Monthly Market Review For November 2019

Highlights

- The overall U.S. economy continues to grow but has shown some signs of weakness, particularly in the manufacturing sector.

- The U.S. stock market is at new all-time highs as optimism is regained from trade talks between the U.S. and China in what could be a potential truce.

- Interest rates saw little change in the month of November but still remain significantly lower than they were at the beginning of the year.

Economic Review

The U.S. manufacturing sector remains in a technical recession as the U.S. and China trade war has hampered the sector's growth. New orders of durable goods and industrial production, two key barometers of the manufacturing sector, have both seen deteriorating year-over-year growth that show little to no signs of improvement.

Despite the U.S. manufacturing sector showing signs of a suffering economy, the overall U.S. economy appears to remain stable with Real GDP (i.e. inflation-adjusted) growing at a year-over-year rate of 2.08%. Furthermore, the jobs market also continues to look strong with job growth sitting at a relatively strong 1.4% and the unemployment rate sitting at a historically low 3.6%. The U.S. retail and housing markets have also shown no signs of weakness with strong year-over-year growth rates that continue to improve.

Inflation also remains intact with the core Consumer Price Index (CPI) growing at a stable year-over-year rate of 2.31%. However, the core Personal Consumption Expenditures (PCE) index, appears to be weaker with a year-over-year growth rate of 1.59%, which is well below the Federal Reserve’s 2.0% target.

(Click on image to enlarge)

Market Review

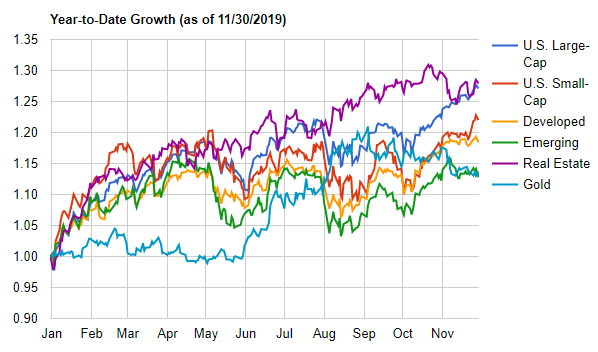

November was yet another good month for the U.S. stock market with large-cap stocks rising roughly 3.8% and small-cap stocks rising roughly 4.1%. Much of the rise came from the optimism of a potential trade truce between the U.S. and China and better than expected economic data. Since the beginning of the year U.S. large-cap stocks have risen 27.1% and small-caps 22.0%.

Meanwhile, the international stock market continues to lag the U.S. stock market with developed international markets rising only 1.3% in November and emerging international markets rising only 0.5%. Since the beginning of the year, developed markets have risen approximately 18.4% and emerging markets 12.8%.

The price of gold fell 3.2% in the month of November as better than expected economic data had investors fleeing from the haven metal. However, the price of gold is still 13.7% higher than it was at the beginning of the year due to concerns on trade and the global economy.

Real estate (REITs) has also slowed down, dropping 1.3% in the month of November, yet still remains one of the top-performing asset classes so far this year with a year-to-date return of 28.0%.

(Click on image to enlarge)

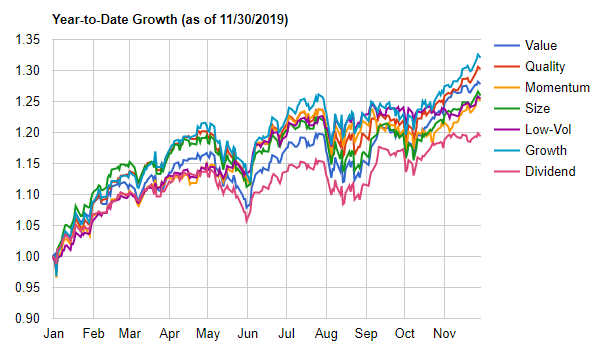

Growth stocks continue to dominate in performance with the best monthly and year-to-date returns of 4.4% and 32.1%, respectively. Quality stocks (i.e. those with high return on equity, stable earnings growth, and low leverage), have spent most of the year about par with the rest of the market but has since risen to the top with a 4.4% return in November and a 30.2% return so far this year. High-Dividend and Low-Volatility stocks continue to lag the market with returns of only 1.6% and 1.4%, respectively. Year-to-date High-Dividend and Low-Volatility stocks remain among the worst-performing with returns of 19.4% and 25.5%, respectively.

(Click on image to enlarge)

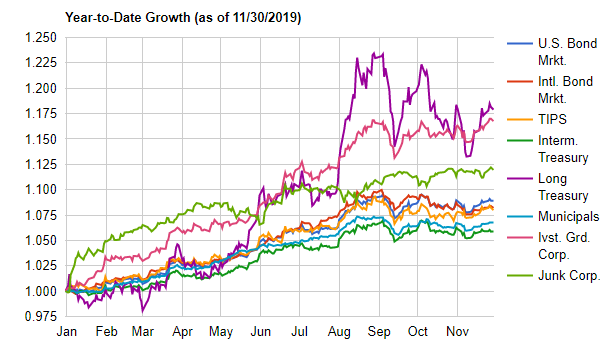

Bond Market Review

The overall U.S. bond market saw little change in the month of November with a return of only -0.04%. However, since the beginning of the year, the total U.S. bond market is up a relatively large 8.9% as interest rates have moved lower on concerns of trade and slowing global economic growth. That said, longer-dated bonds (which are more sensitive to changes in interest rates), have benefited the most from falling interest rates with long-term Treasury bonds up nearly 18.0% so far this year.

High-yielding “junk” corporate bonds were also impacted by the concerns of trade and slowing global growth, however negatively, as their investment-grade counterpart has outpaced them by nearly 5.0% so far this year.

TIPS (treasury bonds that benefit from rising inflation) have also outpaced their counterpart (non-inflation protected intermediate-term treasury bond) by approximately 2.1% so far this year as inflation has mostly exceeded expectations.

(Click on image to enlarge)