Personal Capital Review + Marketing Genius

How Personal Capital Upended the Robo-Advisor Financial Industry With Their Freemium Model

The recipe is ingenious. Start with iconic founders, create a unique product, add on extra features and finish off with an amazing free giveaway. For investors seeking a sophisticated financial and investment management platform, for free, it’s tough to beat Personal Capital. Wealthy investors looking to minimize advisory fees and create a sophisticated “smart beta” investment portfolio, will appreciate the reasonable fees and access to human financial advisors.

How Personal Capital Broke the Automated Investment Advisory Mold

The founders of Personal Capital clearly state their goal; “build a better money management experience for consumers.” The how is to blend technology with non-biased financial advice. In a few short years, Personal Capital has garnered 1.1 million registered users, $270 billion in tracked accounts and 3.4 billion in direct assets under management.

The brainchild of Bill Harris, Personal Capital benefits from Harris’ financial and technology expertise. Bill Harris was the initial CEO of Intuit of Quicken fame, PayPal and then as an investor. With robust startup capital and a large employee base, Personal Capital is not your typical robo-advisor. The firm, uses a smart beta methodology in their investing, not the usual all-index ETFs of other digital investment platforms. Additionally, the company pairs users up with their own personal financial advisor.

Although not the cheapest robo-advisor, their fees are lower than those of most comparable human financial advisory firms.

What Do You Get with Personal Capital? The Freemium Model

Personal Capital took the freemium model and went to the moon with it. They offer anyone who signs up and links their financial accounts an amazing financial toolkit, rivaling the paid Quicken tools and in some cases surpassing it. Registered users gain access to the impressive dashboard along with an array of money management tools.

After linking your accounts, in a painless and efficient manner, you get a 3600 personalized financial picture including; budgeting, spending, saving, investing, asset allocation and even a detailed retirement planner.

The free Personal Capital reports include:

- Account Balances

- Income Report

- Spending Report

- Investment Returns

- Asset Allocation View

- Projected Investment Fees

- Net Worth

At the risk of sounding like hawker for Personal Capital, I’ll finish with a brief description of one of their best free features-their Investing Tools. The platform brings an investment check that delves into your past and future projected portfolio performance.

Next, there’s the asset allocation analysis. Under the risk and return drill down, you get the following features:

- Retirement Planning Calculator

- Portfolio Fee Analyzer

- Retirement Fee Analyzer

But, there’s more.

The Personal Capital Marketing Genius

The company has taken the freemium model and gone all in. DIYers and others, with no intention of buying into the paid model, still get the Personal Capital dashboard, reports, analyses and wealth management tools-no strings attached.

Additionally, to broaden their reach, Personal Capital has a wide network of online publishers who promote their services (myself included) and pay the affiliates a generous commission, every time a user signs up for their services (based upon certain conditions).

Why Pay for Personal Capital?

Thus far, it appears you get everything for free, but that’s not accurate. Many investors seek a human touch and hands on investment management. And that’s where Personal Capital makes its money. After lowering its minimum account management size from $100,000 to $25,000, the proprietary automated investment advisor opened its door to a greater market of investors.

Although, I didn’t hire Personal Capital to manage my money, as I oversee the investment management myself, the firm prepared a detailed analysis of my investment assets, in the hope that I will eventually use their paid platform.

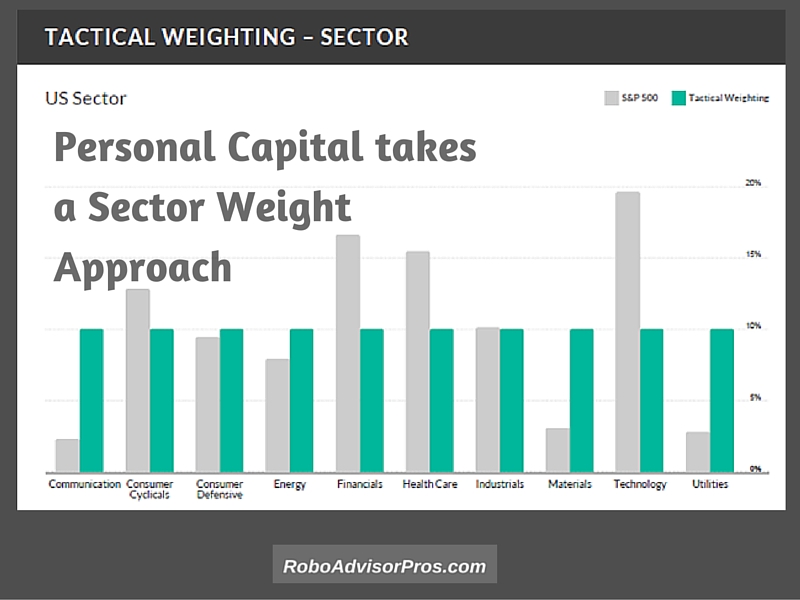

The Personal Capital financial advisor recommended a tactical sector weighting asset allocation and provided a full portfolio review report for me.

For the stock asset allocation, Personal Capital buys individual stocks. For the other asset classes, they use ETFs and ETNs.

Their paid services approach those of typical financial advisors-with a twist. Their proprietary investment strategy was back-tested against the S&P 500 and in most cases outperformed the index.

The other paid services include access to a CFP, portfolio management that takes all accounts into consideration, rebalancing and tax loss harvesting, private banking and lower fees for accounts of children and/or parents.

Personal Capital Wrap Up

As a financial product, Personal Capital is not your typical robo-advisor. Their free dashboard and related financial and investment management tools are extremely valuable. Their paid service assists those who appreciate the automated platform and want a human touch. The firm nailed it on their business model and differentiated themselves from the ever expanding robo-advisory field.

For those that buy in to the paid model, the fees are steeper than some of their other robo-advisor competitors. With a management fee of 0.89% for assets up to $1,000,000 and 0.79% for the first $3,000,000, you can get lower fees and access to advisors at Vanguard Personal Advisors robo. Vanguard’s robo-advisor platform charges just 0.30% for account management and includes access to financial advisors. Additionally, the Personal Capital sector-weighted investment management approach is distinct from a typical market-cap index fund investment tactic that most other robo’s employ. Which type of investment management yields better returns, remains to be seen. In general, you need a good decade (at least) of historical data to evaluate an investment approach and that’s tough to find in the automated advisory arena. Personally, I don't buy in to the idea that back-tested analysis is enough.

For those DIYers, and others with their own financial advisor-Personal Capital paid services might not be for you. Yet, if you want a free overview of your financial picture-updated in real time-then why not sign up for the dashboard, no strings attached.

Disclaimer:I use the free services and promote the firm as an affiliate. Yet, if I didn’t think the Personal Capital offering was of value, I wouldn’t recommend it. I am a ...

more