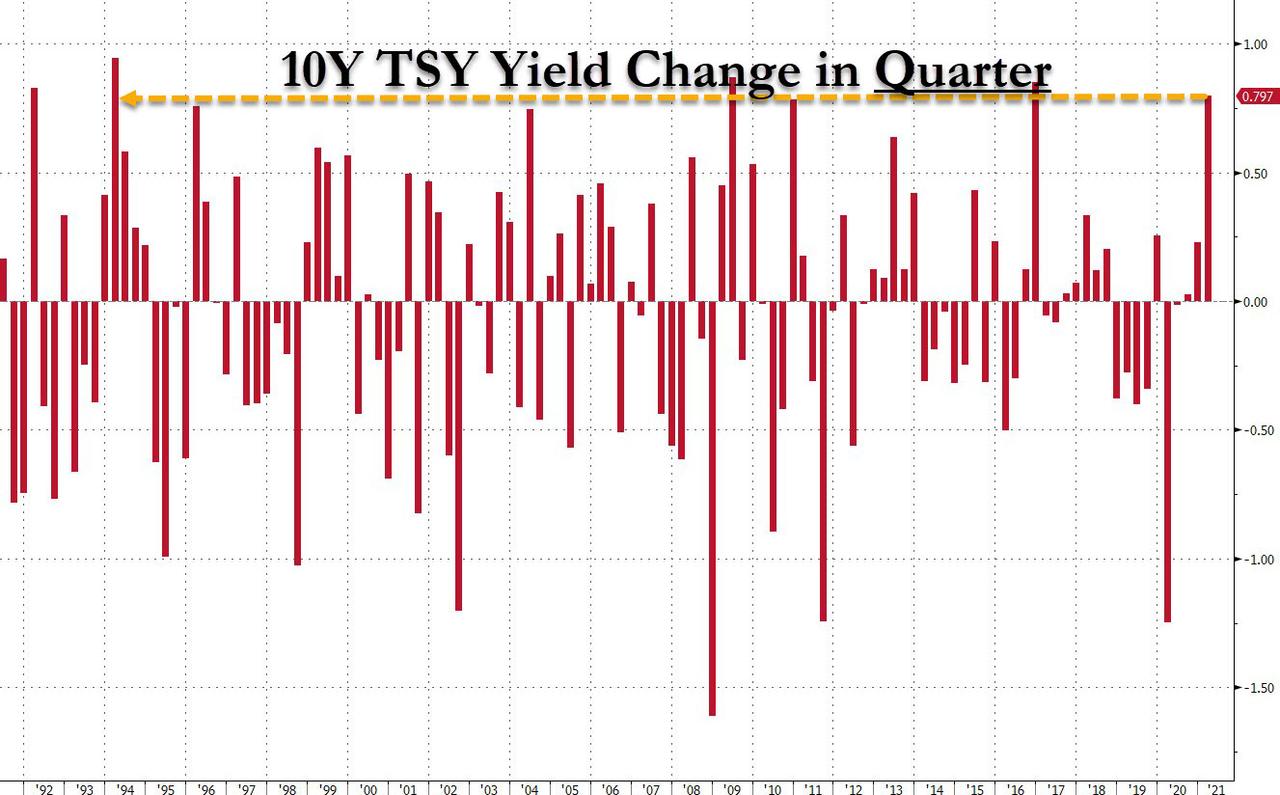

If Yields Rise 7bps Today, Q1 Will Be The Worst Quarterly Rout For Treasuries In The 21st Century

On the last day of Q1, the quarter seems to be ending very much how it began, with Treasury yields rising to fresh highs as investors await the announcement of further spending proposals in President Biden’s infrastructure package while buying stocks first (the S&P just hit a new all-time high) and asking questions later.

Indeed, as DB's Henry Allen writes, the rise in 10yr Treasury yields in Q1 so far had reached a massive +82.7bps (0.797bps at the time of writing), which puts them just shy of the 21st century’s other quarterly records back in Q4 2016 (+85bps) when President Trump won the presidential election, and Q2 2009 (+87bps) as the global economy was climbing out of the financial crisis. Of note: even the 2013 taper tantrum was a far more modest, and slow move compared to what we have seen now.

And while everyone is waiting for Biden to reveal further details from his infrastructure package on Wednesday, should today’s Biden speech spark a further climb in yields, that could then leave this as the biggest quarterly rise going all the way back to the Great Bond Massacre of Q1 1994, when yields blew out +94.4bps.

(Click on image to enlarge)

Incidentally, at their peak on Tuesday, the 10Y had reached a 14 month high of 1.77% - their highest level since January last year, aided by the prospect of further stimulus as well as continued progress on the vaccine rollout - which would make the Q1 yield blowout on par with the Q2 2009 yield surge. That said, yields on 10yr Treasuries actually fell back to 1.71% this morning. Real yields (+1.6bps) lost out to inflation expectations (-1.8bps) falling back, while the dollar index strengthened +0.38% to its highest level since Election Day last November.

In terms of what to expect today, Biden will be unveiling his plans in a speech later in Pittsburgh, which are part of his agenda to “Build Back Better” from the pandemic. We’re yet to get the full details, but the Washington Post reported yesterday that it would be worth around $2.25tn, with the focus on physical infrastructure, housing, clean energy and manufacturing, among others.

Currently there is $650 billion earmarked for bridges, highways and ports, while additional $300 billion for housing and manufacturing separately. Here is a full breakdown of the initial proposal, per the NYT:

- 180bln for research and development

- 115bln for roads and bridges

- 85bln for public transit

- 80bln for Amtrak and freight rail

- 174bln to encourage EVs via tax credits and other incentives to companies that make EV batteries in the US instead of China

- 42bln for ports and airports

- 100bln for broadband

- 111bln for water infrastructure

- 300bln to promote advanced manufacturing

- 400bln spending on in-home care

- 100bln in programs to update and modernize the electric grid

- 46bln in fed procurement programs for government agencies to buy fleets of EVs

- 35bln in R&D programs for cutting-edge, new technologies.

- 50bln in dedicated investments to improve infrastructure resilience

- 16bln program intended to help fossil fuel workers transition to new work

- 10bln for a new “Civilian Climate Corps.”

Today's speech comes ahead of another address scheduled for next month, in which he’ll be looking at other areas of investment such as healthcare and education. The combined cost of the two parts could reach $4 trillion, and since Magic Money Trees do not actually exist, contrary to what the socialistpolicymakers would like you to believe, it's only a matter of time before the move higher in yields breaks all records.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more