Monthly Market Monitor – July 2020

Most Long-Term Trends Have Not Changed

A lot has changed over the last 4 months since the COVID virus started to impact the global economy. Asia was infected first with China at ground zero. Their economy succumbed first with a large part of the country shut down to a degree that can only be accomplished in an authoritarian regime. The rest of Asia responded to the initial outbreak better than the Chinese (and most everywhere else we now know) and generally mitigated the health effects, if not the economic ones. China opened back up first and the rest of Asia has followed suit. Economic recovery in China, appears at least, to be accelerating. The rest of Asia is also recovering but the depth of the downturn was not as great and so neither is the recovery pace.

Europe got it next with concentrations in Italy and Spain. The response across the continent was varied but the results have generally been pretty good and economies are, for now, recovering. France has, surprisingly, led the way with Germany also performing well. The worst-hit countries are still struggling to find their footing but in general, it appears Europe is well on the way to recovery.

Next was the US where the response could be called a lot of things but not “well organized”. Individual states were mostly left to craft their own policies which in a federalist system is probably as it should be, but not ideal for containing a pandemic. With different shutdown periods and different state and local responses, the recovery has arrived but not in a uniform way. Some states such as Texas, Arizona, and Florida are seeing infections rise again, although death rates do not seem to be following suit. That may change in the coming days and weeks, but we really don’t know how this thing will progress. Other states like New York continue to improve but they also took the hardest early hit and had the most drastic response.

Emerging markets, no matter where they are geographically, are being hit hard and struggling to find a minimally effective response. Much has been made of Brazil’s lax response but frankly, I’m not sure there was much that could be done differently except in attitude. They just don’t have the infrastructure or resources to mount a vigorous defense against this virus. That is also true of most of the rest of the developing world. They don’t have the luxury of a big fiscal response either so they can’t really shut down their economies. It will be interesting – and potentially very sad – to see how the virus proceeds in areas where there has been basically no serious medical response. Emerging markets will recover last, I’m sure, but when that will be is anyone’s guess.

Given all that has happened in the 4 months since the virus started to seriously impact the global economy, it is amazing how little the long-term market trends have changed.

For most of the last decade, US stocks have outperformed the rest of the world and that trend has not been broken by the virus:

(Click on image to enlarge)

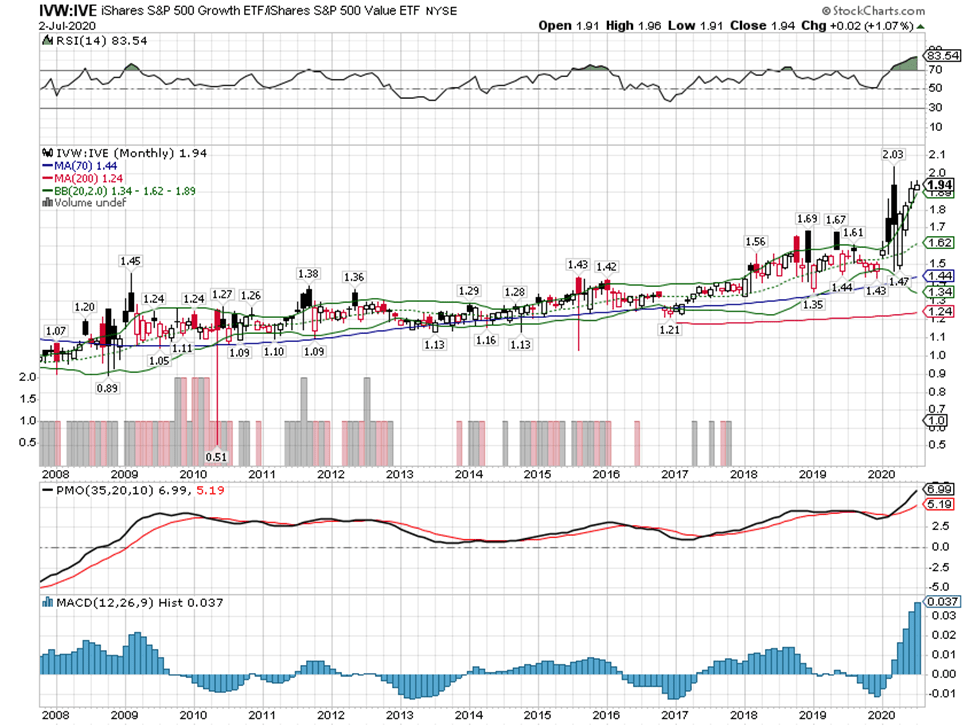

Growth stocks – and particularly tech stocks – have also outperformed for most of this cycle and the virus just accelerated that trend:

(Click on image to enlarge)

Small-cap stocks have shown the same tendency:

(Click on image to enlarge)

Nasdaq continues to outperform the S&P 500:

(Click on image to enlarge)

Stocks have outperformed commodities the entire cycle and that trend also accelerated during the virus crisis:

(Click on image to enlarge)

US government bonds have continued to outperform international government bonds:

(Click on image to enlarge)

Long-term bonds continue to outperform short-term:

(Click on image to enlarge)

Gold continues to outperform the general commodity index:

(Click on image to enlarge)

Stocks continue to outperform real estate:

(Click on image to enlarge)

US real estate continues to outperform international:

(Click on image to enlarge)

A lot of these trends are influenced by the trend of the dollar. The dollar index has been strong and steady for nearly five years and that hasn’t changed either:

(Click on image to enlarge)

None of these trends will last forever, but many of them have been in place for years, and changing them will not be easy. Changing these trends will also likely require a change in the dollar trend. Any long-term trend change will start with a short-term trend change that becomes an intermediate-term trend change. That may be happening now as the dollar peaked in mid-March and broke under the 200-day MA in late May. That change corresponded with other short-term trend changes:

(Click on image to enlarge)

China, where the virus started and where economic recovery first appeared, has been outperforming since early February.

(Click on image to enlarge)

And technically, it looks as if the long-term downtrend of China vs the US may be ending:

(Click on image to enlarge)

Europe has been outperforming since mid-May:

(Click on image to enlarge)

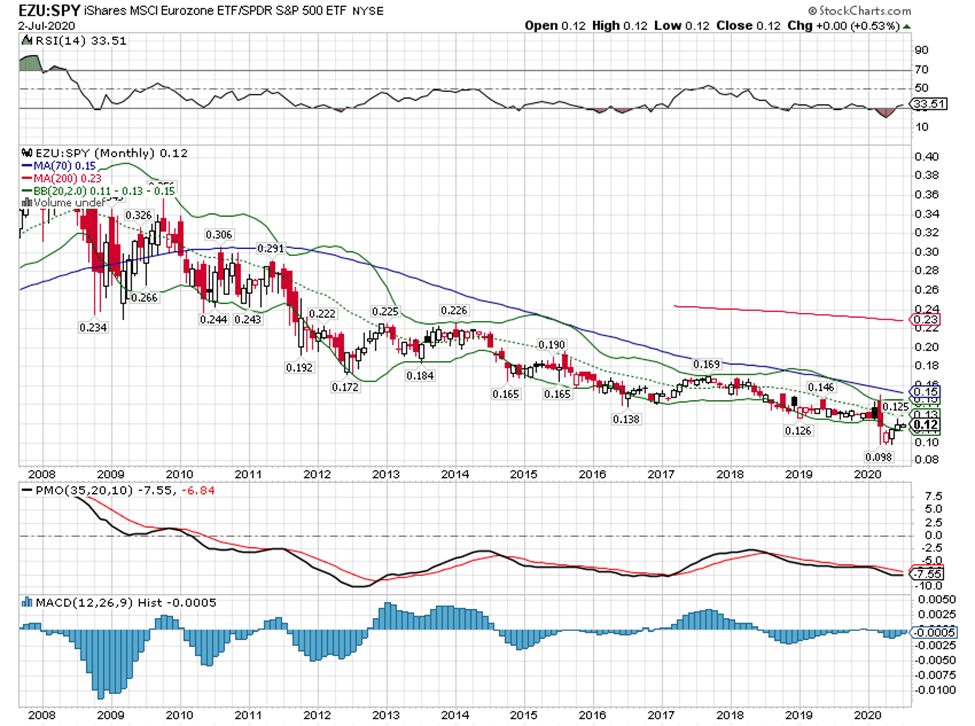

But it’s going to have to move a lot more than that to reverse the long-term trend:

(Click on image to enlarge)

Asia ex-Japan outperformed the US in June:

(Click on image to enlarge)

Commodities have outperformed stocks since late April:

(Click on image to enlarge)

Copper has outperformed stocks during the virus crisis:

(Click on image to enlarge)

Crude oil has been in a long-term downtrend versus stocks:

(Click on image to enlarge)

But has outperformed since late April:

(Click on image to enlarge)

And the copper:gold ratio has been in a short-term uptrend, reflecting optimism about economic recovery:

(Click on image to enlarge)

The ratio has been a good leading economic indicator and the 10-year Treasury yield usually tracks it pretty well. Today a gap has opened with the ratio rising and bond yields stagnant. That gap will be closed, but how is the $64,000 question.

There is also a growing divergence between gold and the dollar. The yellow metal has been in a steep uptrend since late 2018. Is gold leading the way for the dollar index?

(Click on image to enlarge)

And gold has been outperforming stocks since about the same time:

(Click on image to enlarge)

Despite this near two-year uptrend of gold over stocks, the long term view shows that this only reverses a small fraction of the previous decline. If this is the beginning of a long-term trend, it could have a long way to run:

(Click on image to enlarge)

Gold and the dollar are inevitably entwined, gold rising as the dollar falls. But it isn’t a perfect correlation and there are plenty of other factors that impact the price of gold. Nevertheless, I think it is wise to pay attention when two normally closely related price trends diverge. This is a plot of gold versus the inverse of the dollar index. How will that gap be closed?

(Click on image to enlarge)

Will gold fall or will the dollar? I don’t know but real interest rates support the view of gold. Gold is signaling weak growth and so are TIPS. 10-year real rates are near all-time lows:

(Click on image to enlarge)

Most of the long-term trends haven’t changed since the onset of the virus crisis in late February. Indeed, many of them actually accelerated. Short term trends are being influenced by recent dollar weakness and there is some evidence that the weakness may continue. Having said that, I don’t generally try to predict the future since it is basically impossible. We have taken some positions to take advantage of the shorter-term trends but a full tactical shift to a weak dollar portfolio will have to wait for more evidence.

(Click on image to enlarge)

Market Scorecard

(Click on image to enlarge)

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more