How High?

“Davidson” submits:

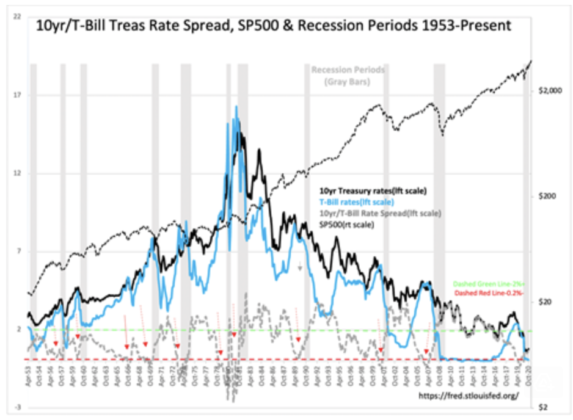

How high a market can climb in any cycle has many inputs all ending in peak enthusiasm at the time, i.e. “Market Psychology”. Everyone will have a reason why markets will not peak at the top, but the historical factor which has helped to time peaks since 1953 is the T-Bill/10yr Treas rate spread.

It works if one treats rates as reflecting investor psychology.

- Market Pessimism = Lower Rates

- Market Optimism = Higher Rates

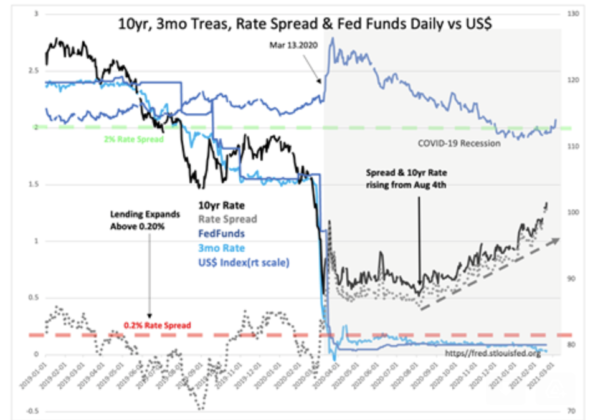

Market pricing is fluid. Very fluid! Highly dependent on conditions leading up to peaks and especially tied to unexpected events. COVID as just experienced was one of these. Historically, the T-Bill/10yr Treas rate spread has followed the same pattern since we have the rate record. During recessions pessimism is high and rates across the yield curve are low. Typically, fear is so high that 10yr rates fall below that of T-Bills. This is called an “Inverted Yield Curve”. Gradually, some investors envision equity opportunities and sell a portion of their 10yr Treasuries to buy equities. The effect results in 10yr Treas rates rising with a rise in equity indices. Over time other investors follow suit. The widening spread of the T-Bill/10yr Treas rate spread reflects improved optimism and also stimulates bank lending with higher net income margins. As the business cycle gains momentum investors begin to shift ever more capital into equities causing both T-Bill and 10yr Treas rates to rise with the pace of 10yr Treas being higher. Further along in the cycle, investor optimism causes capital from T-Bills to enter equities as well creating a period when short and longer term rates rise in parallel. Speculation begins in earnest when the T-Bill/10yr Treas rate spread is 2.0% level. Still further in the cycle optimism overpowers any caution and speculation begins as T-Bill/10yr Treas rate spread begins to narrow. At market peaks, speculation is high and the T-Bill/10yr Treas rate spread has narrowed to 0.2% levels which causes bank lending to fall sharply. What follows is a collapse of speculation without additional lending. A recession follows investors panic and rates fall sharply across the yield curve. After roughly 18mos of financial restructuring, default and write-offs, the next cycle begins anew.

The relationship in the T-Bill/10yr Treas rate spread has been a good market indicator. 2018-2019 was unusual in that the T-Bill/10yr Treas rate spread collapsed without recession due to issues with foreign autocrats forcing capital into the US 10yr Treasury for safety which resulted in an inverted yield curve yet no recession till COVID lockdowns. The T-Bill/10yr Treas rate spread still remains a decent indicator of market speculation.

Currently, the T-Bill/10yr Treas rate spread is widening. The US economy is in a strong recovery outside of government lockdowns. Lockdowns are being eased every week. Employment is recovering, retail, housing, manufacturing, and other indicators reflect a “V” shaped recovery. Market have always risen with these conditions and are expected to do so this time as well. Economic activity and the equity markets are likely to peak once we approach an “Inverted Yield Curve” condition. Using past measures of market psychology and fundaments suggests an SP500 peak of $6,000+ in 3yr-5yr. This estimate comes from the SP500 Value Investor Index.

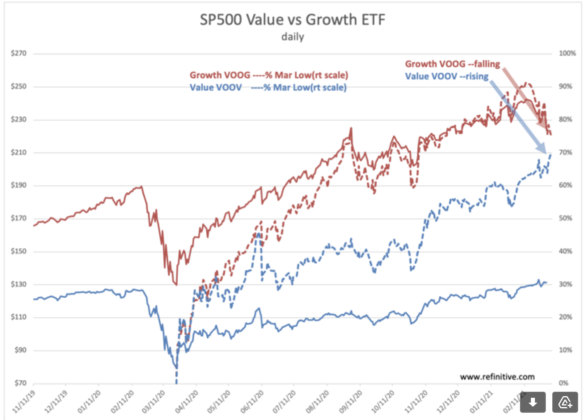

With market psychology and the ever-presence of unpredictable geopolitical events, predictions of this type have little precision. Simply, the next inverted yield curve will likely be the market peak. Along the way, investors will speculate in one theme or another. COVID provided a focus that is now ending as seen in the correction of VOOG (SP500 Growth ETF). The VOOV (SP500 Value RTF) is gaining investor interest. COVID is behind us and VOOV is very likely to out-perform VOOG for the next few years.

For now, markets remain in an uptrend as ~8mil-9mil currently unemployed individuals return to work. The sharp rise in the T-Bill/10yr Treas rate spread indicates a sharp rise in investor optimism. Current levels indicate much more is yet to come.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests ...

more