Is The Goldilocks Economic And Financial Boom Almost Over?

The current bull market in equities is on the verge of breaking records for its longevity.

The largest equity and bond markets reside in the US, and the American economic expansion that began with the ending of the Great Recession in 2009, will become the longest on record this July.

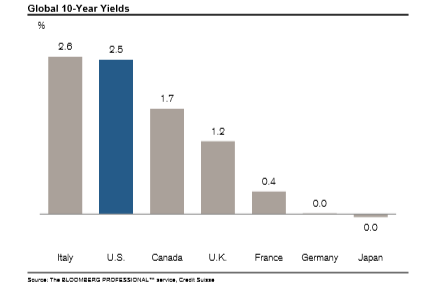

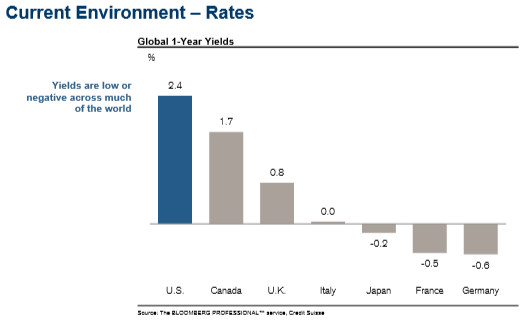

Even in the face of such strong equity markets, money market interest rates and bond yields are extremely low. Indeed, money market yields are low or negative in many of the advanced countries.

The American economic expansion out of the Great Recession has been characterized by strong economic growth, robust job creation, and unusually low inflation. The US unemployment rate in April was only 3.6%, the lowest unemployment rate in fifty years.

There is a case to be made that in a world of persistently moderate economic growth and persistently low inflation, optimistic stock markets and pessimistic bond markets are not in contradiction.

Rather, as Anatole Kaletsky argues in a recent Project Syndicate article (April 29, 2019), high equity prices and low bond yields are really sending out messages about their different priorities.

Equity prices are driven by prospects for economic growth and corporate profits, while bond prices primarily reflect expectations for inflation and the interest rates that are associated with higher or lower inflation.

Nonetheless, at some point, the Goldilocks scenario we are experiencing will falter. In this writers’ view, the ending of the bull market will most likely be triggered by an outside economic or financial shock.

“Sooner or later, some political shock will doubtless disrupt the happy balance of robust global growth and low inflation, as US President Donald Trump’s trade wars and oil sanctions almost did last year. But until such a shock actually happens, investors can sit back and enjoy their porridge just the way they like it.” (Anatole Kaletsky, Goldilocks Growth, April 29, 2019)

Who knows, the current trade standoff between the US and China could just be the grim reaper catalyst.

Interest Rates Are Low Or Negative In Many Of The Advanced Economies

(Click on image to enlarge)

(Click on image to enlarge)