Rates Strategy: Low And Slow

Gravity is reasserting itself in interest rates. Low rates and low volatility benefit positive carry trades, such as sovereign spread tighteners and long-end steepers. The Fed's balance sheet continues to ease lower, illustrating reduced systemic stress. Rates are thus more reflective of macro angst. Fed corporate buying also remains quite tame.

Source: Bloomberg, ING

Low and slow…

When we said yesterday that we expected rates to return to their COVID-induced downtrend, we didn’t think they would be able to shrug off a strong jobs report. As our economics team noted, the headline number doesn’t tell the whole story and the prospects for the July report are grim, as more contemporaneous indicators suggest. Still, there is optimism in financial markets, equities notably have been defying gravity of late, largely ignoring ominous signs that the epidemic is taking its toll on economic activity. If sentiment indicators continue to surprise to the upside across the world, the latest instance being the beat in Caixin China PMIs released overnight, the record number of COVID cases in the US should give investors pause for thought.

Today’s session promises to be less eventful with US markets closed and only second PMI readings on the data docket. Our base case is that interest rates continue their plunge, towards -0.50% for 10Y Bund as a short term target. Another view of ours is playing out at the same time: peripheral bond yields continue to converge to their core peers. As we wrote after the June ECB meeting, the pace of tightening is slower now but our conviction that 10Y Italy-Germany will go through 150bp is greater. Yesterday evening, the Bundestag voted that the ECB's PSPP satisfied the German Constitutional Court's proportionality requirement, in line with earlier press reports.

… good for spreads and long-end steepeners

Another side effect of the normalization in interest rates markets, as we consider low rates and low volatility to be their equilibrium under heavy monetary accommodation, has been a re-steepening of the long-end of the curve. As for peripheral spreads, the re-steepening is slow but our conviction is increasing, and as for peripheral spreads, investors have time on their side. Both spread tighteners and long-end curve steepeners are positive carry plays, the very reason why they benefit from lower volatility and easy monetary policy.

The Fed's balance sheet contracts for the third week running

The Fed's balance sheet has now dipped below USD 7trn, having fallen by another USD 35bn in the past week. It is still a huge balance sheet for a USD 20trn economy, but the fact that it is falling is indicative of a system very much on the mend.

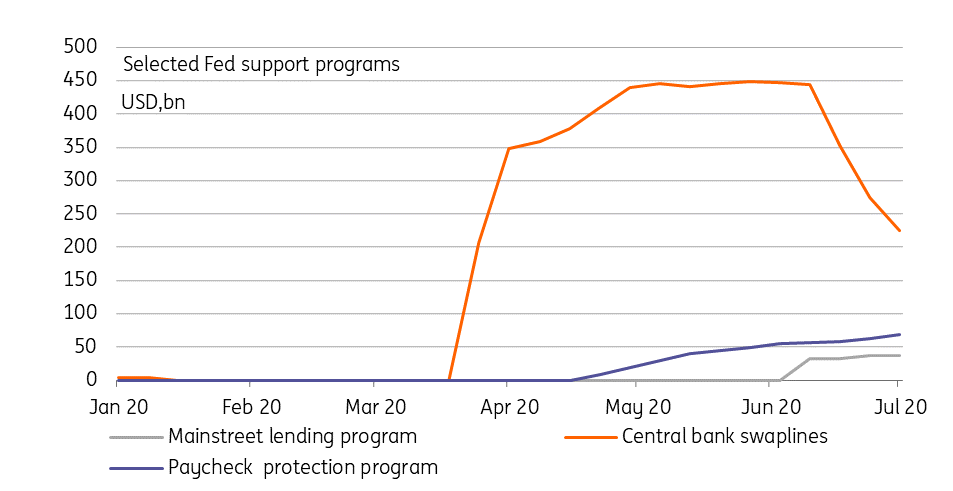

There was another near USD 50bn fall in the Fed's swap line to international central banks that had been queuing up to access dollar liquidity. That help now stands at USD 225bn, well down from the peak in the area of USD 450bn. Required support for money market funds and primary dealers also continues to ease lower, and the Fed also downsized holdings of mortgage-backed securities.

There were offsetting increases though, mostly in the support for Main Street. The paycheck protection programme saw a build of USD 7bn, and now stands at USD 67bn in balance sheet support. The Mainstreet lending programme saw a USD 5bn increase, to a balance sheet size of USD 38bn.

Meanwhile, spending on corporate bond-buying was USD 1.4bn and thus remains relatively tame. We suspect that more of this is now in actual bonds than in EFTs. But volumes have not materially changed, even if the corporate buying route is deemed more direct.

The implication here are impulses that are consistent with a lower premium attached to the USD, and thus less need for safety demand for core USD bonds. If that is indeed the case, then the bid for core bonds is more reflective of traditional macro angst than of systemic worries.

Swap ines drive the balance sheet contraction, but there are offsetting factors

Source: Federal reserve, ING

Today’s Events: not much

The main data releases today are European PMIs but most of these are second readings. One potential banana skin is Knot’s comments around the middle of the European session. A hawkish tone would not be out of character but could resonate with markets focused on improving economic data.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more