In Stunning Reversal, Investors Are Now "Most Bearish Since The Financial Crisis"

Moments ago, in the aftermath of Mario Draghi's "shocking" admission that things are back to square (minus?) one and more easing will be needed, another ECB member said something that was even more striking:

- PRAET: MARKETS DON'T SAY ACT NOW, THEY WANT TO BE REASSURED

Wait, the S&P is 1% below all-time highs and the markets "want to be reassured?"

That may explain why as Bank of America reported earlier today, the bank's latest Fund Manager Survey which polled 230 panelists with $645BN in AUM between June 7 and 13, found that investor confidence is now the most bearish since 2008's Global Financial Crisis due to "concerns over trade war/recession, monetary policy impotence, and low strike prices for policy puts", those of Powell and Trump.

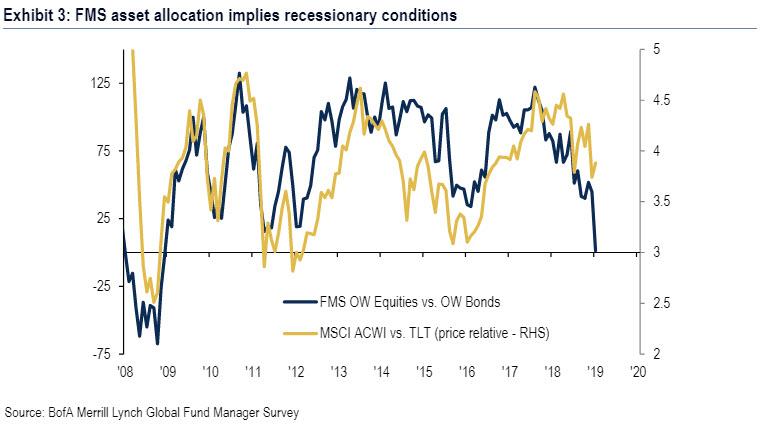

As BofA finds, the asset allocation of fund managers, implies recessionary conditions with the 2nd biggest ever sequential drop in equity allocation of those polled - down 32% to net 21% underweight, the lowest allocation to equities since March 2009 and second biggest one-month drop on record.

(Click on image to enlarge)

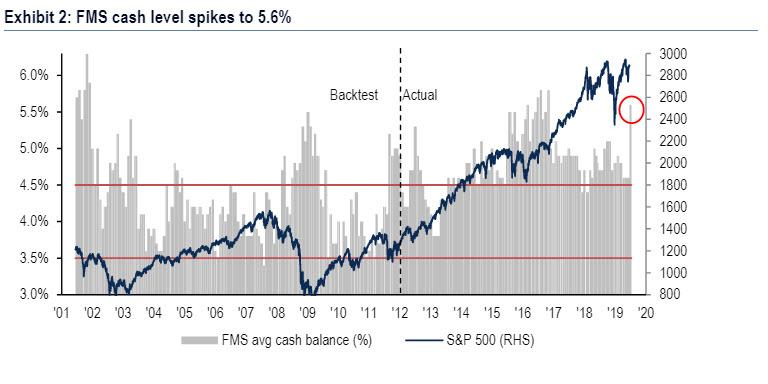

At the same time, Average cash balance soars to 5.6% from 4.6% for each of the last three months, marking the biggest jump in cash since the debt ceiling crisis in 2011; allocation to cash jumps 10ppt from last month to net 43% overweight.

(Click on image to enlarge)

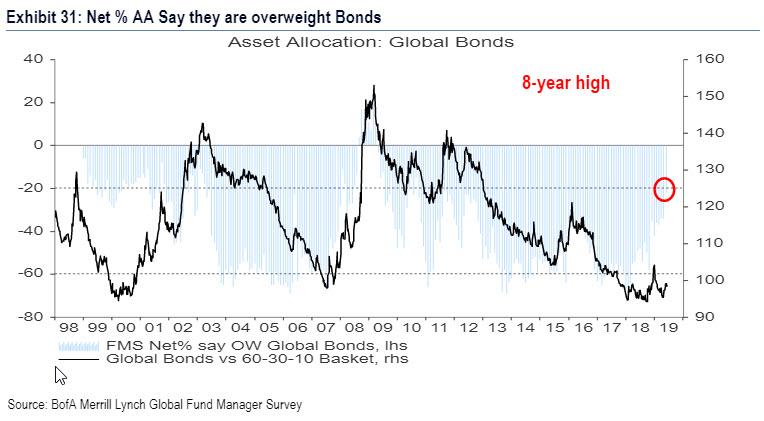

As investors dumped stocks, bond allocation soared 12% to net 22% underweight, the highest level since September 2011, as dovish central banks, falling inflation expectations, and a risk-off sentiment drive interest rates lower.

(Click on image to enlarge)

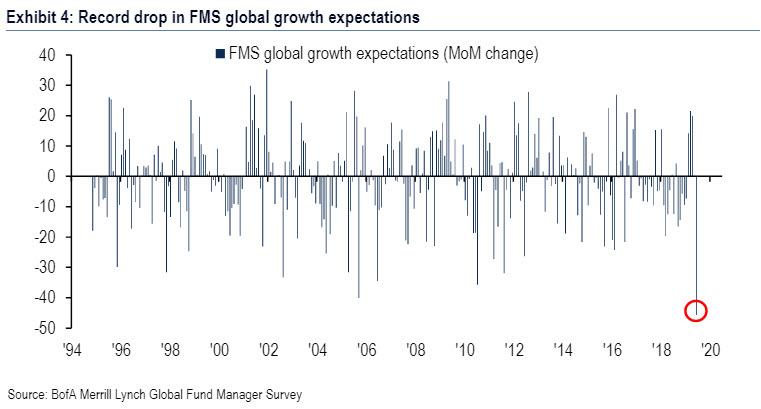

It's not just market views: according to the survey, global growth expectations plunged by a record amount since the Nov 1994 FMS ("Tequila crisis")...

(Click on image to enlarge)

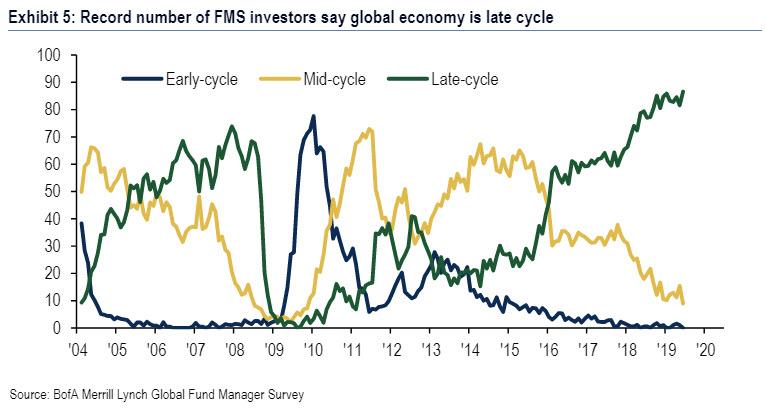

... 2nd biggest ever drop in EPS expectations, as a record number of investors say economy "late-cycle":

(Click on image to enlarge)

Not just equity allocations have plunged: interest rate expectations have also collapsed; in just 8 months, the percentage of investors expecting higher shorter rates has flipped from net 89% to -10%, the lowest level since 2008.

(Click on image to enlarge)

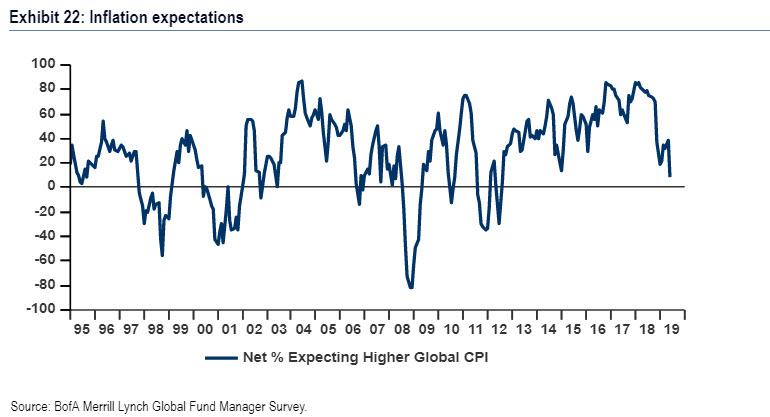

As rates plunge, so do inflation expectations: just 9% of fund managers now expect higher global CPI in the next year, down 30ppt from last month and the most bearish inflation outlook since August 2012.

(Click on image to enlarge)

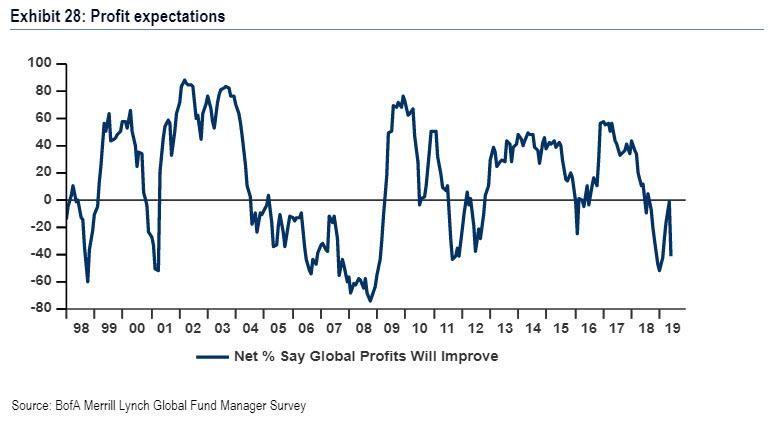

Adding to the depressionary mood, global profit expectations plummeted 40% to net 41% of investors surveyed saying they expect EPS to deteriorate in the next year, the second biggest one-month collapse in the 23-year history of the Fund Manager Survey.

(Click on image to enlarge)

Meanwhile, perhaps expecting a rate cut by the Fed tomorrow, a record net 60% of investors surveyed find the US dollar overvalued, up 16ppt from last month. The current valuation is 2.1 stdev above the long-term average.

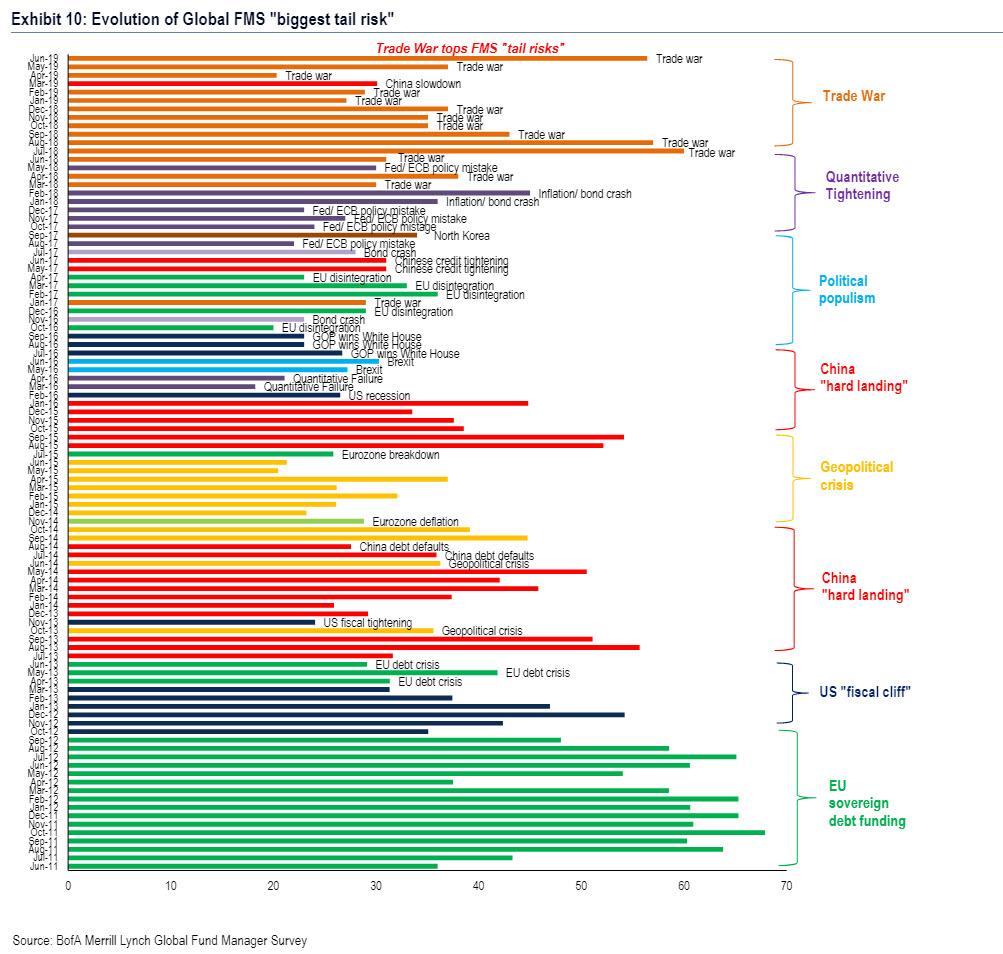

So what is behind this unprecedented downgrade in investor mood and confidence? As BofA notes, "concerns about a trade war soar," with 56% of investors surveyed naming it the top tail risk to the market, up 19ppt from last month and topping the list for 14 of the last 16 months; other risks cited include monetary policy impotence (11%), US politics (9%) and a slowdown in China (9%).

(Click on image to enlarge)

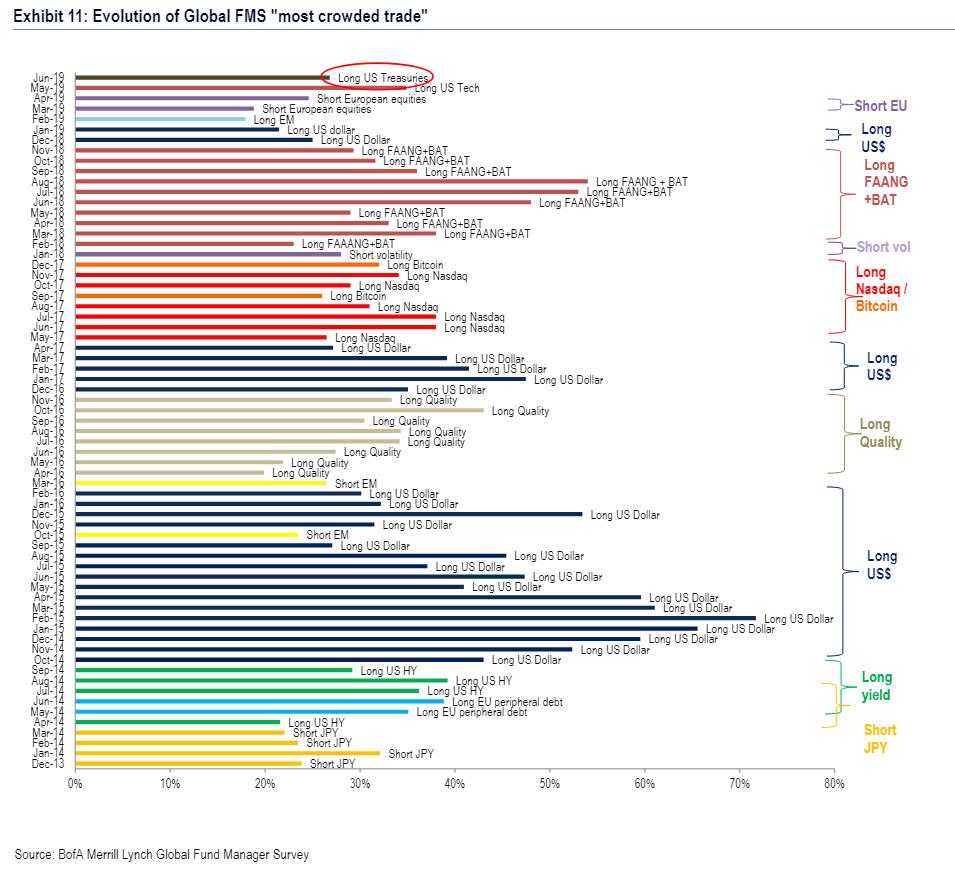

And in another "first" on Wall Street, long US Treasuries (27%) replaces Long US Tech (26%) as the most crowded trade cited by investors for the first time ever, ahead of Long USD (18%) and Short European equities (9%).

(Click on image to enlarge)

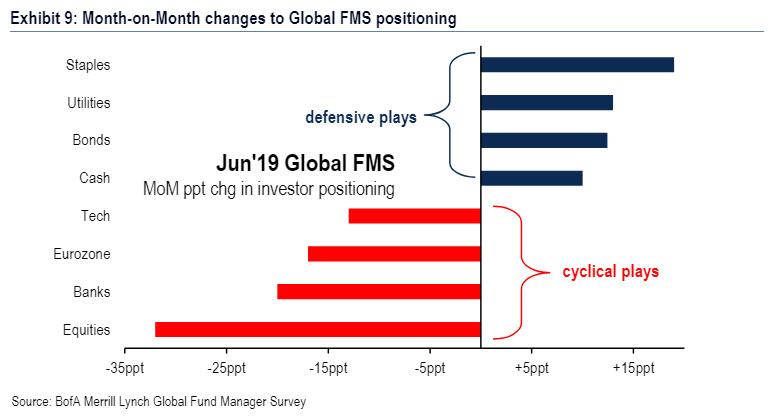

As a result, a huge June rotation is taking place into defensives such as bonds, cash, staples, utilities, and away from equities, banks, Eurozone, tech.

(Click on image to enlarge)

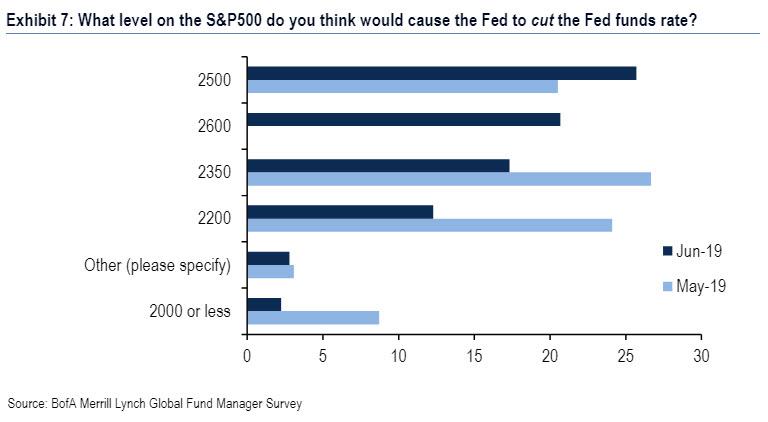

What is odd is that despite the gloom, investors continue to believe in low-strike prices for both the Fed put & the Trump put: S&P 500 level at which investors expect Fed to cut = 2430, at which Trump cuts comprehensive trade deal = 2350.

(Click on image to enlarge)

“FMS investors have not been this bearish since the Global Financial Crisis, with pessimism driven by trade war and recession concerns” summarized the survey's creator, Michael Hartnett, chief investment strategist. His assessment: "The tactical ‘pain trade’ is higher yields and higher stocks, particularly if the Fed cuts rates on Wednesday."

Finally, according to BofA, trades for the contrarian bull: "long gold, short US$", "long stocks, short Treasuries", "long Eurozone, short EM", "long banks, short utils", "long energy, short discretionary".

Yet what we find most bizarre of all, is that investors have never been more bearish... with the S&P at all-time highs. One can only imagine what would happen if stocks dropped 10% (or, gasp, more), and nobody came to "reassure" them as Praet said earlier.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more