Market Week In Review - Friday, May 15

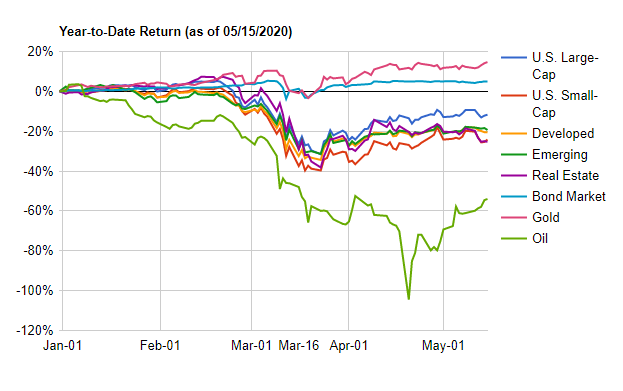

The U.S. stock market ended the week lower amid plummeting retail sales and Fed Chairman Jerome Powell describing the economy’s path as uncertain. Consequent to Powell’s comments interest rates also moved moderately lower with the 10-year Treasury yield dropping from 0.69% to 0.64%, meanwhile the 2-year treasury yield was unchanged at 0.16%. The price of gold rose over 2.0% to $1,754 an ounce as poor economic data drives up the demand for the haven metal. The price of crude oil had another positive week, rising over 7.0% to $29.76 a barrel, amid further production cuts of the oversupplied commodity.

(Click on image to enlarge)

Fasten Your Seat Belts

Warren Buffett famously said: ”Forecasts usually tell us more of the forecaster than of the future.”True as that may be, anyone who invests in the stock market is forecasting that the market will be higher at some point in the future than it is today, or he or she would not have invested in the first place.

David Kostin, the chief U.S. equity strategist at Goldman-Sachs, announced this past week that he has lowered his S&P 500 forecast to 3,000 for the end of 2020 from the previous 3,400 year-end estimate. If correct, the S&P will finish 2020 with a gain of approximately 2%, which may seem like a good result to many, considering what has transpired so far. But there’s a catch — Mr. Kostin is also predicting the S&P will plunge by 18% over the next 3 months, before bouncing back in the third and fourth quarters.

In this week’s The Market Commentator’s podcast (which you can find here), I discussed my impression of the trench warfare being waged on Wall Street as to what will happen next. On one side of the field are the bulls, who are optimistic about the re-opening of the economy and the discovery of a medical solution to the pandemic. On the other side, you have the bears who are concerned that loosening the social distancing restrictions will lead to a resurgence of the virus, which will, in turn, extend and deepen the recession.

Federal Reserve Chairman Jerome Powell’s statement on Wednesday gave support to the bear camp. According to Powell, “While the economic response [so far] has been both timely and appropriately large, it may not be the final chapter, given that the path ahead is both highly uncertain and subject to significant downside risks.”

I don’t claim to know which camp is right. One thing I do believe is that higher stock prices raises the risk of a market decline. If you are not comfortable accepting the increased risk, then it may make sense to reduce market risk by temporarily reducing the share of your portfolio that is allocated to equities. If you are committed to maintain your equity investments come hell or high water, then standing pat may be best for you. Either way, I suggest you fasten your seat belts: it could be a bumpy ride.