Market Top?

‘Davidson” submits:

Market prices despite the many predictions by professionals have never followed a cohesive logic connected to fundamentals. Prices of everything bought/sold are set by market activity driven by market psychology of what things are worth. Markets fluctuate dependent on market psychology of the moment fed by media headlines. Human activity is market activity and includes product, service and information exchange. When you look deeper, products and services are items derived from information and innovation repurposed into business offerings on which individuals derive profit. Most stop their analysis at evaluating what stocks and bonds are worth, but what something is worth is at all times a moving target of information exchange. If the idea improves standards of living better than other ideas, it sells better and produces profit for the innovator. In the marketplace innovators offer ideas but it is consumers who make the judgement on utility. While businesses are believed to set prices, prices are in fact set by consumer willingness to purchase. This is an individual value judgement of one offering vs other offerings. What people believe things are worth differs frequently from fundamental measures. This is the crux of Momentum vs Value Investing. Momentum investors believe prices reflect intrinsic value but Value investors see prices as only what investors are willing to pay for fundamentals.

Markets always reflect a wide gap between prices and fundamentals with areas mispriced based on the themes of the moment. Today two themes are playing out, the ‘stay-at-home’ vs the ‘back-to-work’ as investors cope with the economic impact of COVID. Media headlines can be pessimistic one hour and optimist the next in an ebb and flow too fast to fathom with common sense. Advisors promoting their expertise (and seeking new clients) provide so many short-term streams of direction it is a muddle based on enigma.

How one makes sense of it all is to ‘connect the dots’, i.e. all the dots possible to find the fundamental drivers of market pricing. The ‘dots’ comprise a wealth of inputs but when one works through it, simple relationships become apparent. Over the short-term these patterns do not jump out of you but longer-term they are far more obvious. Net/net it is fundamentals over the long-term that drives market psychology despite the presence of an unpredictable quicksand of short-lasting themes. Short-term market themes provide head-fakes throughout every market cycle. This creates confusion for any investor with a short-term trading mindset. Short-term themes are very much like being in a house of mirrors. Bitcoin is one of these.

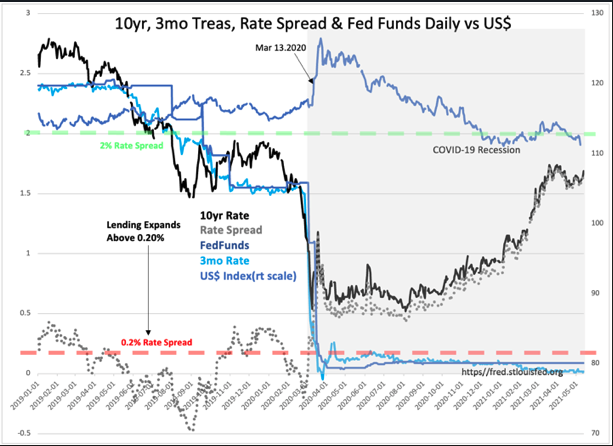

Rates are market prices set by market psychology. Rates, especially the Rate Spread is a good measure of the current state of investor psychology and provides insight to the overall condition of speculation during a cycle. Every cycle since the Fed has kept track of rates, since 1953, has displayed the same pattern:

- In recession the yield curve is inverted and rates are at the low point of the cycle

- Emerging from recession 10yr Treasury rates rise while T-Bill rates lag as investors gain confidence and seek higher returns but keep some capital aside, rate spread widens.

- Middle of the cycle T-Bills rates begin to rise with 10yr Treasury rates as investor confidence expands. Roughly a 2% rate spread range. Bank lending accelerates with net income profits and economic activity is spurred higher.

- Speculation begins to develop and investors shift capital out of T-Bills forcing the rate spread to narrow.

- Speculation and bank lending continues till the rate spread narrows to 0.2% reducing lending profits significantly. Rates are at the top of the cycle. At this point, banks and investors are over-leveraged and additional capital coming into the economy and markets slows. Defaults in over-leveraged businesses creates a domino cascade into the next recession.

Rates are not fundamental measures of economic activity but a measure of market psychology and investor positioning. The fundamental measures that provide the economic background are employment indicators, measures of goods manufacturing and transport, measures of retail consumption and etc. The trends in fundamentals is what eventually drives investor psychology to shift capital seeking the better perceived risk/return at any point in time. Investors pushing rates higher in the shift from fixed income to equities does eventually impact the cost of doing business and hiring new employees. It is a feedback mechanism between market psychology and economic activity that is always present. This is a long-term relationship not the short-term impact reported to be shifting daily in the media. In ‘connecting the dots’, it is the long-term dots which connect best with the rest of the information being head fakes regarding actual long-term returns.

At this point in the current cycle, T-Bill rates remain near record lows as 10yr Treasury rates continue to rise. Even though it should be apparent we exited recession April 2020, more than 12mos ago, many continue speak as if we remain in recession and demand further stimulus.

There are copious levels of liquidity present. It appears we are roughly half way towards the next economic/market top with ~8mil individuals still to reenter the economy. There are pockets of rank speculation in SPACs, in Internet related ‘stay-at-home’ and new but untested technology companies and the latest craze, Bitcoin and other cryptocurrencies. The valuations are non-existent in many of these reflecting Momentum themes based purely on price with fundamentals and common sense lacking altogether. Cryptocurrencies are unconnected to economic activity. Fearing a top is not new for those involved only in these issues ignoring the fundamentals of long-term economics vs pricing. Recognize the differences in Momentum vs Value Investing and employ both in your thinking. Be balanced! Reassert that balance every day.

Connect the long-term dots and ignore what is in between as noise. The fundamentals remain in uptrends and the rate spread continues to indicate tops are a ways off into the future as do fundamentals. Perhaps there is a top in 3yr-5yrs. Not today!

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more