Recession Lurks. What Will The Fed Do?

By Permission

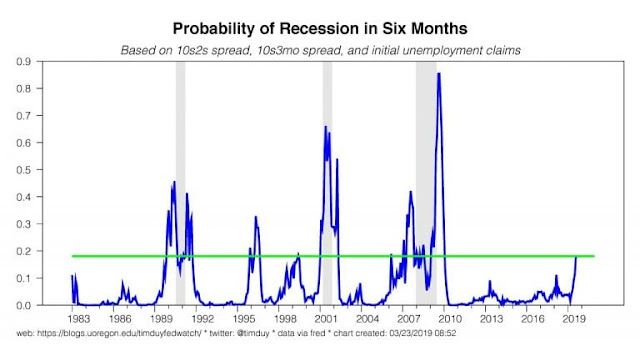

The Federal Reserve bank has done dreadful things in the past. In the section concluding the article, Does the Fed Ever Change, there is a Fed quote from 1937 that is exceedingly disturbing. But first, the chart above is worth understanding.

Tim Duy usually is quite calm and matter of fact as a Fed watcher. However, he is alarmed and we can discuss that. The chart above shows that he believes potential recession deserves the immediate attention of the Federal Reserve. What to watch for, in Professor Duy's opinion, is rate cuts as a means of keeping the wolf from the door as is what happened in the '90s. Of course, it could be that things are way more complex this time, as a global recession seems baked in.

The professor views the Fed as being behind the curve. He says:

The above leads me to the conclusion that the Fed needs to get with the program and cut rates sooner than later if they want to extend this expansion. Given inflation weakness and proximity to the lower bound, the Fed should error on the side of caution and cut rates now. Take out the insurance policy. It’s cheap. There will be plenty of opportunity to tighten the economy into recession should inflation emerge down the road.

and:

What would delay that rate cut? Data. A yield curve inversion is a long leading indicator. Sure, the data is softer. But soft enough to cut rates? Not necessarily from the Fed’s perspective. Moreover, cutting rates now means admitting the December rate hike was an obvious error. The Fed hates admitting error.

Of course, the question is, does the Fed want to be behind the curve. Is this stealth protection of bonds and of the new normal? The Fed now knows that inflation is fairly benign. It can hold off on raising rates and hold off on emptying its balance sheet. But how long can it hold off on rate cuts?

It appears that the Fed is desperate to keep rates floating above the dreaded zero lower bound. Duy quotes Powell on this very subject:

So, if inflation expectations are below two percent, they’re always going to be pulling inflation down, and we’re going to be paddling upstream and trying to, you know, keep inflation at two percent, which gives us some room to cut, you know, when it’s time to cut rates when the economy weakens...The proximity to the zero lower bound calls for more creative thinking about ways we can, you know, uphold the credibility of our inflation target, and you know, we’re openminded about ways we can do that.

Duy says the Fed never was going to have enough room to lower rates without dropping to zero rates anyway. Duy fears that the Fed will turn into the Bank of Japan! The BOJ has been at zero and it looks like there is no way out.

But Why Didn't The Fed See More?

Professor Edward Lambert has said that low capacity utilization keeps inflation down. Capacity Utilization for February 2019 is running at 78.2281, the lowest since July 2018. It has never reached or broken 80 percent in this century.

So, the Fed worrying about inflation either was because they are just stupid or because it is a diversion. Keep people's eyes on inflation and they may not notice the new normal slow growth regime.

The Fed should be honest. It should announce that tepid growth is the best we can do as a developed nation and so we must rely on China and India for world growth and direct our investments there! Japan learned that lesson not so long ago.

Of course, Jay Powell has said as much in language that most people don't get. Powell and former President Kashkari, both believe that the only other option to help outgrowth is to grow the nation with immigrants.

They are correct, but when it comes to immigration, Americans are NIMBY's. We all know about nimby behavior when it comes to new houses in favored neighborhoods. That may have an adverse effect on the competitiveness of America. Likewise, nimby behavior towards immigrants will hurt growth of the nation, and limit competitiveness.

People who want the USA to stay exactly the same, sharing Donald Trump's xenophobia and hatred of Chinese prosperity, want to return to the days of prosperity that we saw last century. But they can't have it both ways. Do it Trump's way and prosperity will likely suffer. Trade wars are not easy to win because exports suffer and trust among nations is eroded.

Capitalism right now is weakening because of lack of end demand from those who have not benefited from its prosperity. The wealth inequality we see contributes to this lack of end demand. The consumer is tapped out due to stagnant wages and too much credit.

Capitalism only works if either the workers can afford to buy the product or the product is exported. Trump tariffs are partly the cause of exports slowing. And we as a people cannot afford what is produced in America. This is a serious problem. Labor has been destroyed by union weakness and by global competition and by automation. Capitalism is eating its young as big corporations are slow to hire and small corporations were left for dead by a Fed that did not help them in the Great Recession.

The Fed knows how to maintain the new normal of slow growth, which seems to bring stability even if the Fed diverts from admitting it. It does not know how to bail out society after the recession hits. It is too narrow in helping only big banks and big lending.

Does the Fed Ever Change?

Economist Scott Sumner posted an article in which he quoted the Fed 1937 transcript. You can read the article at Econolog. The alarming quote exposes the Fed. The article shows what many see, that the Fed is seriously slow to act when recession is at the door and fast to act when inflation is at the door. That is seemingly the opposite of common sense and destroys what people think of as balance.

But the quote that sort of seals the deal as to the Fed's favorable treatment of recessions back in '37 is a doozy:

We all know how it developed. There was a feeling last spring that things were going pretty fast… If action is taken now it will be rationalized that, in the event of recovery, the action was what was needed and the System [Fed] was the cause of the downturn. It makes a bad record and confused thinking. … I would rather not muddy the record with action that might be misinterpreted.

So, in essence, the Fed was saying that if they took action to cause a recovery, they would look bad for not applying the recovery policy sooner! The Fed was playing with lives, people suffering and going hungry, losing homes, divorcing, killing, giving up pets, etc. The Fed, in 1937, was delaying help to the people of the United States of America while all the bad, horrible things that went along with the Great Depression continued, just to save face. Sickening.

If this is how the Fed still operates at certain times unknown to the rest of us, and it likely is, beware!

Conclusion

Janet Yellen believes that what was done by the Fed in the past, rate cuts will be all that is needed to avoid the onset of recession. She did not say imminent rate cuts as is called for by Tim Duy and others. She said:

And in fact it might signal that the Fed would at some point need to cut rates, but it certainly doesn't signal that this is a set of developments that would necessarily cause a recession.

Perhaps this is a certain time in which the Fed will:

1. Admit a mistake in raising rates in December 2018, and lower rates quickly. This would require the leopard to change its spots. But will it?

2. Or it will assert independence and take Donald Trump and the economy down to prove its power and independence that Trump has threatened.

3. Or it could be a time for acting slowly, allowing a possible recession to entice investors to invest, to start a new cycle, without looking like it is destroying Trump. It won't have to admit any mistakes this way.

Number 3 would fit the historical pattern since the Fed is confident it can apply a recovery in a reasonable time and it doesn't want to people to think any downturn was ever caused by the "system".

Disclosure: I have no financial interest in any companies or industries mentioned. I am not an investment counselor nor am I an attorney so my views are not to be considered investment ...

Update 2: Moore and Kudlow call for a half point rate cut. This means things are really getting bad, that a trade deal is stuck, or something happening not revealed. If the Fed cut i/2 point they would be admitting they really don't know what they are doing. Thats unlikely. It may have a positive effect on the economy. Not sure about stocks!

Update: The Fed is behaving like I expected. John Williams and James Bullard are calling rate cuts premature. They are looking for a second quarter pick up. For those who believed that the Fed would reverse course quickly in the face of warnings, it is unlikely. The Fed would have to admit the December error, and that leopard cannot change its spots, if indeed it was a crucial mistake.

The Fed is also working against cutting rates because it will still do quantitative tightening to the tune of $50 billion a month until Sept--- that is, withdrawing about $350 billion from the money supply. In this regard, the Fed is behind a different curve in the sense it is too late to forestall a recession because it insists on tightening lending conditions.

Haven't people been saying a recession is lurking right around the corner for years now?

Good point. But the yield curve did not really invert before. A recession is not a guarantee. It is just a large risk made worse by Fed behavior as pointed out by Norman. Add that the Fed likely will not admit a December mistake, and therefore will not lower rates and a recession most likely will happen. Will the leopard change its spots?

I think they may know it Prof. You make a great point. I get the feeling that they want to slow things down while appearing to be pleasing Trump. Interest rates are going lower, but housing is toppy.