Immaterial Jobs

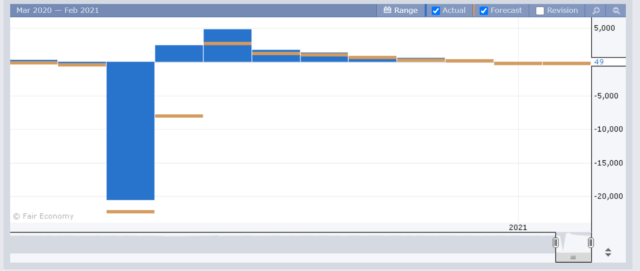

The monthly jobs report came out today, and we’re back to the kind of market in which it doesn’t mean a thing. The jobs added fell short of expectations, but the dynamism of last year – – and the uncertainties and expectations – – are in the rearview mirror. This report has re-entered irrelevancy.

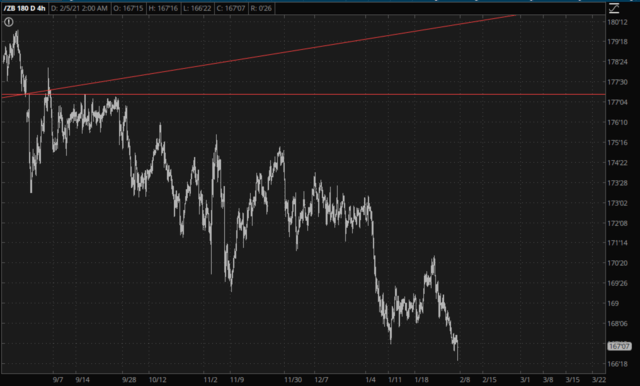

To my way of thinking, the two worst things for the true economy would be, first, falling bond prices, which would push up interest rate expense on our debt-choked system………..and that’s just what is happening:

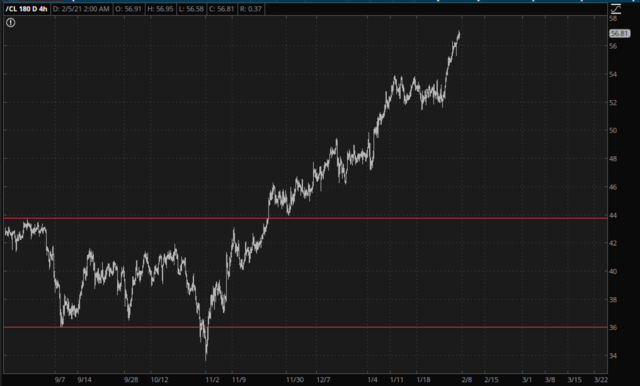

And the second thing that would be a meaningful headwind would be rising energy prices, and that’s precisely what we’re getting:

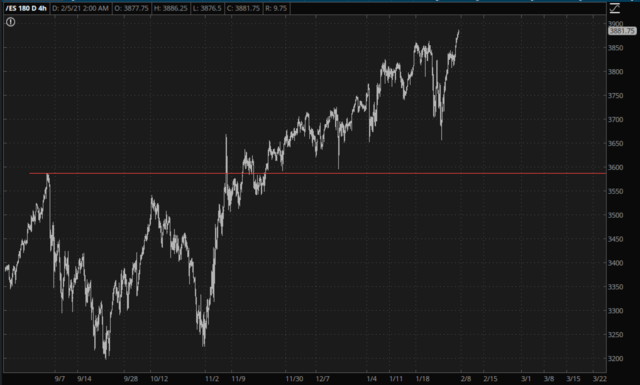

Yet in spite of interest rates pushing higher, and energy prices doing the same, the equity market absolutely could not be happier with itself.

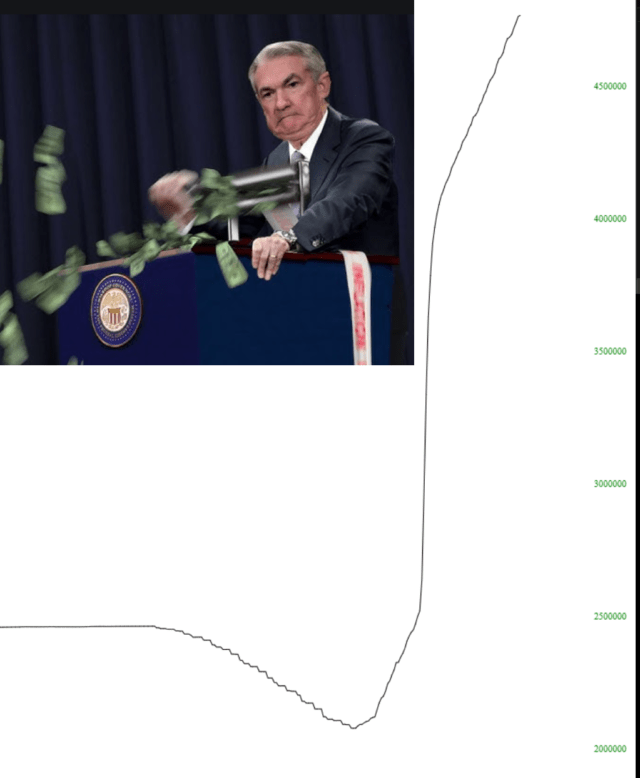

Because, of course, quaint old notions like employment, productivity, energy expenditures, and debt burden mean absolutely zilch now. We are moving our way, step by step, toward a very clean and simple society: a minuscule clique of asset-owners at the very top (whose assets appreciate exponentially in value) and the great unwashed masses who are provided just enough to survive. All thanks to this man, and this up-to-date chart of the assets he is gobbling up:

Disclaimer: Please read the disclaimer here.