Mega Rally In Small Caps, Banks And Oil

Massive Monday Rally

Stocks absolutely exploded on Monday as President Trump was released from the hospital and tweeted in favor of a stimulus. Uncertainty over his health is over as many knew it would be. Odds of a stimulus passing in October probably increased.

We won’t know if President Trump getting healthier helps him or hurts him in the polls until we get new polls in the next few days. We expect at least a very minor, or possibly major bump.

Monday’s rally had very strong breadth as the Russell 2000 was up 2.77%. The small-cap index is up 4.9% month to date and down 5.2% year to date. This was the first time more than 100 stocks made new highs on the Nasdaq since September 2nd which was the Nasdaq’s peak. There was general optimism on the economy as WTI oil was up 6.5% to $39.46. That was the biggest 1-day increase in 4.5 months.

As you can see from the chart below, the 30-year treasury yield rose above its 200-day moving average. It rose from 1.49% to 1.59%. This was the highest since June 8th. The 10-year yield hit 78.8 basis points (then fell 2 basis points Tuesday morning).

(Click on image to enlarge)

Because of the increase in yields, the banks had a great day as the KRE regional bank index was up 4.17%. And because of the rally in oil, the energy index was up 3%. ExxonMobil was only up 2.3% as almost nothing can push this behemoth higher. It’s like trying to stop an avalanche.

Surprisingly, the increase in yields did nothing to stop tech stocks. If this increase in yields continues, they will likely sell-off. We’re pretty close to the tipping point with some of these names. And if the 10-year yield rises to 1% like many expect, some of the most speculative stocks can easily crash over 30%.

Another problem with higher yields is in housing as affordability suffers when borrowing costs increase. Zillow was up 1.8% which is amazing because it’s up 196.6% in the past 6 months despite the fact that they lose money on their house flipping business. Losing money doesn’t work when rates rise.

Two Big Movers

The 2 biggest movers during the day/after hours were Draftkings (DKNG) and Alteryx (AYX). Draftkings fell 5.1% because the company issued stock. This is a great example of why it’s a bad business. They don’t have enough money to pay for advertising to acquire customers. This stock simply can’t rise in the long term. It’s a massive bubble that can easily pop, sending it down 80%.

On the other side of the coin, Alteryx rose 23.9% after hours after the company’s CEO stepped down and he was replaced by Mark Anderson. Mark is the former CEO of Palo Alto Networks. The company also raised its Q3 revenue growth guidance from 9% to 23%. Many thought SaaS stocks were valued highly because they are consistent. This is anything but consistent.

Put To Call Ratio Is Still Low

It’s amazing how much differently the market looks compared to 2 weeks ago. We went from the despair of a 10% correction to optimism again. There’s almost euphoria already. As you can see from the chart below, the 10 day average of the put to call ratio is still very low.

Nasdaq 100 is up 6.5% from its low. It’s only down 7.5% from its record high on September 2nd. Investors don’t see any way it reaches a new record within the next year. That’s a bold statement.

(Click on image to enlarge)

Either the economy looks better and yields rise which hurts tech or COVID-19 comes back and everything falls apart. We can continue to believe that better treatments, a vaccine, and more tests will solve this crisis within the next 6 months.

Furthermore, the deaths won’t get as bad this winter as they were in the spring. We have much better testing and treatments. It’s still not where it needs to be to end the pandemic yet.

By April 1st, the economy will be almost fully re-opened. It doesn’t matter who is president because it’s only partially up to the government. Abbott developed the tests. Government just bought them. Plus, Trump and Biden both support buying tests.

Software Bubble

These software bubble stocks are so extreme that Square now has a larger market cap than Goldman Sachs. Square rose 6.7% on Monday as it now has an $80 billion market cap. Goldman Sachs as a $69 billion market cap. Square is worth more than most banks. Deutsche Bank is merely a mid-cap as it has an $18 billion market cap. Wells Fargo is only at $101 billion.

(Click on image to enlarge)

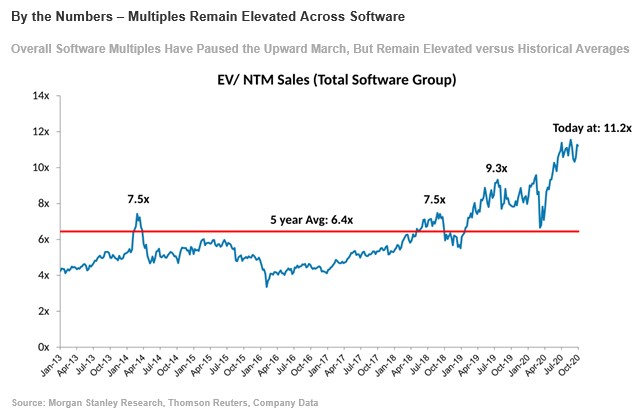

As you can see from the chart below, the bubble in software stocks stalled in the past few weeks, but these stocks are still expensive. Enterprise value to the next 12 months of sales is at 11.2 for the software industry which is almost twice the normal multiple.

People look at the long term trend of software stocks and completely ignore that they weren’t expensive 2 years ago and now they are. In the process of getting extremely expensive, a stock will do well, but that doesn’t mean the trend will continue. It’s statistically impossible for it to do so. Furthermore, the top 5 most expensive software stocks have an average EV to sales multiple of 34.6 which is over double the 5 year average of 14.8.

(Click on image to enlarge)

Software stocks are about to be in a world of hurt because the IPOs and secondaries increased supply and competition within the industry. Plus, demand is going to fall as the economy reopens. It’s the worst possible scenario. It sets up for a major crash within the next few months.

As you can see from the chart above, expectations for IT spending rose dramatically in Q1 but fell from those lofty levels in Q2. Specifically, a smaller percentage of firms said they would increase IT spending versus decrease it compared to Q1.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more