Market Update: When Fundamentals No Longer Matter

Economic data continues to show improvements while investors panic over the potential effects of Covid-19. An above-average PE ratio made the market more vulnerable to an external shock such as this. However, the steep decline in rates to historic lows makes stock valuations as attractive as they have been over the last 5 years. The temporary nature of this event means that when investors eventually come to their senses, they’ll realize the TINA (There Is No Alternative) effect is stronger than ever.

Economic Data:

(Click on image to enlarge)

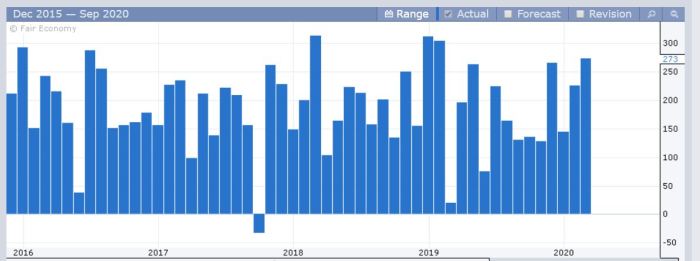

Today’s jobs report showed a much better than expected 273K jobs created for February after 225K jobs were created in January. The jobs picture remains robust and the consumer remains in good shape.

(Click on image to enlarge)

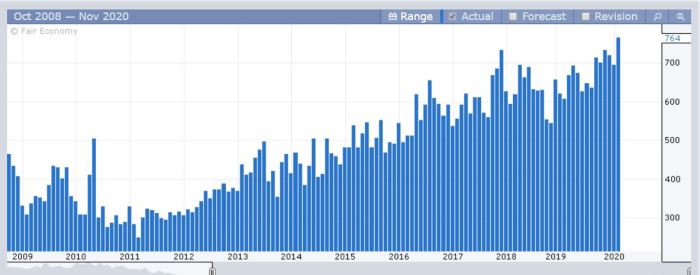

New Homes Sale for the month came in at 764K, which made a new high for this business cycle and the highest reading since 2007. The trend should only continue with rates going lower.

(Click on image to enlarge)

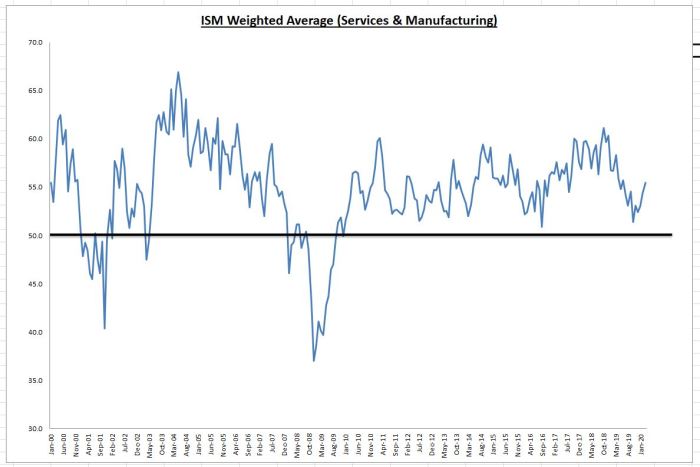

ISM Manufacturing came in at 50.1, while ISM Services came in at 57.3. The combined weighted average for February is 55.5, another increase over the prior month.

(Click on image to enlarge)

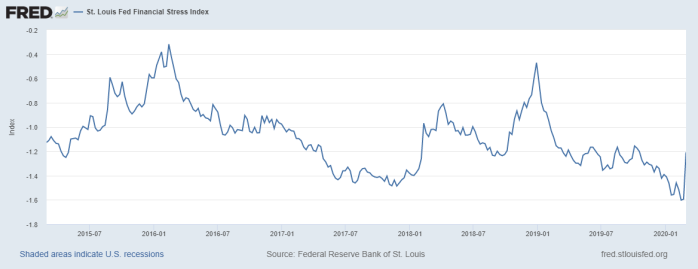

The St. Louis Fed Stress Index increased this week, mainly due to the rise in the volatility index during the recent sell-off. The index is still deep in negative territory and below the 2018 and 2016 highs.

Clearly, the market is looking past the data and trying to estimate the future damage the virus will cause.

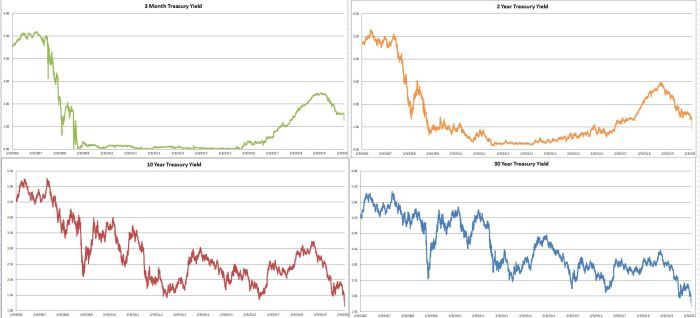

Interest Rates:

(Click on image to enlarge)

Long term interest rates are making new all-time lows while short term rates gravitate back to the 0% bound. This has caused the 3-month / 10-year rate to go back to inverting. While this isn’t a great sign, the rest of the curve is looking fine and credit spreads aren’t showing any unusual signs of stress yet.

Earnings:

Stocks generally trade on future earnings expectations. Most of the time earnings projections are fairly accurate. But when you have these unforeseen shocks to the system, future earnings projections are thrown out the window.

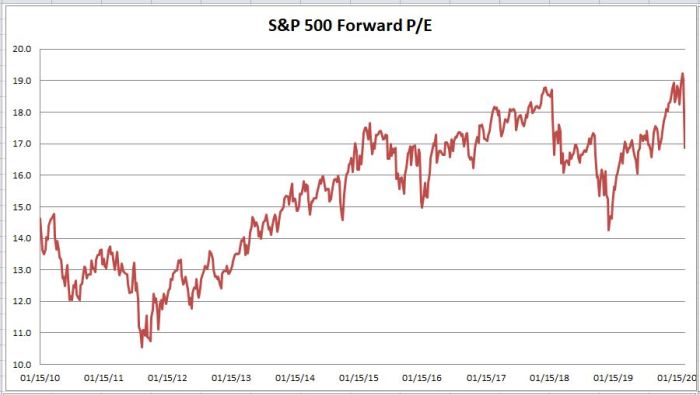

(Click on image to enlarge)

As of last week, the market forward PE fell to 16.9x. This represents an earnings yield of almost 6%, while the 10-year treasury rate has fallen to 0.75%.

(Click on image to enlarge)

This makes the equity risk premium as high as its been over the last 5+ years. Translation, stocks are becoming even more attractive over fixed income.

But can forward estimates be trusted when the future is so uncertain? The answer is probably not. The market was expecting 7% earnings growth in 2020. Let’s assume we end up getting 0% earnings growth in 2020.

The 2019 EPS was $162.98. As of today’s open (Friday) that equates to a PE of 18.1x, an earnings yield of 5.50%, and an equity risk premium of 4.74%. Still good on the valuation front.

Technicals:

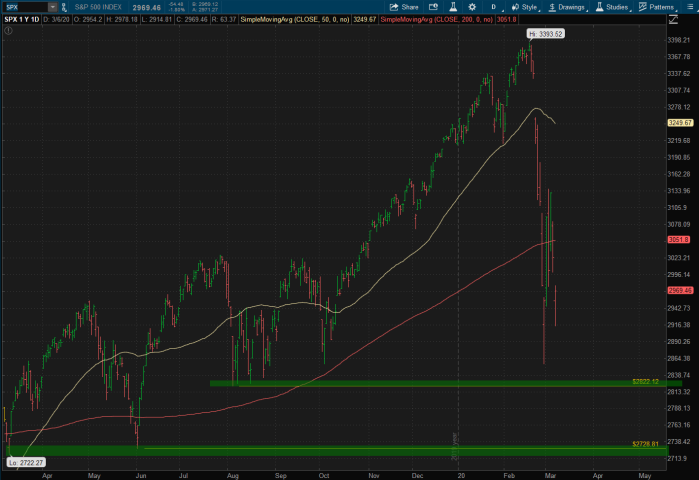

(Click on image to enlarge)

If last Friday’s low fails to hold. Look for a shakeout around the 2720-2730 level in the S&P 500. Which coincides with a correct roughly the size (in percentages) of the December 2018 panic.

Conclusion:

The news flow is likely to worsen for the next couple of weeks or so. Meaning volatility could be here to stay for a bit. If you’ve done things correctly by staying well-diversified and ensuring all near term cash flow needs are out of the market, there isn’t a need to overreact to any of this. As the saying goes, this too shall pass. And then it’ll be on to the next one!

The extreme pessimism has pushed rates to historic lows. When this temporary setback subsides, investors will eventually come to their senses and realize they can own stocks with a dividend yield of around 2% and an earnings yield of 6%, while Treasuries are below 1%.

It’s really a no-brainer.

Disclosure: None.

Nothing on this article should be misconstrued as investment advice. Trading and investing is very risky, please consult your investment advisor before making any ...

more