New Data On Retail Investment

Experienced investors are flummoxed by the Fed’s unwillingness to do anything about the current speculation in markets. The Fed doesn’t want to tighten policy because the real economy is still in bad shape. It’s a difficult situation to be in because if they acknowledge that the current speculation in stocks posed a systemic risk, it would scare the market. Secondly, the Fed would have to act to curtail this risk. It can’t just say there is systemic risk, but do nothing about it. Obviously, allowing the current speculation to continue could have many negative impacts, but whether it’s a bubble is up to interpretation.

As we mentioned in a previous article, the Fed is not likely to stop this bubble. It’s not entirely the Fed’s fault either as retail investors have a lot of cash and time to invest. However, the Fed has the power to get rid of the excess if it wanted to. A hawkish statement would change sentiment. As for now, we have a market that’s going vertical. As you can see from the chart below, the monthly Russell 2000 hasn’t been this far above its Bollinger Bands in 20 years.

Monthly $IWM has not been this far above the BB in 20 years. pic.twitter.com/W6207lDgJX

— SF Giants Fan (@brian95123) February 9, 2021

Is It A Bubble?

If the stock market experienced a drawdown, there would be huge ramifications because pension funds and mutual funds have their lowest cash positions in decades. Everyone is fully invested. Anyone can have an opinion on whether this is a bubble or not, but the valuations don’t look good. As you can see from the chart below, the Russell 2000’s EV to trailing 12-month sales ratio is at a record high by far (going back to 1995).

2) Updated Russell 2000 EV/T12M Sales. Enterprise value increases with price. Scaling mostly with price for now since denominator hasn't changed much. pic.twitter.com/55jsp8Jit5

— QF Research (@ResearchQf) February 9, 2021

The chart below uses interest rates to value the S&P 500. As you can see, the S&P 500’s 2 year ahead forward yield minus the 10-year yield has fallen below its average due to rising stocks and rising rates. If the 10-year yield gets above 2%, we could easily see the lowest implied equity risk premium since 2008. Currently, tech investors are confident about the rise in rates because their speculative stocks are doing well. However, with even higher rates and changing sentiment, that relationship can change. There is no reason to celebrate now.

I keep track of a modified equity risk premium (2Y Forward Yield on S&P 500 less 10Y rate).

— Bauncey Chillups (@PrefShares) February 9, 2021

Pretty tight right now. pic.twitter.com/c8bMGm400V

Data On Retail Investment

The fact that new surveys are being funded to measure which stocks everyday people are buying, is a signal in itself that there is a bubble in market participation. It sounds great to “democratize markets”, but these new investors have no experience in dreadful markets that go down for years. People are being told the S&P 500 has recovered from every correction in history, so they are piling into stocks with no regards for potential losses. It’s scary!

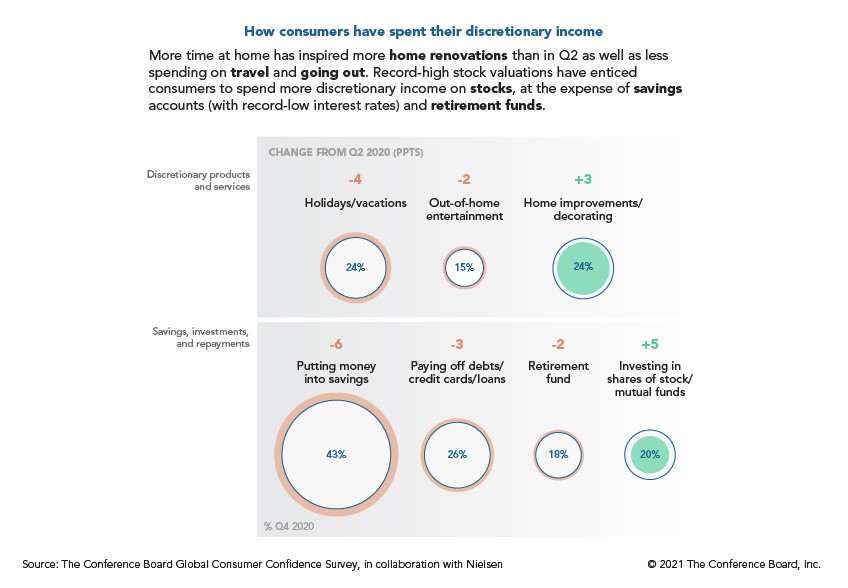

According to the latest Consumer Dynamics report in Q4 2020, 20% of consumers invested in stocks/mutual funds which is 5 points above Q2 (plus 18% in retirement fund). 24% spent more on home improvements which is 2 points ahead of Q2. We think that will reverse later this year as people spend less time in their houses. Plus, home improvements last for years. Some demand was pulled forward.

24% of consumers spent money on holidays/vacations which was down 4 points from Q2. That decline occurred because of the 3rd wave of COVID-19. Vacation spending will increase dramatically this summer. 10% of consumers said they have no cash to spare. The $1,400 stimulus will really help them.

![]()

Yahoo Finance & The Harris Poll did a new survey of meme stock investing in January. 28% of consumers bought at least one share of a meme stock (the list of 20 companies can be found via this link). As you can see from the chart above, 10% of people bought AMC and 9% bought GameStop. That’s a massive amount of support for such small companies. 40% of people ages 18-44 and 40% of men bought shares. Most of the investments in these meme stocks were small as people seemed to understand that they were a gamble. 53% of the investments were less than $250 and only 15% were more than $1,000. That’s not to say, retail investors aren’t investing much more than they have in the past.

As you can see from the chart below, the purchase of equities by retail investors has been elevated since the March crash. Usually, equity purchases tick up during corrections. The maintained increase in purchases is evidence of a broad-based market bubble similar to the late 1990s.

No surprise here but retail investors’ equity purchases have picked up substantially post-pandemic @WSJ @VandaTrack pic.twitter.com/7kiIscZXsJ

— Liz Ann Sonders (@LizAnnSonders) February 9, 2021

Don’t Buy Highly Shorted Stocks!

The recent rally in highly shorted stocks is the biggest ever. That’s why we say this is the worst market to short ever. It’s much different than the late 1990s bubble. The ‘dash for trash’ makes even less sense than when speculators bought up internet stocks in the 1990s that had little sales and no profits.

As you can see from the chart below, the top 10% of shorted stocks divided by the Russell 3000 is up 147% since the March bottom. Keep in mind, this ratio falls 6.9% per year on average. Every time an investor tries to short stocks because this rally has been unpreceded, they lose. Generally, when a move in markets is extreme, it gets more extreme rather than normalizing. It always ends though.

The most popular short trades have generally done well through history, aside from the occasional reversal. But last month saw the mother of all short squeezes. Chart from DB's @JimReid35 pic.twitter.com/vvn49tDLXj

— Robin Wigglesworth (@RobinWigg) February 9, 2021

Conclusion

There is a bubble in stocks. The Fed will not take away the punchbowl because the real economy is weak. An unprecedented number of Americans invested in meme stocks. Those speculations may have been small, but overall retail involvement in the market is very high. Some say this is a “new normal.” We think this is a temporary mania. However, manias can last for years. It hasn’t worked to step in front of the market by shorting stocks. Short sellers have never done worse than now.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be ...

more