Mediocre 10Y Auction Sees Sharp Drop In Indirects As All Eyes Turn To Settlement Date

Ahead of today's 10Y Treasury auction, there was some concerns that the Zoltan Pozser report on an upcoming repo crash would spook buyers and we could get dismal demand as a result of the bond's Dec 16 settlement - same as the quarterly tax remittance day - when liquidity could potentially collapse as we enter the notorious month-end repocalypse 2.0. That did not happen, however, with the $24 billion reopening of CUSIP YS3, pricing at 1.842%, stopping 0.1bps through the When Issued, and slightly higher than last month's 1.809%.

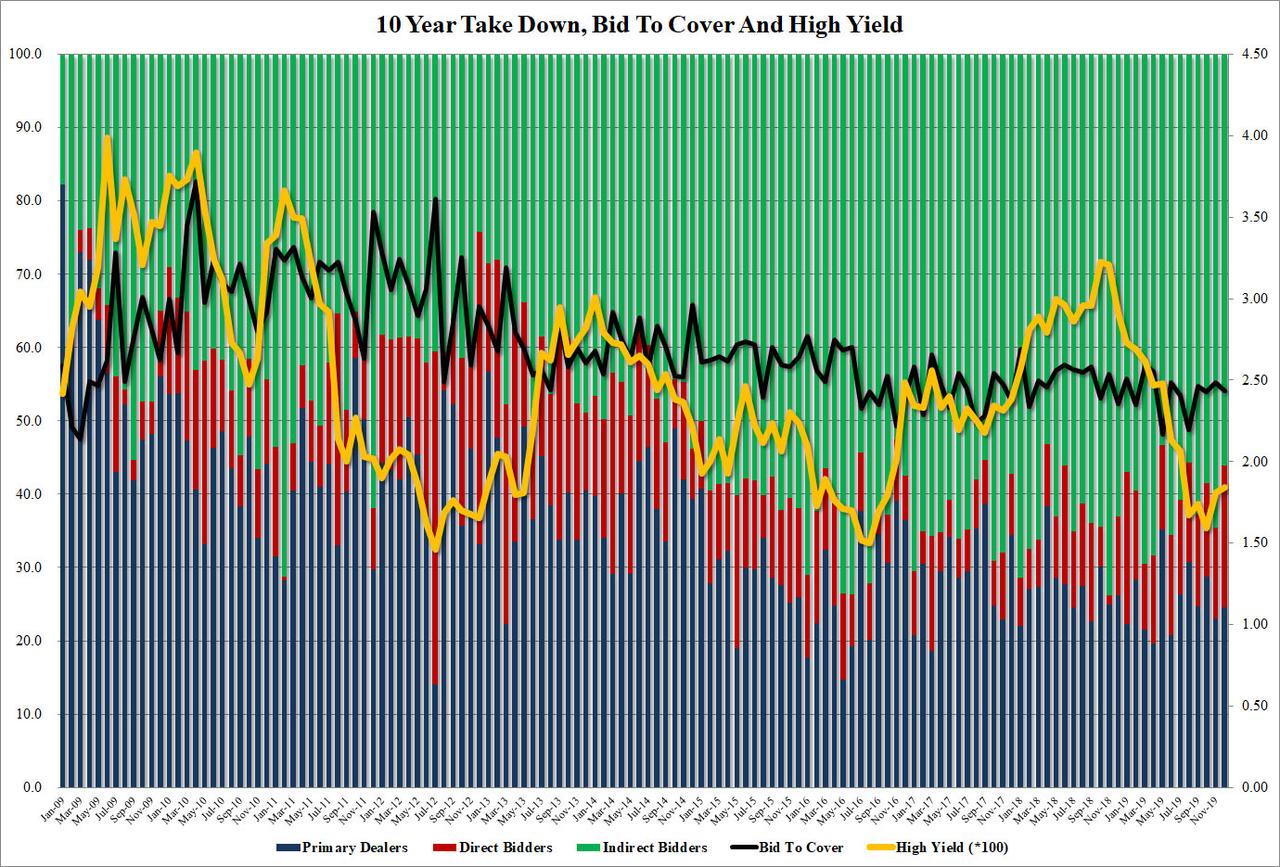

The Bid to cover was unremarkable, sliding from 2.49 to 2.43, just above the six auction average 2.41. However, the internals were more concerning because even as Directs surged from 12.4% to 19.4%, the highest since January, it was the Indirects that offset this spike, the foreign takedown tumbling from 64.5% to just 56.1%, well below the 61.3% recent average and the lowest since August.

(Click on image to enlarge)

Still, in lights of Pozser's dramatic claim that the Fed is about to lose control of overnight rates resulting in a spike in yields, today's 10Y was hardly evidence of fears. Or perhaps buyers moved a step ahead and were pricing in the upcoming QE4 that would inevitably follow a late-year market crash, as it would then allow them to flip today's purchase right back to the Fed at a generous profit. In any case, we have to wait until year-end to see just how this dramatic liquidity tug of war plays out.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more