Market Briefing For Tuesday, March 17

Black Swans collided - nearly two months ago, before the whole flock lost its way, as many money managers (not the Fed) thought they could somehow buy dips or minimize the reality of a modern global pandemic, and now seem to be sobering all at once over the last couple of weeks.

Part of that doesn't just relate to the President saying the Covid-19 peak could be as late as July or August, although that sure took the wind out of any sails that were hoping for low-level stability, which sort of preceded. It was only when Dr. Fauci 'clarified' that means we might be past the hump essentially before then (and reassess 15 days from now, incidentally), it was calming. But the damage was done and the decline accelerated.

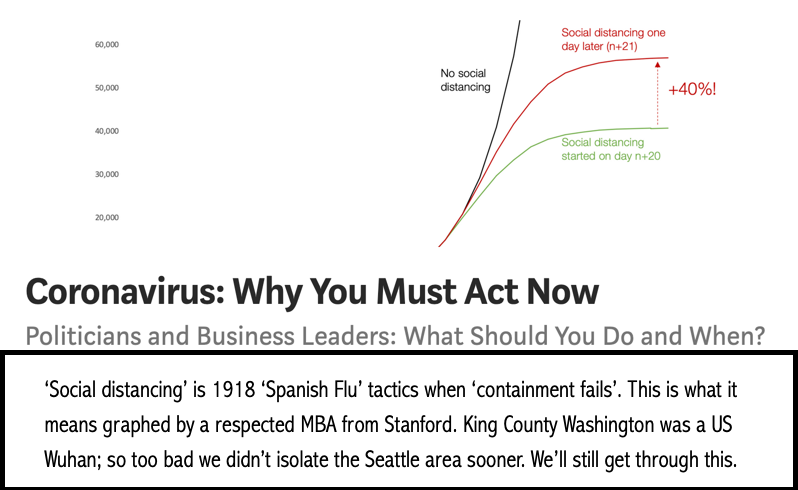

I'm glad the President clarified that we might be 'through this' by then and not that the peak wouldn't come until later Summer. I personally thought 'peak' would be late April / early May, and I still speculate that way as I've heard Fauci ruminate that as well. It depends how well these draconian, almost-lockdown, efforts go in the United States.

Technically I have projected and totally believed that the preceding 2018 lows (and more) come out as this 'WuFlu-based 2020crash' evolves (it's so complex that maybe we should have a contest to name the seminal or historic event overall. It's not just WuFlu and it's not just excessive debt in an already-absurdly priced-to-perfection market, and it's not what in 2007 I labeled a coming 'Epic Debacle', but it has elements of all of that.

Which reminds me that while there were various 'bubbles' (debt the most evident for a long time, and now it goes from incredible to insane) and it's not a CMO or CDO 2007-'08 derivatives crisis we projected, it is financial too, and the leveraged funds in many cases have loans and credit lines that will be compromised, called, or result in compelled liquidations.

I have talked about 1800 S&P every now and then, I don't like measures, but I suspect those looking at 2000-2100 are too optimistic overall. For that matter 1800 could be too optimistic, again what's the duration of WuFlu in North America? Once that's know and we start to surmount the hump, it's quite reasonable to expect the stock market to stabilize and begin what's a process of accumulation, because distribution will be done before then. It's not the time to catch falling knives or to engage in wishful thinking.

It's been known for awhile and again 'Newton's Law' applies on a macro basis too. Damage is sufficiently severe to lead to a 'generational buying' or entry opportunity, similar to my observation after the 1987 crash. But we are not there yet, stay tuned.

The equity market got so complacent on the upside, including those who were bearish back when we called the 2018 low. That matters because it is necessary for those who were late chasers to be washed-out. And that doesn't happen overnight, which is part of the unwinding we are seeing.

Perfect storm

So it is a 'biological' rather than 'financial' decline by origin, in-part only as it was extended and at growing risk before the virus was appreciated. So the health of the market was challenged by both the epidemic and debt in many ways, and it all comes together in a form of perfect storm.

As the institutional clients of Wall Street firms, increasingly are quite torn between safety and responsibility issues, there are so many aspects to this crisis, that it's not necessarily mind-boggling, but I think you all know how those break-down.

Absorbing the core information has been slow, by what is a 'leveraged' Wall Street more worried about pressing gains they missed last year by pushing stocks that were already overpriced to higher levels. (As we said back in January.. not shorting but emphasizing it was on borrowed time, and not 'just' because of then then evolving WuFlu).

Maybe it's that equity over-positioning or chasing I warned about back in January, that reflects 'why' it makes no sense for those same managers (or technicians) to try measuring moves 'off the top' when that 'top' was a nonsensical move related mostly to overpriced FANG & MAGA stocks (a small universe of issues) (APPL) (GOOGL) (FB), before the decline. So listen to messages of the market, as I've suggested we knew where this market had been, where it was in recent weeks, and where it was going (which was lower). Sure we hope to identify an area of a bottom, but this is not that.

In-sum: buying time for banks to provide capital to companies is terribly important, and the move of the Fed Sunday (as I wrote in my special 2nd Edition weekend report) was intended to stabilize the system not the S&P (SPY) in my opinion; and the market's action certain reinforced that.

Now, I hear strategists talking about 'exhaustion' and just stops declining. Nope, not that way at least now. Because there is compelled liquidation, as well as no valid price-discovery methods for complex derivatives and a slew of other factors that (as I mentioned this morning) can't be done just by 'work-at-home' computers. And that's part of the destabilization.

Lack (so far) of action in the Commercial Paper market is part of it too, as while I don't want to be alarming, that relates to Money Market levels too (and expect the Fed to strenuously make efforts to avoid 'break the buck' challenges). That's why the President's uncoordinated reference to long lasting aspects of Covid-19 shook markets, too. It's not just the economic impact (though that's incredible), but rather the stress on the system and yes more than measuring bear market levels or any of that.

Bottom-line: major artillery has been dragged-out and somewhat fired at the issues; but investor confidence is eroded by just visualizing reality as so many (including some personal friends) tried to ignore or trivialize.

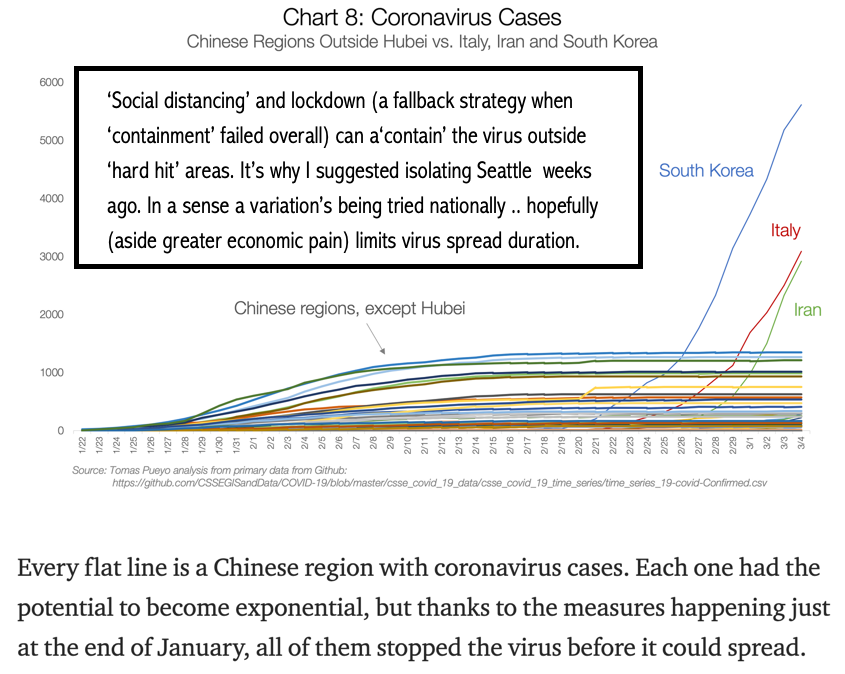

Globally the challenges remain severe, but the virus has been evolving in our direction, so there is some prospect of 'some' containment in a few of our regional areas, but probably not most major cities, where mitigation is already the ongoing effort.

The real concern, as a few have concurred, is the Treasury Market and in this case the 'credit market' debt bubble that has been there for months in advance of this crisis. The wild volatility swings in Treasuries isn't helpful and denotes the nature of this situation. It's about the system, not market and no it's not because anyone is attacking us, though it feels like it.

Why do I have a feeling that while we really don't know how extensive it's going to spread (WuFlu) in the United States, we do smell a rebound just around the corner, but nothing particularly sustainable.