Market Information Hierarchy

“Davidson” submits:

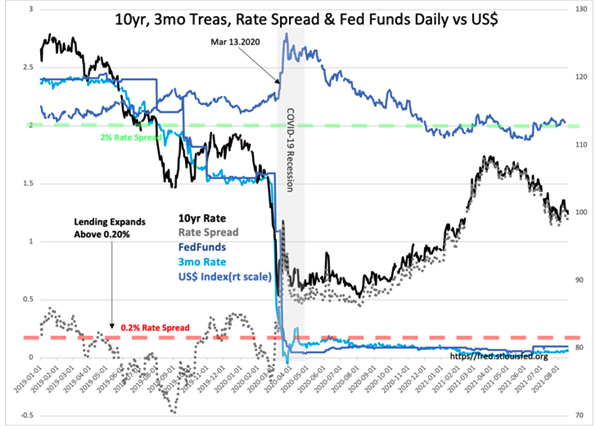

Watching the daily interplay between Rates, the Rate Spread, and the Trade Weighted US$ is not something on which business or investment decisions are based but it does help to understand the continuity of longer-term relationships vs global geopolitics. The pattern of stronger periods in the Trade Weighted US$ with lower 10yr Treasury rates is clearly evident. Falling 10yr rates reflects global uncertainty driving capital to US$ denominated debt as a safe haven. Afghanistan is only the most recent geopolitical disturbance. Wall Street commentary has flip-flopped repeatedly (weekly at times) with every turn in 10yr rates. Rising rates leads to higher oil prices, favoring the industrial economy and inflation. Falling rates leads to selling oil and favoring highly-priced technology and stay-at-home issues. It is binary on-off perception without consideration of fundamental economic trends that continue to solidly indicate additional expansion remains.

Even today, it seems that there is no one voicing the NBER declaration that the COVID Recession ended April 2020, 14mos ago. The gray recession bar in the chart is adjusted accordingly. The recession fear and the Fed monthly bond buying has been on going in the face of the April 2020 turn higher of key identifiers of economic activity, i.e. Retail Sales, Chemical Activity Barometer, Intermodal Rail, US Refined Crude Product Consumption, Job Openings and etc. My notes identified these turns and the broad economic turn shortly afterwards.

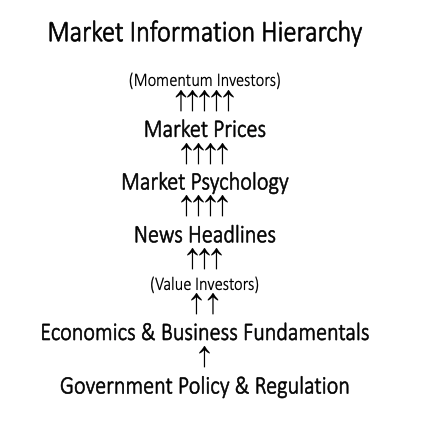

That the consensus still demands additional stimulus, is more a reflection of a lack of critical thinking group-think. Reality has taken a back seat. It is a form of mental Momentum. All think the same till at some point they do not. This will change because the economic progress since April 2020 will eventually force its way into everyone’s psyche as it always does. No market in history has ever ignored what appears to be a profit opportunity once it was recognized. The Market Information Hierarchy illustration has been reformatted to better explain how different investors incorporate information into investment decision making. Momentum Investors which dominate the current marketplace, are the last to know fundamentals developed at the base of the hierarchy. It can take 2yrs+ for markets to recognize strong fundamental trends as investible.

The patterns in Rates, the Rate Spread and the Trade Weighted US$ are dominated by market psychology of Momentum Investors who rely on changing price trends and deploy capital according to computer driven algorithms. The media tells us these shifts are fundamental and tell us something about economics, but they are not. These shifts only tell us how Momentum Investors are thinking. Being pessimistic long enough, Momentum Investors have caused price declines of several years with a resulting economic impact. They have done this with the Global Warming ESG theme and forced oil prices lower even the oil consumption trend continued. The net/net of this has been to starve this industry of capital. Consumption continues to recover from the COVID Recession. At some point, an “Oh my god!” point is realized that oil and natural gas, both just as vital for economic activity as in the past, are in overly-short supply and that a significant investment opportunity is at hand. When this occurs will prove impossible to predict but investment history is full of examples to buttress this prediction. The US energy industry is tied to the 80%+ of the US economy currently ignored by most investors.

The belief we remain in recession is reflected in the recent decline in 10yr Treasury rates. The reality of economic expansion still remains buried in the information hierarchy. When 10yr rates rise, perhaps with inflation or perhaps a recognition of economic activity which cannot be ignored, the industrial company profitability now occurring will emerge as favored opportunities.

Patience is required. The Market Information Hierarchy requires time for important economic information to impact pricing. The information which drives market cycles is not binary, does not turn on one week and off the next. Instead, the most important information drivers of market prices are the long-tern demand trends as individuals seek to advance their standards of living. The current cycle by current measures has several years to continue regardless of how messy the domestic and geopolitical climate.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more