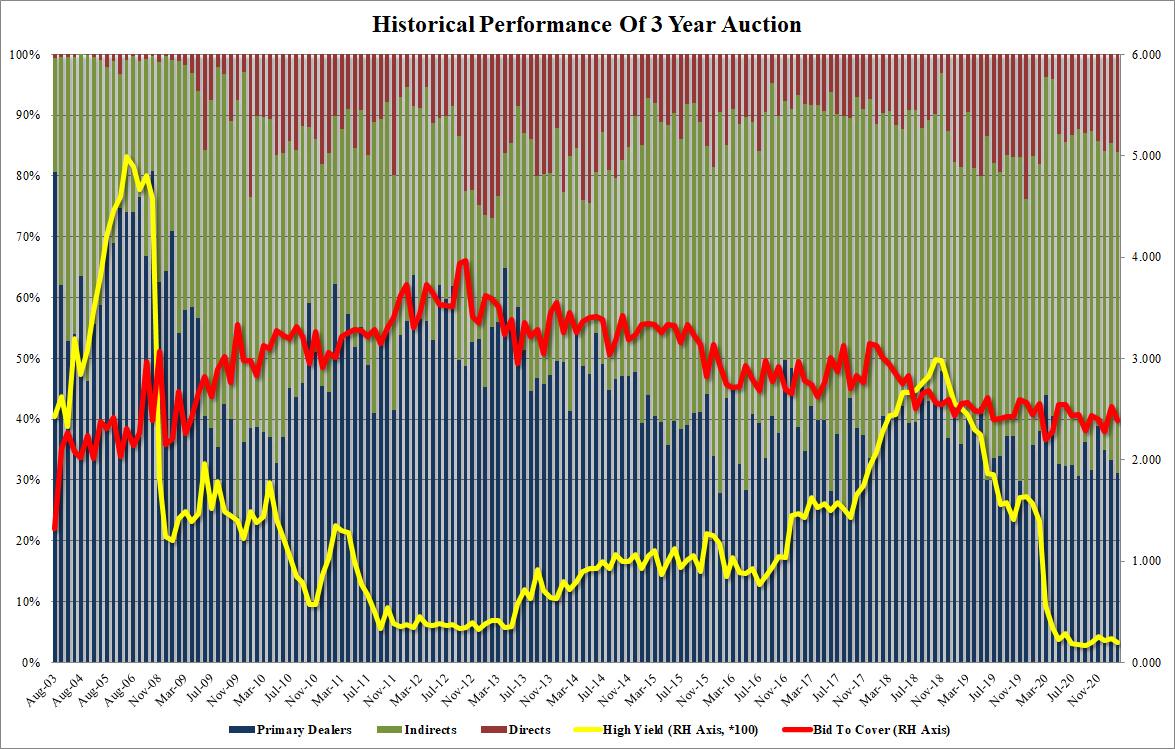

... at a high yield of 0.196%, down from last month's 0.234% and pricing "on the screws" with the 0.196% When Issued.

The bid-to-cover of 2.391 was a drop from the 2.520 last month, and just below the six-auction average of 2.393.

The internals were unremarkable, with Indirects taking down 52.7, up fractionally from 52.2 in January and in line with the 52.0 recent average. Directs rose to 16.0% - the highest since February 2020 - and obviously well above the recent average of 13.8% leaving Dealers holding on to 31.2%, which was below both January's 33.2% and the recent average of 34.3%.

Overall, a boring auction that priced pretty much in line with expectations, as the absolute lack of reaction in the secondary market confirmed.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more