March 2020 Yield Curve Update

Well, so much has happened, I hardly need to update the yield curve. Coronavirus has given us one big push into the recessionary outcome that we have been tentatively dancing around for some time.

The first graph here is the comparison of the 10-year yield and Fed Funds Rate. The imminent recession has pushed the neutral rates of both down considerably. But, the Fed has been very responsive.

There are so many moving parts moving in such extreme directions, I really don't have anything to say at this point. Normally, I would suggest that we should be hoping for 10-year yields eventually to run up above 1.5% or 2% as a first step to recovery, but it is all so complicated now, and the Fed makes it even more complicated than it needs to be, so for now, I'm just going to watch.

Here is the yield curve at several points since the early days of the coronavirus development. Short term rates have steadily moved down but long term rates have bounced around a lot. Again, I'm not sure I have much to say. A lot of the movement on the long end may have been related more to market disequilibrium than to any systematic trends or expectations. Again, I am in waiting mode.

Inflation expectations have declined to less than 1%. As long as that is the case, there is probably a pretty tight limit to how high long term rates will go.

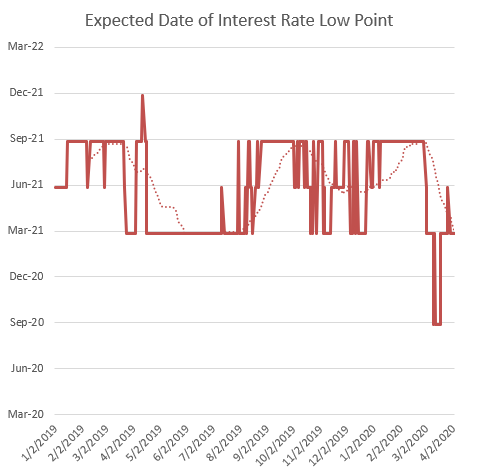

The one thing that might be even slightly informative this month is the expected low point of the Federal Funds Rate. It had been at September 21 for a while, suggesting that Fed policy was expected to allow some sort of economic contraction that would settle in for more than a year.

But, the coronavirus has made everything suddenly more acute and one interesting result of that is that the expected low point of the Fed Funds Rate is now March 2021. It had gone as early as September 2020, but that might have been related to short term market disequilibria.

If this holds up, it suggests that the Fed has been spurred into a more vigorous reaction, and even though the recession will be much deeper than whatever was going to happen, we might recover more quickly because the Fed has jumped from a "minding the store" approach to a "whatever it takes" approach.

We have suddenly switched from a set of fiscal and monetary approaches that were, mistakenly, aimed at making American household assets illiquid, to a new approach where the Treasury and Fed are creating liquidity wherever they can. Because the bias for the past decade has been so far in the other direction, there is a lot to be gained by this.

But, of course, the virus creates many uncertainties.